ServiceNow Applies Intelligent Automation to Business-critical Processes with Launch of New Finance and Supply Chain Workflows

ServiceNow Applies Intelligent Automation to Business-critical Processes with Launch of New Finance and Supply Chain Workflows

New AI-powered workflows help finance, supply chain, and procurement leaders reduce costs and accelerate time to value, while improving user experience

LAS VEGAS--(BUSINESS WIRE)--Knowledge 2023 — ServiceNow (NYSE: NOW), the leading digital workflow company making the world work better for everyone, today announced a major expansion of the ServiceNow portfolio, applying intelligent automation to business-critical processes, with the launch of Finance and Supply Chain Workflows. These new AI-powered workflows help finance, supply chain, and procurement leaders reduce costs and accelerate time to value, while improving user experience.

A powerful addition to the ServiceNow portfolio, Finance and Supply Chain Workflows uses artificial intelligence (AI) to help organizations modernize mission-critical processes like sourcing, procurement, supplier and accounts payable management. Organizations can now simplify operations and experiences, create more resilient supply chains, and increase compliance. These new workflows join ServiceNow’s existing Technology, Employee, Customer, and Creator Workflow solutions.

“ServiceNow’s Finance and Supply Chain Workflows broaden our portfolio to help meet the unique needs of modern business leaders and organizations, including CFOs, procurement professionals, and supply chain executives,” said Josh Kahn, senior vice president of Creator and Finance and Supply Chain Workflows at ServiceNow. “To gain a competitive edge in an increasingly complex business environment, these leaders can now deploy automated capabilities across core business functions to drive efficiency and business value at scale, all on one, easy-to-use platform.”

Organizations today require more connected, responsive solutions that work across multiple departments and systems. Unfortunately, for many organizations, siloed systems of record were not built for today’s agile work and are difficult and costly to change. Finance and Supply Chain Workflows bring together people, processes, data, and technology in one easy-to-use platform to get work done across critical business processes. Now, finance, procurement, and supply chain teams can operate more efficiently, lowering the total cost of operations, while improving user experiences. By using data from existing ERP investments, businesses can automate processes and digitize mundane, manual work faster without the cost and organizational impact associated with large migrations.

Net-new built-in features include:

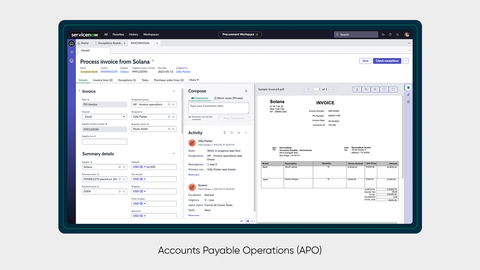

- Accounts Payable Operations (APO) automates the accounts payable process so employees don’t have to manually enter data or reconcile invoices against purchase orders and goods delivered. Now, teams can manage more suppliers and incorporate ESG, legal, and compliance activities into a single view to operate more efficiently.

- APO is part of Source-to-Pay Operations, which brings together everyone involved in sourcing, procuring, and paying for goods and services into one environment to automate the entire process. Launched in 2022, Source-to-Pay Operations helps enterprises automate procurement activities so they can handle more requests with fewer resources, manage spend more effectively, and source from partners that meet ESG benchmarks.

- Complementing our packaged Finance and Supply Chain Workflows, Clean Core ERP with App Engine uses ServiceNow’s low-code development tool to intelligently identify legacy ERP technical debt that can be removed, replaced, or automated. This allows non-technical users to rapidly lower legacy ERP costs and accelerate migrations.

These new solutions build on existing ServiceNow offerings to accelerate supplier management and procurement, which include Sourcing and Procurement Operations (formerly known as Procurement Service Management) and Supplier Lifecycle Operations (formerly known as Supplier Lifecycle Management), to transform the entire ERP journey, on the intelligent end-to-end platform for digital business.

“Finance and supply chain leaders understand the critical need to drive digital transformation and modernization across business functions with fewer resources,” said Mickey North Rizza, Group Vice-President of Enterprise Software for IDC. “Therefore, solutions that help organizations achieve sustained agility and efficiency, faster are becoming a requirement over a nice to have.”

What ServiceNow customers and partners are saying:

EY

“Collaborating with ServiceNow has allowed us to implement effective solutions to improve EY finance and procurement teams’ work experience,” said Hank Prybylski, EY Global Vice Chair – Transformation. “Building on this valuable alliance, new solutions in ServiceNow’s Finance and Supply Chain Workflows, such as Accounts Payable Operations (APO), will help EY teams operate more efficiently by connecting a wide range of data, systems, and people, so they can drive more business value.”

Nomura Research Institute, Ltd.

"At Nomura Research Institute we are using ServiceNow Procurement Operations Management to speed up the purchasing process and aim to reduce procurement work by employees by 50 percent," said Akira Matsumoto, senior corporate managing director, DX Platform Division at Nomura Research Institute, Ltd.

Siemens GBS

“Our long-lasting partnership with ServiceNow has been excellent. We have been impressed by their dedication to ensuring customer success and have enjoyed collaborating with them on strategic initiatives,” said Philip Hechtl, Head of Artificial Intelligence and Digital Service Management at Siemens AG, Global Business Services. “We are excited about their expansion into new business segments, specifically in the Finance and Supply Chain Workflows, and look forward to continuing our journey of co-creation. Together, we are confident in achieving our shared goals and continued success.”

Tata Consultancy Services

“TCS is helping clients cope with a volatile and uncertain world by redesigning their supply chains for greater agility, intelligence and resilience,” said Ram Subramanian, global head of the ServiceNow business at Tata Consultancy Services. “The launch of ServiceNow's new Finance and Supply Chain Workflows and Accounts Payable Operations comes at the right time for many of these business transformation initiatives. We will combine our domain knowledge with the configurability of these new solutions to streamline processes and improve turnaround times. Further, we have launched TCS Crystallus™ on Now - `Source to Pay’ to accelerate our clients’ transformation journeys and help finance and supply chain leaders realize business benefits much earlier.”

Availability:

Accounts Payable Operations and Clean Core ERP with App Engine are expected to be generally available this Fall as part of the Now Platform Vancouver release.

All other Source-to-Pay Operations products are generally available now and can be found in the ServiceNow Store.

Additional Information:

Learn more about the Finance and Supply Chain Workflows capabilities here.

About ServiceNow

ServiceNow (NYSE: NOW) makes the world work better for everyone. Our cloud-based platform and solutions help digitize and unify organizations so that they can find smarter, faster, better ways to make work flow. So employees and customers can be more connected, more innovative, and more agile. And we can all create the future we imagine. The world works with ServiceNow™. For more information, visit: www.servicenow.com.

© 2023 ServiceNow, Inc. All rights reserved. ServiceNow, the ServiceNow logo, Now, and other ServiceNow marks are trademarks and/or registered trademarks of ServiceNow, Inc. in the United States and/or other countries. Other company names, product names, and logos may be trademarks of the respective companies with which they are associated.

Contacts

Jacqueline Velasco

(408) 561-1937

press@servicenow.com