Black Friday 2023: Neo Financial offers a guide to more rewarding spending and saving

Black Friday 2023: Neo Financial offers a guide to more rewarding spending and saving

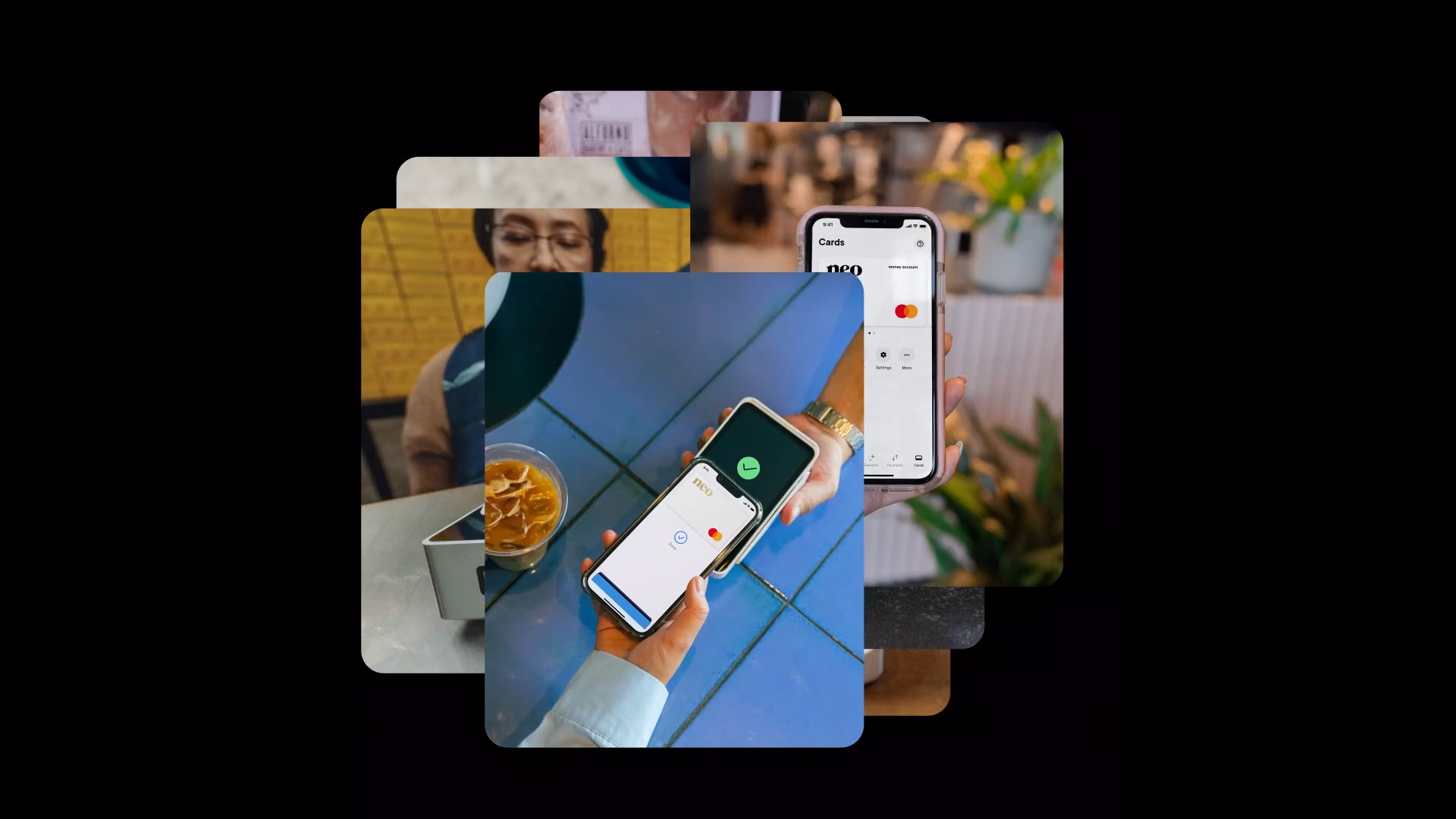

CALGARY, Alberta & WINNIPEG, Manitoba--(BUSINESS WIRE)--Neo Financial (Neo), Canada’s leading financial technology company1, is giving cost-conscious Canadians more rewarding ways to spend and save their money ahead of Black Friday and Cyber Monday.

