Holiday Online Sales Defy Gloomy Forecasts and Cap a Surprisingly Strong Season With Robust December Sales

Holiday Online Sales Defy Gloomy Forecasts and Cap a Surprisingly Strong Season With Robust December Sales

Determined consumers and big discounts pushed December online sales up 11% over a year ago, powering a holiday season that demolished early expectations

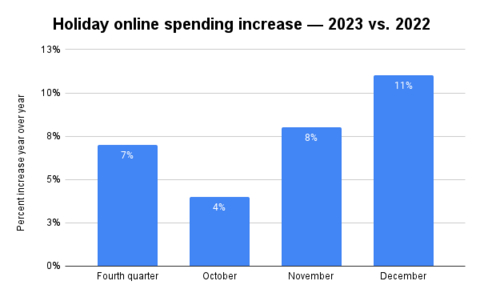

SAN JOSE, Calif.--(BUSINESS WIRE)--U.S. shoppers continued to demonstrate determination in December to fulfill loved ones’ holiday wishes — and perhaps their own — pushing online holiday sales for the season 7% higher than last year, according to data from Signifyd.

Determined consumers and big discounts pushed December online sales up 11% over a year ago, powering a holiday season that demolished early expectations, according to data from Signifyd.

Share

December’s 11% online sales growth over 2022 was astonishing given early season predictions that spending would lose steam through the fourth quarter and end with December seeing 3% growth.

The overall increase in fourth-quarter sales also surpassed early-season projections and defied conventional wisdom that inflation fatigue would dampen holiday sales in 2023. As has been the case since Cyber Week, heavy use of discounts appeared to play a role in consumers’ free-spending ways, according to ecommerce data from the commerce protection provider.

Consumers continued big-spender ways in December

December’s sales figures continued the trend of confounding experts' early expectations. The month’s surge was powered by a 27% year-over-year boost in grocery sales, a 19% increase in electronics spending and a 14% rise in spending on leisure and outdoor goods.

Like November’s sale surge, December’s surprising results were driven by an increased use of discount codes by shoppers who were willing to spend, as long as they found a good deal. Discount code use in December was up 14% over a year ago, according to Signifyd data. In all, 23% of online sales in December were accompanied by a discount code.

For the fourth quarter as a whole, consumers’ use of discounts increased 20% over 2022 and 24% of all sales included a discount.

December online sales — 2023 vs. 2022 |

All categories |

+11% |

Grocery |

+27% |

Electronics |

+19% |

Leisure & outdoor |

+14% |

Luxury goods |

+12% |

Fashion & apparel |

+7% |

Alcohol, tobacco & cannabis |

+7% |

Home goods & decor |

+4% |

Beauty & cosmetics |

+2% |

Consumers returned to pre-COVID buying patterns in 2023

The surprising degree to which overall holiday online sales jumped in 2023 is a testament to the resilience of U.S. consumers. Conventional wisdom before the season kicked off had it that consumers would shop early, pulling spending forward into October, before pulling back and coasting through November and December.

Instead, consumers steadily increased spending month over month during the fourth quarter. Signifyd Chief Customer Officer J. Bennett noted that the pattern was a return to pre-COVID years when the holiday peak shopping season stretched from roughly mid-November to Dec. 20.

“Both we and our merchants were pleasantly surprised by the staying power of the consumer throughout what has typically been the peak holiday period,” Bennett said. “This felt like a return to normalcy, with consumers waiting for better deals later in the season. When retailers ultimately offered those deals, consumers responded in a big way.”

Consumers flipped holiday projections, starting slowly, then building up speed

Heading into Q4, Signifyd projected holiday season sales would increase 5% over a year ago. The analysis saw October sales rising 7% year over year before cooling to a 5% increase in November and a 3% jump in December. Instead, online sales in the last three months of the year were up 4%, 8% and 11%, which was good news for ecommerce businesses.

As is always the case, ecommerce fortunes varied by individual retailer and by retail category. Grocery had the strongest Q4, rising 24% over holiday 2022, in part due to higher prices. The category including alcohol and cannabis products was up 19% year over year, while leisure and outdoor, electronics and luxury all had strong showings.

Holiday season (Q4) online sales — year-over-year change |

All categories |

+7% |

Grocery |

+24% |

Alcohol, tobacco & cannabis |

+19% |

Leisure & outdoor |

+11% |

Electronics |

+9% |

Luxury goods |

+9% |

Fashion & apparel |

+4% |

Beauty & cosmetics |

+3% |

Home goods & decor |

0% |

Methodology

Signifyd’s Holiday Season Pulse Tracker data is derived from transactions on Signifyd’s Commerce Network of thousands of ecommerce retailers and brands. Commerce Network intelligence also powers Signifyd’s Commerce Protection Platform, which leverages AI-driven machine learning models and data from millions of transactions to detect and block fraudulent activity. Signifyd has seen more than 600 million unique shopper wallets1 globally, meaning that 98% of the time when a shopper comes to a Signifyd-protected site, Signifyd’s machine-learning models recognize the shopper instantly. For a tutorial explaining the methods and meanings behind Signifyd’s Holiday Season Pulse Tracker visit Signifyd’s YouTube channel.

About Signifyd

Signifyd provides an end-to-end Commerce Protection Platform that leverages its Commerce Network to maximize conversion, automate customer experience and eliminate fraud and consumer abuse risk for retailers. Signifyd, which is the leading provider of payment security and fraud prevention for the Digital Commerce 360 Top 1000 Retailers, is headquartered in San Jose, CA, with locations in Denver, New York, Mexico City, São Paulo, Belfast and London.

__________________________

1 A digital wallet is a distinct combination of signals present in an online transaction.

Contacts

Mike Cassidy

Signifyd head of PR & storytelling

mike.cassidy@signifyd.com