TD Ameritrade Investor Movement Index: IMX Score Drops in November

TD Ameritrade Investor Movement Index: IMX Score Drops in November

Clients were net sellers of equities in the November IMX period, with the most pronounced selling in the Information Technology, Communication Services, and Consumer Discretionary sectors

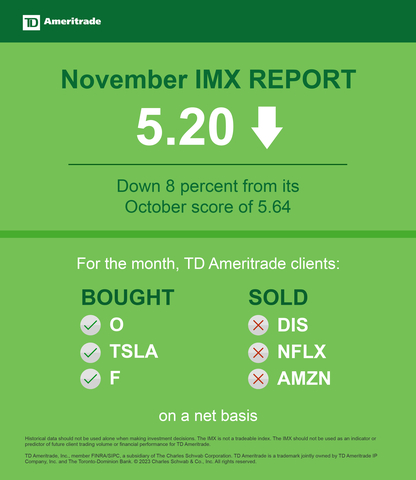

OMAHA, Neb.--(BUSINESS WIRE)--The Investor Movement Index® (IMXSM) decreased to 5.20 in November, down from its score of 5.64 in October. The IMX is TD Ameritrade’s proprietary, behavior-based index, aggregating Main Street investor positions and activity to measure what investors actually were doing and how they were positioned in the markets.

The reading for the four-week period ending November 24, 2023 ranks “moderate low” compared to historic averages.

“We generally see clients starting to take profits toward the end of the year, and the rally in November seems to have offered an opportunity for a head start. Clients sold some of the year's biggest gainers and rotated into stocks that had recently fallen out of favor,” said Joe Mazzola, Director of Trading and Education at Charles Schwab. “This follows a recent shift in the underlying dynamics of the market as breadth is widening and interest rate-sensitive names that had underperformed are suddenly gathering momentum. At the sector level, we saw some buying interest in the Health Care, Consumer Staples and Energy sectors. But the story of this month is one of selling in the wake of macroeconomic data that pointed towards a more optimistic picture for inflation and the economy at large.”

Falling bond yields, slower job growth, and unemployment ticking higher paved the way for U.S. equity markets to soar during the November IMX period. The U.S. Bureau of Labor and Statistics’ Employment Situation Summary released on November 3rd reflected that unemployment ticked higher, from 3.8% to 3.9%, and that nonfarm payrolls rose slightly lower than expected, by 150,000, in October. The U.S. Federal Reserve’s Federal Open Market Committee (FOMC) voted to leave rates unchanged on November 8th and Fed Chair Jerome Powell’s subsequent press conference was perceived as dovish, spurring an equity rally. On November 14th, it was reported that the Consumer Price Index (CPI) rose by 3.2% year-over-year in October, down from 3.7% in September, and cooler than the street’s expectations of 3.3%.

U.S. equity markets rallied strongly in response to this better-than-expected inflation data, viewing it as further evidence the U.S. Federal Reserve may be done tightening monetary policy. During the November IMX period, the S&P 500 (SPX) surged almost 11% higher to close at 4559.34. The CBOE Volatility Index (VIX) collapsed to its lowest level since before the Covid-19 pandemic, ending the period at 12.46 while the U.S. Dollar Index edged lower to close at 103.415. January Crude Oil Futures traded 9% lower against a backdrop of weaker-than-expected demand, settling at $75.54 per barrel to end the period.

TD Ameritrade clients were net sellers of equities overall during the period. Among the names they did buy were:

- Realty Income Corp. (O)

- Tesla Inc. (TSLA)

- Ford Motor Co. (F)

- Alphabet Inc. (GOOG/GOOGL)

- Chevron Corp. (CVX)

Names net sold during the period included:

- Walt Disney Co. (DIS)

- Netflix Inc. (NFLX)

- Amazon.com Inc. (AMZN)

- Apple Inc. (AAPL)

- Advanced Micro Devices Inc. (AMD)

Millennial Buys & Sells

Like the overall TD Ameritrade client population, TD Ameritrade’s millennial clients were net sellers of equities.

