Affirm Expands Payment Offerings With New Pay in 2 and Pay in 30 Options

Affirm Expands Payment Offerings With New Pay in 2 and Pay in 30 Options

Provides greater choice and flexibility across a wider range of transaction sizes

SAN FRANCISCO--(BUSINESS WIRE)--Affirm (NASDAQ: AFRM), the payment network that empowers consumers and helps merchants drive growth, today announced two new payment options, Pay in 2 and Pay in 30, to bring even greater choice and flexibility to consumers utilizing Affirm’s app and providing affordability across a wider range of transactions. As always with Affirm, consumers do not ever owe a penny more than what they agree to upfront as there are no late fees or hidden charges, like compound or deferred interest.

“Roughly 80% of e-commerce transactions in the United States are for purchases under $150,” said Vishal Kapoor, Head of Product, Affirm. “Providing greater choice and flexibility is key to meeting our consumers where they are. Adding options like Pay in 2 and Pay in 30 allows us to better meet consumers’ individual preferences, enabling them to pay for purchases large or small with more options that work best for their budgets.”

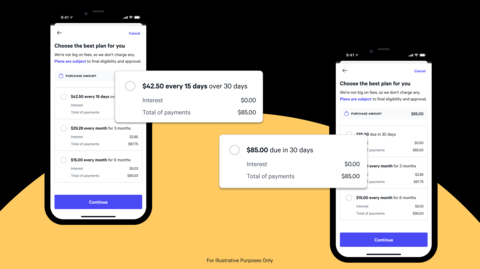

The rollout of Pay in 2 and Pay in 30 will enable consumers to split the cost of their purchase into two interest-free payments per month, or to pay in full interest-free within 30 days of their purchase, without ever revolving. Pay in 2 and Pay in 30 will begin appearing in Affirm’s app, joining Pay in 4 and monthly installments. Affirm has seen an increase in cart conversion within its app since offering its Pay in 2 and Pay in 30 options. Affirm plans to test and roll out its Pay in 2 and Pay in 30 options more broadly to its integrated merchant partners in the coming months.

About Affirm

Affirm’s mission is to deliver honest financial products that improve lives. By building a new kind of payment network – one based on trust, transparency and putting people first – we empower millions of consumers to spend and save responsibly, and give thousands of businesses the tools to fuel growth. Unlike most credit cards and other pay-over-time options, we show consumers exactly what they will pay up front, never increase that amount, and never charge any late or hidden fees. Follow Affirm on social media: LinkedIn | Instagram | Facebook | X.

Payment options through Affirm are subject to eligibility, and are provided by these lending partners: affirm.com/lenders. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to California Finance Lender license 60DBO-111681.

AFRM-F

Contacts

Press:

Affirm

Andrea Hackett

press@affirm.com