Inflation Drives Down Small Business Satisfaction with Merchant Services as Cost and Fee Concerns Mount, J.D. Power Finds

Inflation Drives Down Small Business Satisfaction with Merchant Services as Cost and Fee Concerns Mount, J.D. Power Finds

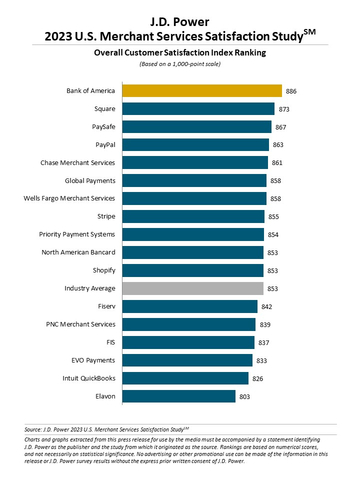

Bank of America Ranks Highest in Merchant Services Customer Satisfaction for Second Consecutive Year

TROY, Mich.--(BUSINESS WIRE)--Yes, there’s a lot of frustration when credit card readers do not respond to a customer’s dips, taps and swipes—or require a reset halfway through a transaction. According to the J.D. Power 2023 U.S. Merchant Services Satisfaction Study,SM released today, the small business owners who are fighting inflation and the significant costs and fees associated with those credit card readers have experienced sudden declines in customer satisfaction this year. The decline is driven by a combination of a tough economy, cost of service and chronic customer support difficulties with payment processing technology.

“It’s tough out there for small businesses right now,” said John Cabell, managing director of payments intelligence at J.D. Power. “Nearly two-thirds—66%—of small business owners say inflation is having a ‘severe impact’ or ‘major impact’ on their businesses this year, and many are still fighting supply chain issues and challenges related to the COVID-19 pandemic. Accordingly, the costs and fees associated with payment processing solutions are driving significant declines in customer satisfaction among small business owners. Now is the time when merchant services providers really need to prove their value to small businesses by offering proactive service and support to address inflationary concerns and high-quality technology that works every time.”

Following are key findings of the 2023 study:

- Overall satisfaction falls, driven by cost and fees: Overall small business satisfaction with merchant services providers is 853 (on a 1,000-point scale), down 6 points from 2022. The decline is driven largely by lower satisfaction with cost of service, which accounts for 30% of the overall satisfaction score. On a bright note, businesses that use in-person mobile devices have faster account funding and significantly higher cost of service satisfaction than in 2022.

- Technical issues plague end-user customers: According to small businesses, fewer than half (43%) of transactions are always completed without assistance when retail customers are using their credit or debit cards to pay for goods. Even in ecommerce transactions in which a physical credit card is not present, just 47% of transactions are always completed without some type of retail customer assistance. Most frequently cited problems include card being declined; tap/dip/swipe issues; frozen screens; and receipt malfunctions.

- Restaurants and very-small businesses feeling the pain: The biggest declines in overall customer satisfaction with merchant services providers are in the restaurant industry and among small businesses with less than $1 million in annual revenue. Restaurant and food industry businesses in this segment tend to be smaller and say they receive less support from their merchant services provider when it comes to understanding payment processing and fee structure. They also have lower satisfaction with cost of service for in-person payment methods than with takeout/delivery ecommerce platforms.

- Top customer service channels: Small businesses have higher levels of satisfaction and faster problem resolution when using mobile apps, video conferencing and merchant services provider websites than when they use email, phone calls to account representatives or interactive voice response (IVR).

Study Ranking

Bank of America ranks highest in merchant services satisfaction for a second consecutive year with a score of 886. Square (873) ranks second and PaySafe (867) ranks third.

The overall satisfaction results of FIS, Fiserv, Global Payments, North American Bancard and PayPal reflect their corporate results, meaning they include the results of various sub-brands (e.g., Braintree, Clover, EPX, Heartland, Worldpay and others) that operate under the respective corporate brand names. Two of the banks in the study—PNC Merchant Services and Wells Fargo Merchant Services—partner with Fiserv to provide merchant services to their small business clients. Fiserv also manages direct, standalone merchant services businesses that are distinct from these bank relationships.

The 2023 U.S. Merchant Services Satisfaction Study is based on responses from 4,825 small business customers of merchant services providers. The study was fielded from September through November 2022.

For more information about the U.S. Merchant Services Satisfaction Study, visit https://www.jdpower.com/business/merchant-services-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2023009.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com