Climate Change-Influenced Hurricane Season Could Threaten an Estimated 33 Million Homes According to CoreLogic

Climate Change-Influenced Hurricane Season Could Threaten an Estimated 33 Million Homes According to CoreLogic

- More than 33 million U.S. properties are at risk of hurricane-force wind damage

- High-risk areas include the metro areas of New York City, Houston and Miami/Ft. Lauderdale

- $11.6 trillion total reconstruction cost value at risk, nationally

- Climate change is expected to alter hurricane activity, intensifying related risks across U.S. coastal counties

IRVINE, Calif.--(BUSINESS WIRE)--To mark the start of the 2023 Atlantic Hurricane Season, CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its 2023 Hurricane Risk Report, shedding light on the evolving landscape of hurricane risk in the face of climate change. The report analyzes risks for single-family residences (SFRs) and multifamily residences (MFRs) along the U.S. Gulf and Atlantic Coasts.

Tom Larsen, Senior Director for CoreLogic Insurance Solutions, stated, "CoreLogic remains committed to empowering the industry with reliable insights and innovative solutions that help safeguard people, businesses and communities from the escalating impacts of climate change. Insurers and lenders should adapt to these changes by deepening their understanding of property risk, embracing proactive loss prevention measures and collaborating with stakeholders across the industry to ensure long-term resilience."

Report Highlights

National Implications

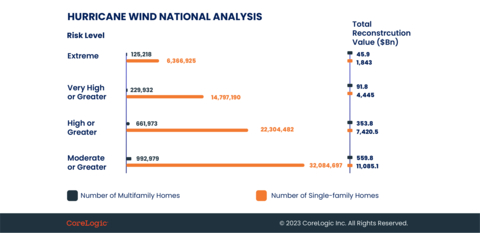

This year, CoreLogic has identified that more than 32 million single family residences (SFRs) and an additional one million multi-family residences (MFRs) are at moderate or more significant risk of sustaining damage from hurricane-force winds. This damage would have a combined reconstruction cost value (RCV) of $11.6 trillion. Approximately 7.8 million homes, with a combined RCV of $2.6 trillion, have direct or indirect coastal exposure, making them susceptible to storm surge flooding.

Metro Area Implications

CoreLogic’s 2023 Hurricane Risk Report has also identified major U.S. metros at greater risk for hurricane damage. More than 4.3 million SFRs and MFRs in the New York City metro area are at risk of hurricane-force winds. These properties, spanning New York City, Newark and Jersey City, equate to a combined RCV of $2.4 trillion at risk. Other major metro areas with substantial hurricane wind risk are the Houston-Woodlands-Sugar Land and Miami-Ft. Lauderdale-Pompano Beach areas have 2.1 million SFRs and MFRs, each, and a combined RCV of $649.8 and $585.0 billion, respectively.

Hurricane Projections by 2050

CoreLogic analyzed historical data, climate patterns and predictive models in conjunction with its property database and suite of climate change models to forecast the potential impacts of hurricanes on coastal and neighboring regions by mid-century. Research suggests that, by the year 2050, more powerful storms, a rise in sea level and warmer atmospheric temperatures will give hurricanes a greater capacity to hold more moisture. Simultaneously, warmer sea surface temperatures give storms the fuel to penetrate further inland to locations previously shielded from consequential damage. CoreLogic has found that the biggest increase in homes at risk of damage from hurricane-force winds are in the counties furthest from the coast, who had previously only experienced dissipated winds. However, by mid-century, homeowners may need to consider how to mitigate and recover from hurricane wind damage as storms travel further inland, exposing more homes to hurricane force winds. The 2023 Hurricane Risk Report further illustrates what these risks might look like, using the Houston-Galveston area as an example.

For insights into hurricane activity this season, visit HazardHQ.com. Click here for the full hurricane risk report and methodology. To listen to the hurricane risk webinar, click here.

About CoreLogic

CoreLogic®, a leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, buy and protect their homes. For more information, please visit www.corelogic.com.

CORELOGIC, and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries. All other trademarks are the property of their respective owners.

Contacts

Robin Wachner

Corporate Communications

newsmedia@corelogic.com