Tide Helps More SMEs Simplify Accounting With ‘First-of-its-Kind’ Upgrade

Tide Helps More SMEs Simplify Accounting With ‘First-of-its-Kind’ Upgrade

Tide Accounting is the first fintech service in the UK to introduce accrual-based accounting

LONDON--(BUSINESS WIRE)--Tide, the leading digital business financial platform, has today launched its improved Tide Accounting tool, powered by Sage, to help more small businesses meet their accounting needs directly from one place - their bank account.

At present SMEs have to connect multiple solutions to their accounting software - their bank account, payments providers, payroll and more. Managing these systems is complex, time-consuming and costly.

To address this, Tide Accounting has streamlined the process into one user-friendly experience. Tide members can get paid, manage their bills, track their business performance and file their taxes – all via an embedded accounting service directly from their Tide account.

The simple tool, launched last year for cash accounting, has now been upgraded to introduce standard accrual-based accounting. It’s the first solution of its kind embedded in a bank account.

Standard accrual-based accounting recognises revenue when it's earned and expenses when they’re incurred. Most businesses in the UK use this method. Adding this service to the platform means Tide solutions are available to many more SMEs.

Today’s launch strengthens Tide's mission to save SMEs time and money when running their businesses by adding to the platform’s banking, finance and admin solutions. These already include invoice generation, payment and payroll services and expense cards.

In addition, businesses using Tide Accounting can utilise their records to access credit opportunities via the Tide Partner Credit marketplace.

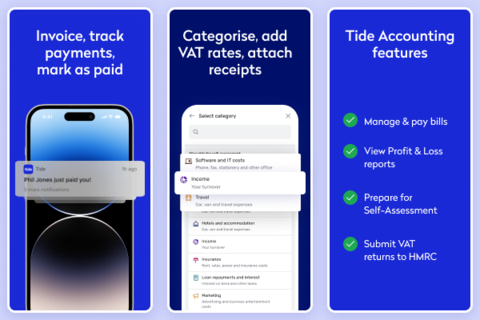

Available to existing Tide Members, Tide Accounting supports SMEs across their business journey, bringing together the following features:

Get Paid

Invoice customers to get paid on time, and spot unpaid invoices. Tide members can automate invoice matching and payment reminders with Invoice Assistant.

Manage bills

Pay bills at the right time to manage cash flow.

Track business performance

Keep financials in check to grow the business by reconciling accounts and balancing the books, directly from the Tide app. Members can categorise transactions, adding VAT rates and receipts.

File taxes

Submit tax returns accurately and securely. This includes automatically generated estimates for sole traders that make it easier to fill in self-assessment tax forms. In addition, members can submit their VAT return via Making Tax Digital with HMRC-compliant software, straight from their Tide account.

New members opening a bank account through Tide’s Company Formation service will benefit from a free six-months access to Tide Accounting.

Vinay Ramani, Chief Product Officer at Tide, said: “For small business owners, accounting can be very time-consuming and intimidating as they have to move transactions from their bank account to their accounting tools. Tide Accounting introduces accrual-based accounting embedded in a bank account - unlocking real convenience and ease of use without the stress and hassle. And once their accounting is done well - those businesses become more attractive for credit opportunities via the Tide Partner Credit marketplace. In this way our strategy to help a small business with their overall banking, finance and admin needs comes to life.”

Neil Watkins, EVP Product at Sage, said: “We know that technology is vital to the creation, survival, and growth of SMEs across all sectors and like Sage, Tide is on a mission to help small business owners get their work done more efficiently by streamlining and simplifying processes.

“We are pleased Tide chose Sage Accounting and Compliance as a Service (ACaaS) as a key component of their Tide Accounting offering, enabling small businesses to do their business banking, bookkeeping and accounting in one seamless experience. Today’s newest development to support accrual based accounting will help even more small businesses simplify their money admin, to radically simplify their essential bookkeeping and accounting tasks.”

Contacts

For more information: tide@secnewgate.co.uk