Luxury-Home Purchases Sink a Record 45% to the Second-Lowest Level on Record

Luxury-Home Purchases Sink a Record 45% to the Second-Lowest Level on Record

The supply of luxury homes is also near historic lows as sellers hold off amid economic uncertainty

Miami and Long Island see sharpest declines in luxury-home sales

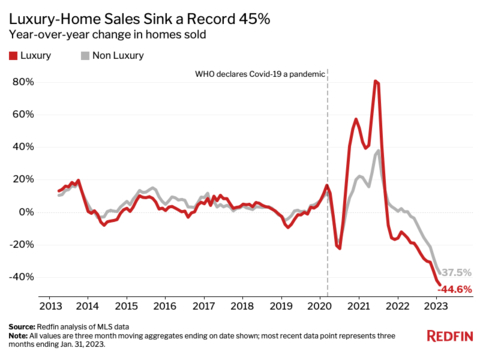

SEATTLE--(BUSINESS WIRE)--(NASDAQ: RDFN) — Sales of luxury U.S. homes declined a record 44.6% year over year during the three months ending Jan. 31, 2023, according to a new report from Redfin (redfin.com), the technology-powered real estate brokerage. That outpaced the record 37.5% drop in sales of non-luxury homes. Redfin’s data goes back to 2012.

The housing market has cooled significantly over the last year due to elevated mortgage rates, persistently high home prices, ongoing inflation and a shaky economy. Many wealthy Americans are choosing to invest in assets other than real estate because elevated mortgage rates and softening housing prices have cast a shadow over prospective real estate returns.

“Uncertainty is the main factor driving the luxury-market slowdown in Los Angeles,” said Alin Glogovicean, a local Redfin Premier real estate agent. “If you’re investing millions in a property, you want to make sure it will hold its value. Most luxury buyers and sellers are thinking, ‘Let’s just wait and see what happens to the market. When it stabilizes, we’ll be ready to go.’ Everyone is kind of at a standstill.”

The drop in high-end home sales was led by Miami, where luxury-home sales slumped 68.7% year over year, followed by Nassau County-Suffolk County, NY (-62.6%), Riverside (-59.8%), Anaheim (-59.3%) and San Jose (-59%). These markets are likely seeing high-end buyers back off because they were already among the least affordable in the nation, and rising rates added fuel to the fire. These markets also saw outsized surges in luxury sales during the pandemic, so luxury purchases are also likely coming down from unsustainable levels.

Luxury-Home Prices Remain Near Their Peak

While the housing market has slowed significantly, home prices have been propped up by a lack of supply. The median sale price of luxury homes rose 9% year over year to $1.09 million. While that’s roughly half the year-over-year gain of a year earlier, luxury prices remain near the all-time high of $1.1 million reached in spring 2022.

“The silver lining for the luxury buyers who are still in the market is that competition is sparse and jumbo loans now often have lower mortgage rates than other loan types, in part because there’s less risk that high-end buyers will default on their mortgages,” said Redfin Economics Research Lead Chen Zhao. “Wealthy house hunters are also frequently offered additional rate discounts from their banks as a perk for storing substantial funds there.”

Luxury-Housing Supply Is Just Shy of Its All-Time Low

The number of luxury homes for sale rose 7.1% year over year, the biggest jump since 2015. The sizable year-over-year increase is largely due to the fact that supply hit rock bottom roughly a year earlier; supply is also piling up because so few people are buying homes.

But supply remains tight by historical standards. The number of luxury homes for sale was not much higher than the record low hit about a year ago. Supply remains near historic lows in part because fewer people are putting their homes on the market. New listings of luxury homes fell 6.6% year over year. New listings of non luxury homes slumped 22.5%, the second biggest drop on record.

Redfin’s analysis defines luxury homes as those estimated to be in the top 5% based on the estimated market value. Non-luxury homes are defined as those estimated to be in the 35-65th percentile based on market value.

To view the full report and methodology, including charts and metro-level data, visit: https://www.redfin.com/news/luxury-home-sales-january-2023

About Redfin

Redfin (www.redfin.com) is a technology-powered real estate company. We help people find a place to live with brokerage, rentals, lending, title insurance, and renovations services. We sell homes for more money and charge half the fee. We also run the country's #1 real estate brokerage site. Our home-buying customers see homes first with on-demand tours, and our lending and title services help them close quickly. Customers selling a home can have our renovations crew fix up their home to sell for top dollar. Our rentals business empowers millions nationwide to find apartments and houses for rent. Since launching in 2006, we've saved customers more than $1 billion in commissions. We serve more than 100 markets across the U.S. and Canada and employ over 5,000 people.

For more information or to contact a local Redfin real estate agent, visit www.redfin.com. To learn about housing market trends and download data, visit the Redfin Data Center. To be added to Redfin's press release distribution list, email press@redfin.com. To view Redfin's press center, click here.

Contacts

Contact Redfin

Redfin Journalist Services:

Alina Ptaszynski, 206-588-6863

press@redfin.com