Nidec Completes Acquisition of Automatic Feed Company and Related 2 Companies, US-based Press Machine Equipment Manufacturers

Nidec Completes Acquisition of Automatic Feed Company and Related 2 Companies, US-based Press Machine Equipment Manufacturers

KYOTO, Japan--(BUSINESS WIRE)--Nidec Corporation (TOKYO: 6594; OTC US: NJDCY) (the “Company” or “Nidec”) today announced that the Company has acquired full ownership of Automatic Feed Company, Lasercoil Technologies LLC, and Automatic Leasing Company, privately-owned US companies (collectively the “Target”), from its founding family on August 1, 2023 (the “Transaction”). As a result of the Transaction, the Target became a consolidated subsidiary of Nidec, as outlined below:

1. Outline of the New Subsidiary |

||||

(1) |

Company names |

(i) | Automatic Feed Company |

|

| (ii) | Lasercoil Technologies LLC |

|||

| (iii) | Automatic Leasing Company |

|||

(2) |

Headquarters |

Napoleon, Ohio, United States | ||

(3) |

Foundation |

1949 | ||

(4) |

Business leader |

Peter Beck | ||

(5) |

Business base |

Manufacturing, sales and service base: Napoleon, Ohio, United States | ||

(6) |

Principal of businesses |

Manufacturing, sales and service for press peripheral equipment | ||

(7) |

Number of employees |

80 (Consolidated) | ||

(8) |

Consolidated Sales |

The fiscal year ended December 31, 2022 |

37 million USD

|

|

2. Target’s Strengths

The Target is an Ohio, U.S.-based company that manufactures and sells peripheral equipment for medium and large presses and sheet metal cutting equipment for presses. The Target has strong ties with major U.S. automakers and Tier 1 suppliers, and holds a 70% of market share on certain segments of peripherals equipment for auto body parts press machine lines. The Target offers its products and services to not only U.S. but also Japanese major automakers.

The Target's laser blanking technology has the flexibility to be programmed to accommodate a variety of products and applications, with high precision blanking.

3. Nidec’s Press Machine Business |

|||

(1) |

Company name |

Nidec Minster, Nidec Drive Technology (Kyori press-machine), Nidec Arisa, Nidec Vamco, Nidec SYS, Nidec CHS |

|

(2) |

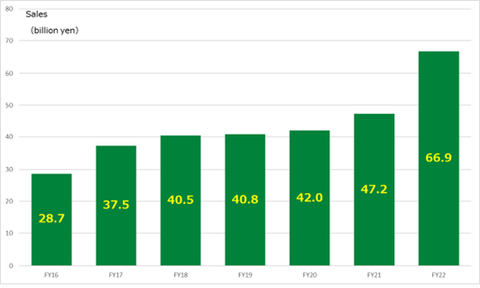

Sales |

The fiscal year ended March 31, 2023 |

66.9 billion yen |

(3) |

Products |

Small high-speed presses, medium-sized presses, large presses, peripheral equipment |

|

(4) |

Manufacturing sites |

Japan, China, U.S.A., Mexico, Germany, Spain |

|

(5) |

Number of employees |

Approx. 1,200 |

|

4. Synergies with our group

Through our Press Machine Business companies, we have expanded our press machine manufacturing, sales, and service business globally, as well as increased our lineup of presses and peripheral equipment products with M&As.

With the addition of the Target, we will be able to offer a wide range of products and services to our customers and pursue following synergies in terms of products, sales, and technology.

(1)

|

Combine the Target’s equipment with Minster and Arisa’s medium and large presses, offering a complete line on a turnkey basis. |

(2)

|

Expand sales of Minster and Arisa presses to automotive customers based in North America. |

(3) |

Incorporation of laser blanking technology is our portfolio of products. |

5. Effect on Financial Performance for the Current and Next Fiscal Year

The transaction is expected to have no significant impact on the Company’s consolidated financial performance for this fiscal year ending March 31, 2024. If necessary, the Company will make additional disclosure on a timely basis in accordance with the rules of the Tokyo Stock Exchange upon determination of further details.

Contacts

Masahiro Nagayasu

General Manager

Investor Relations

+81-75-935-6140

ir@nidec.com