At a time of acute cost-of-living challenges, Neo continues to offer Canadians more value for every dollar through the Neo Money™ card, Neo Credit card, and Neo Secured Credit card:

-

New rewards partners that Canadians love: The Neo cashback rewards network continues to grow, adding to Neo’s more than 11,000 merchant partners across the country. Neo customers now earn cashback rewards of up to 10%2 in-store and online at popular retailers including:

- Simons

- Harry Rosen

- ALDO

- Structube

- The Shoe Company

- JD Sports

- Decathlon

-

Roots Canada

- 3% cashback at the gas pump and grocery store: Neo customers can now enjoy 3% cashback on these essentials — saving up to $240 per year3.

- Boosted cashback on everyday spending: Neo customers can earn an average of 6% cashback on dining and food delivery, 3% at retail partners (online and in-store), and 4% on streaming and rideshare services4.

- Credit score monitoring and extended warranty: Premium customers benefit from credit score monitoring directly in the Neo app, enhanced purchase protection, and extended warranty5.

The Neo Credit card and Neo Secured Credit card were recently named as Canada’s best credit cards in their respective categories by Hardbacon.

“Canadians are working harder than ever just to make ends meet. They deserve financial products and services that make every day more rewarding, by providing more value for every dollar,” said Andrew Chau, Neo Financial CEO. “We’re proud to offer financial products that transform how Canadians spend, save, and earn — including high-interest savings, boosted cashback rewards, a fully digital mortgage experience, and much more to come.”

About Neo Financial

Neo Financial is a technology company simplifying finances through reimagined spending, savings, investing, and mortgages. Founded in 2019 by the co-founders of SkipTheDishes, Neo has raised more than $299 million in funding and has been recognized as one of the top tech startups in Canada by LinkedIn. Neo is headquartered in Calgary and Winnipeg, and is backed by top-tier investors across North America.

Through partnerships with leading financial institutions, Neo provides members with a safe and secure way to spend (Neo Credit), save (Neo Money™), invest (Neo Invest™), and get a mortgage (Neo Mortgage™). Neo for Business powers financial solutions for Tim Hortons, Cathay Pacific, Hudson’s Bay, and over 11,000 other partners across the country. To learn more, visit neofinancial.com.

The Neo Money™ card is a prepaid Mastercard® issued by Equitable Bank pursuant to license by Mastercard International Incorporated. The Neo Money™ card is powered by the Neo Money™ account, which is provided by Concentra Bank.

Neo Money™ card and Neo Money™ account are not available for Quebec applicants.

Neo Credit and Neo Secured Credit cards are issued by ATB Financial pursuant to license by Mastercard International Incorporated.

Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

1 Based on metrics including app store ratings, revenue growth, third-party product rankings, industry awards, and company valuation, according to Neo research.

2 Cashback may be limited and varies by perks, offer, and partner. Value increase is an average and depends on card use. Offer is subject to the Rewards Policy. Offer may be amended or cancelled at any time without notice. Cashback, perks, insights, and other offers and rewards are operated by Neo. Third party merchants may have minimum age requirements.

3 Based on the maximum $300 category spending per month. Cashback may be limited and varies by perks, offer, and partner. There may be monthly limits for boosted cashback offers. For more information, visit the Neo app.

4 When using Neo’s Premium plan.

5 This insurance coverage is underwritten by Chubb Insurance Company of Canada under a Group Policy issued to Neo Financial Technologies Inc. All coverage is subject to the terms, conditions, limitations and exclusions outlined in the Certificate of Insurance, and for Quebec residents the Summary and Fact Sheet. The cost will be charged to the eligible Neo card that you signed up for the Neo Perks with. Neo, its employees and representatives are not agents of Chubb, nor can they waive or change any terms of the insurance coverage. View the full list of insurance certificates here: https://card.neofinancial.com/legal-bundles.

All product and company names, logos, brands, and images are trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

Contacts

To learn more, please contact media@neofinancial.com.