Personalized Solutions Help Plan Sponsors Address Retirement Readiness

Personalized Solutions Help Plan Sponsors Address Retirement Readiness

Fresh insights featuring perspectives from large 401(k) plan sponsors on the value of managed accounts and other personalized financial wellness offerings

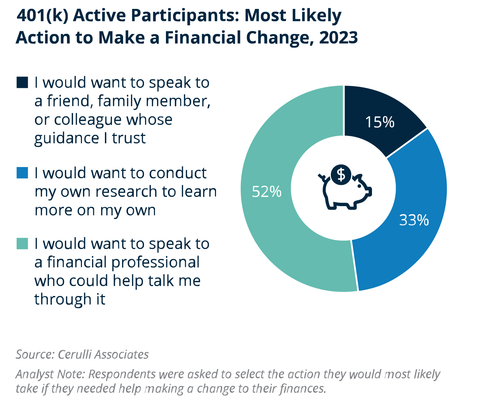

Data from Cerulli shows that more than half (52%) of 401(k) participants would prefer to speak to a financial professional over conducting the necessary research themselves or leveraging the advice of other, non-professional connections when making a change to their finances. (Graphic: Business Wire)

BOSTON--(BUSINESS WIRE)--As plan sponsors eye solutions for retirement readiness, personalization has become a major area of focus, according to The Benefits of Personalization in Defined Contribution Plans, a new white paper issued by Cerulli Associates, with support from Edelman Financial Engines. More than one-third (36%) of 401(k) plan sponsors cite improving retirement readiness as the top priority for their 401(k) plan.

According to the research, a challenge for key decision makers at some of the nation’s largest corporate defined contribution (DC) plans is selecting the right personalized financial service(s) for their participant base. These plans typically have sizeable, diverse participant populations with varying levels of wealth, financial challenges, objectives, and preferences. Accommodating the needs of heterogenous plan participants requires programs and features that can fill in gaps left by target-date funds or other less personalized offerings. “As fiduciaries, we want to make sure the [personalized solution] delivers value and makes sense for at least some portion of our participant base,” reports the head of global benefits for an asset management firm who participated in the research.

More than half (52%) of consultant-intermediated DC plans look to managed account programs to provide participants with greater access to personalized investment advice. However, some plan sponsors seemingly underestimate the value managed account programs can deliver to participants. In conversations with Cerulli, several plan sponsors compare the investment performance of managed accounts to associated target-date fund vintages. “When evaluating whether or not to offer a managed account program, plan sponsors should look beyond the investment returns to uncover the full value that these programs deliver to participants,” says Shawn O’Brien, director. “Financial planning and wellness features, and the ability to speak with an advisor, may have a meaningful impact on participants’ financial outcomes. Nevertheless, plan sponsors may need to employ different performance evaluation approaches to quantify their impact.”

Plan sponsors regularly highlight the importance of giving their participants access to a financial professional who can help them sort through key financial dilemmas in a holistic, nuanced manner. One plan sponsor notes, “In times of stress, they [participant] call one of the advisors from our managed account program, who are very well trained, and they [advisors] help people from doing something crazy. You have to think about what that is worth to somebody. It’s not about whether you call all the time, it’s that one call that keeps you invested and saves you a couple hundred thousand dollars.” Cerulli research shows 401(k) participants value the ability to speak with an advisor when it comes to making key financial decisions. More than half of 401(k) participants prefer to speak to a financial professional over conducting the necessary research themselves or leveraging the advice of other, non-professional connections when making a change to their finances.

For the pursuit of incorporating personalized solutions, the paper recommends that plan sponsors and their consultant partners assess the broader implications of specific program features; in addition to evaluating more-technical due diligence items (i.e., investment methodologies), sponsors should consider the potential benefits of providing access to human advisors, limiting potential conflicts of interest, and providing participants with a broader range of personalized advice via value-add programs, such as financial wellness and planning.

These findings and more can be found in the full whitepaper available here.

Methodology

The Cerulli Associates, October 2023, The Benefits of Personalization in Defined Contribution Plans whitepaper, is based on 19 interviews with key decision makers at large (greater than $250 million in assets) DC plans, including both plans that use and do not use managed accounts. The interviews did not reveal Edelman Financial Engines as the sponsor of the research. The whitepaper also draws from Cerulli’s industry-leading surveys including its 401(k) Plan Sponsor Survey, 401(k) Participant Survey and DC Consultant Survey. To maintain confidentiality, all information collected is presented in aggregate form, and proprietary survey information is not directly attributed to participants or their firms.

About Cerulli Associates

For over 30 years, Cerulli has provided global asset and wealth management firms with unmatched, actionable insights.

Cerulli Associates is a strategic research and consulting firm that provides financial institutions with guidance in strategic positioning and new business development. Our analysts blend industry knowledge, original research, and data analysis to bring perspective to current market conditions and forecasts for future developments.

About Edelman Financial Engines

Since 1986, Edelman Financial Engines has been committed to always acting in the best interests of our clients. We were founded on the belief that all investors – not just the wealthy – deserve access to personal, comprehensive financial planning and investment advice. Today, we are America’s top independent financial planning and investment advisory firm, recognized by Barron's1 with 145+ offices2 across the country and entrusted by more than 1.3 million clients to manage more than $250 billion in assets.3 Our unique approach to serving clients combines our advanced methodology and proprietary technology with the attention of a dedicated personal financial planner. Every client’s situation and goals are unique, and the powerful fusion of high-tech and high-touch allows Edelman Financial Engines to deliver the personal plan and financial confidence that everyone deserves.

1. The Barron’s 2023 Top 100 RIA Firms list, an eighth-year ranking of independent advisory firms, is qualitative and quantitative, including assets managed by the firms, technology spending, staff diversity, succession planning and other metrics. Firms elect to participate but do not pay to be included in the ranking. Ranking awarded each September based on data within a 12-month period. Compensation is paid for use and distribution of the rating. Investor experience and returns are not considered.

2. Edelman Financial Engines data, as of Dec. 31, 2022.

3. Edelman Financial Engines data, as of June 30, 2023.

© 2023 Edelman Financial Engines, LLC. Edelman Financial Engines® is a registered trademark of Edelman Financial Engines, LLC. All advisory services provided by Financial Engines Advisors L.L.C., a federally registered investment advisor. Results are not guaranteed. AM3183486

Contacts

Edelman Financial Engines

PRTeam@EdelmanFinancialEngines.com