Growing Inflation Worries Have More Consumers Tightening Their Spending, a New Survey Shows

Growing Inflation Worries Have More Consumers Tightening Their Spending, a New Survey Shows

But a unique way of looking at customer loyalty could help ecommerce retailers ride out shoppers’ economic jitters, says a Signifyd report highlighting the new consumer data

SAN JOSE, Calif.--(BUSINESS WIRE)--After powering online sales to new heights during the pandemic, consumers are pulling back on spending, saying inflation is taking its toll and that economic uncertainty has them bracing for the worst, according to a new consumer survey conducted by commerce protection leader Signifyd.

When asked about their spending plans in key retail verticals, consumers by significant margins said they would not be spending more in any of them this year, save for one — grocery, which continues to torment consumers with rising prices.

The responses indicate that consumers are more pessimistic about the economy and their finances than they were a year ago when Signifyd conducted a similar survey.

The insights are part of a detailed report Signifyd released today: “The State of Commerce 2023: How today’s customer loyalty trends are defining the shape of retail’s future.” The report combines consumer survey results with a unique analysis of Signifyd’s ecommerce data to chart the course of online spending from the perspectives of both consumers and brands. Among the report’s findings:

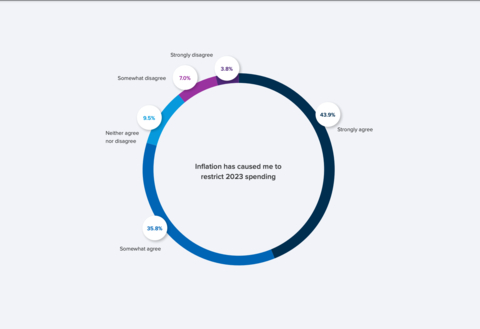

- Nearly 80% of consumers surveyed said inflation has caused them to cut back on spending this year. Last year the figure was 69%.

- Two-thirds of consumers said they abandoned their go-to brands to shop with a competitor in the past year, a third of them because of a bad customer experience.

- While inflation remains stubborn, ecommerce prices are declining, acting as an inflation decelerator for the first time in years.

- Winter holiday spending online will be up in 2023, but perhaps not as much as retailers had hoped.

By analyzing the frequency and recency of online purchases over time, the Signifyd data team was able to demonstrate the importance — and in some cases the transience — of merchants’ most loyal customers. In the electronics vertical, for instance, only a modest percentage of loyalists, which Signifyd labeled “Soulmates,” stick with a merchant from year to year.

That leaves brands scrambling for the less loyal, which make up cohorts Signifyd called “Hot Dates,” “Ghosters” and “Exes,” again based on the frequency and recency of purchases.

“The State of Commerce report provides online merchants with a detailed look into how consumers with different degrees of loyalty come and go. And it suggests ways retailers can hang on to their most loyal customers while attracting those who are intrigued and reuniting with those who have strayed,” said Signifyd Data Analyst Phelim Killough, who co-authored the report. “Customer loyalty has always been a key to retail success and never more so than in times of economic uncertainty for both businesses and consumers.”

In addition to the exploration of customer loyalty and consumer sentiment, the State of Commerce 2023 report includes predictions based on Signifyd modeling for ecommerce sales for the rest of the year and during the holiday season in particular.

About Signifyd

Signifyd provides an end-to-end Commerce Protection Platform that leverages its Commerce Network to maximize conversion, automate customer experience and eliminate fraud and consumer abuse risk for retailers. Its solutions provide the transparency and control that brands need to succeed in the rapidly changing world of commerce. Signifyd is among Fast Company’s 10 Most Innovative Companies in AI and the leading provider of payment security and fraud prevention for the Top 1000 Retailers for 2023. The company is headquartered in San Jose, CA, with locations in Denver, New York, Mexico City, São Paulo, Belfast and London.

Contacts

Mike Cassidy

Signifyd head of PR & storytelling

mike.cassidy@signifyd.com