Both the overall TD Ameritrade client population and millennial population were buyers of the real estate investment trust (REIT) Realty Income Corp (O) as well as vehicle manufacturer Tesla (TSLA), and Ford Motor Co (F). On November 6th, Realty Income Corp reported better-than-expected earnings and the stock bounced sharply off multi-year lows. On October 18th, Tesla reported disappointing earnings and the stock traded lower for the remainder of the October period. Buyers were rewarded quickly, however, as shares bottomed in late October and traded as high as $246.70 during the November IMX period. Shares of Ford Motor Co (F) have struggled for the past six months amid a backdrop of a United Auto Workers (UAW) strike and weaker-than-expected demand for its electric vehicles (EV), and the stock sold off further following an October 26th earnings miss. TD Ameritrade millennial clients bought the weakness and saw the stock trade higher by as much as 10% during the November IMX period as the company detailed several cost-cutting measures. TD Ameritrade millennials were also net buyers of Enphase Energy (ENPH), differing from the overall TD Ameritrade client population, as shares rebounded strongly during the second half of the November period.

Like the overall TD Ameritrade client population, TD Ameritrade’s millennial clients sold shares of Walt Disney (DIS) as the stock price rebounded in November. Disney had several box office disappointments in November but the strong performance of its theme parks and the better-than-expected metrics for Disney+, its streaming service, reported during the company’s October earnings call continued to support the stock price throughout the November IMX period. TD Ameritrade millennial clients sold strength in Netflix (NFLX), mirroring the overall TD Ameritrade client population, as the stock gapped up as much as 20% following an earnings beat reported the month prior. The company’s global reach and its investments in machine learning to curate unique customer experiences continued to impress analysts and investors. Both the millennial and general client populations used a sharp rally in Amazon (AMZN) as an opportunity to lock in some nice profits. Amazon reported an earnings blowout in late October and the stock rose subsequently throughout the November period. Unlike the overall TD Ameritrade client population, TD Ameritrade millennial clients appeared to see an opportunity to reduce exposure in Microsoft (MSFT), selling into strength as shares set another new all-time high in November.

Looking at S&P 500 sectors, TD Ameritrade millennial clients bought most heavily in Energy, Consumer Staples, and Materials; they were net sellers of Information Technology, Communication Services, and Financials.

About the IMX

The IMX value is calculated based on a complex proprietary formula. Each month, TD Ameritrade pulls a sample from its client base of funded accounts, which includes all accounts that completed a trade in the past month. The holdings and positions of this statistically significant sample are evaluated to calculate individual scores, and the median of those scores represents the monthly IMX.

For more information on the Investor Movement Index, including historical IMX data going back to January 2010, to view the full report from November 2023, or to sign up for future IMX news alerts, please visit www.tdameritrade.com/IMX. Additionally, TD Ameritrade clients can chart the IMX using the symbol $IMX in either the thinkorswim® or thinkorswim Mobile platforms.

Inclusion of specific security names in this commentary does not constitute a recommendation from TD Ameritrade to buy, sell, or hold. All investments involve risk including the possible loss of principal. Please consider all risks and objectives before investing.

Past performance of a security, strategy, or index is no guarantee of future results or investment success.

Historical data should not be used alone when making investment decisions. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision.

The IMX is not a tradable index. The IMX should not be used as an indicator or predictor of future client trading volume or financial performance for TD Ameritrade. IMX data includes that from accounts of TD Ameritrade clients which recently transferred to our affiliate, Charles Schwab & Co., Inc., as part of our planned integration.

About TD Ameritrade

TD Ameritrade provides investing services and education to self-directed investors and registered investment advisors. A leader in U.S. retail trading, we leverage the latest in cutting-edge technologies and one-on-one client care to help our clients stay on top of market trends. Learn more by visiting www.tdameritrade.com.

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org) / SIPC (www.SIPC.org), a subsidiary of The Charles Schwab Corporation. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank. © 2023 Charles Schwab & Co. Inc. All rights reserved.

Contacts

At the Company

Margaret Farrell

Director, Corporate Communications

(203) 434-2240

margaret.farrell@schwab.com