ThetaRay and Piie Collaborate in AI Technology for Insurance Payments

ThetaRay and Piie Collaborate in AI Technology for Insurance Payments

Insurtech startup to integrate ThetaRay AML solution to provide risk protection and insights for the insurance industry

CHARLOTTE, N.C. & NEW YORK & TEL AVIV, Israel--(BUSINESS WIRE)--ThetaRay, a leading provider of AI-powered transaction monitoring technology, and Piie, Inc., an insurtech providing an intelligent payment engine, today announced a collaboration to implement an advanced AML solution for insurance claim payments.

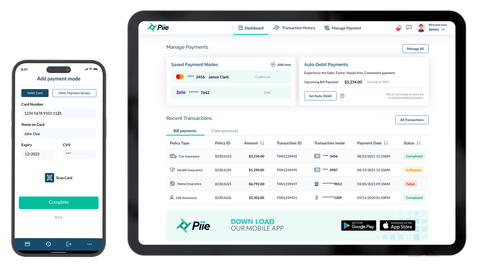

Through the agreement, Piie (Payments Intelligent Integration Engine) will integrate ThetaRay’s AI-driven SONAR transaction monitoring AML solution to monitor and detect anomalies pointing to suspected financial crime on its payments-as-a-service platform that includes mobile application support.

A scalable, secure payments platform headquartered in Charlotte, NC, Piie serves the insurance industry with an AI-driven real-time payments solution. Using ThetaRay’s transaction monitoring AML solution will further enhance and strengthen Piie’s current robust risk controls.

“Piie is revolutionizing how payments are processed within the insurance sector as the financial industry undergoes a digital transformation that is improving the customer journey for insurance companies,” said Mark Gazit, CEO of ThetaRay. “We are proud to partner with an insurtech that is focused on digital payments that enable companies to process insurance payments with lower costs and greater speed and accuracy.”

Ritesh Kirad, CEO of Piie, Inc. noted that "ThetaRay's advanced AML monitoring capabilities complement Piie's focus on a modern, secure payments architecture that reduces cost, improves efficiency, and delights policyholders."

ThetaRay’s award-winning SONAR solution is based on a proprietary form of AI, artificial intelligence intuition, that replaces human bias, giving the system the power to recognize anomalies and find unknowns outside of normal behavior, including completely new typologies. It enables fintechs and banks to implement a risk-based approach to effectively identify truly suspicious activity and create a full picture of customer identities, including across complex transaction paths. This allows the rapid discovery of both known and unknown money laundering threats, and up to 99 percent reduction in false positives compared to rules-based solutions.

About ThetaRay

ThetaRay's AI-powered SONAR transaction monitoring solution, based on "artificial intelligence intuition,” allows banks and fintechs to grow revenues through trusted global payments. The groundbreaking solution also improves customer satisfaction, reduces compliance costs, and increases risk coverage. Financial organizations that rely on highly heterogeneous and complex ecosystems benefit greatly from ThetaRay's unmatchable low false positive and high detection rates.

For more information, visit www.thetaray.com

Contacts

Nina Gilbert, ThetaRay

nina.gilbert@thetaray.com