Stable Surpasses 70 Million EV Charging Data Points Analyzed and Series A Round

Stable Surpasses 70 Million EV Charging Data Points Analyzed and Series A Round

Addition of Lead Investor Congruent Ventures, Along with Homecoming Capital, Ironspring Ventures and Seed Investors, Brings Total Funding to $14 Million to Make EV Charging Profitable

SAN FRANCISCO--(BUSINESS WIRE)--Stable, an EV charging data analysis platform, has now used its proprietary prediction software to analyze 70 million data points for prospective charging site locations across the U.S., and completed its Series A funding round. Lead investor Congruent Ventures is joined by Homecoming Capital and Ironspring Ventures this round, along with seed investors Trucks Venture Capital, Ubiquity Ventures, E14 Fund, Ahoy Capital, Upside Partnership, Qasar Younis and others–bringing total funds raised to $14 million.

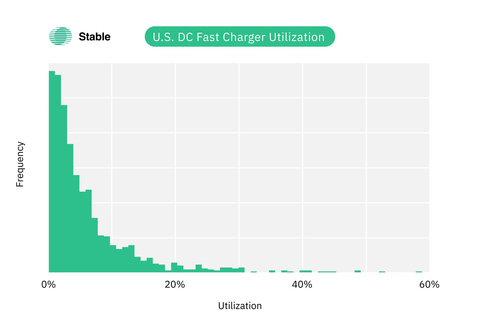

Stable co-founders and MIT Media Lab alumni, Rohan Puri and Jamie Schiel, doubled its funding to accelerate hiring of data scientists and engineers to help guide the next $39 billion* in EV charging deployments and spending from the Bipartisan Infrastructure Law (*according to calculations from Atlas Policy). Making EV charging stations profitable remains critical to adoption, as Stable’s own data shows that most chargers are used less than 10% of the time, and very few are used more than 20% of the time.

“Stable’s Machine Learning models help financial institutions, infrastructure developers and charging networks turn arbitrary decisions into data-driven ones based on a variety of factors like average trip distance, nearby amenities and energy costs,” says Stable co-founder and CEO Rohan Puri. “Predicting charger usage is just the beginning of EV adoption, and we’ll continue to help our customers deploy, track and monitor their investments.”

“We have been closely studying the challenges to EV infrastructure deployment, as millions of chargers are coming online over the next few years, and Stable is solving a major pain point,” says Jackie Kossmann, partner at Congruent Ventures. “Their highly accurate Machine Learning analytics – truly unique in the industry – allow customers to optimize their investments by placing public EV chargers in the best locations, which is essential to ensure consistent profitability for owners and smooth journeys for EV drivers.”

“'We are headed into a surge for a nationwide build out that will 10x the current number of EV chargers available to drivers,” says Reilly Brennan, founding partner at Trucks Venture Capital. “Stable tells asset owners where to put them to make more money and serve more customers.”

For more information, visit http://stable.auto.

About Stable Auto

Stable accelerates investments in EV infrastructure by making them predictable and effective, paving the way for EV adoption in every corner of the globe. Stable’s enterprise software platform–powered by comprehensive datasets from thousands of EV chargers across the United States and precision machine learning–solved a major roadblock to widespread EV adoption, demonstrating for the first time that not only can EV charging be predicted, it can be improved by carefully optimizing energy rates, equipment size, and location. Now, anyone can make informed decisions about EV infrastructure before chargers are even installed, to make multi-million dollar investments profitable and improve the chances of a more sustainable future for transportation. Stable is currently working with major utilities, charging networks, banks, and infrastructure developers across the U.S. http://stable.auto.

About Congruent Ventures

Congruent Ventures is a leading early stage venture firm focused on partnering with entrepreneurs to build companies addressing climate and sustainability challenges across four themes: Mobility and Urbanization, the Energy Transition, Food and Agriculture, and Sustainable Production and Consumption. The firm has over $600M AUM across early-stage climate tech funds. With over 47 companies in the portfolio, Congruent is amongst the most active investors in the climate and sustainability ecosystem.

Video available: https://youtu.be/-JKmmXRU5bo

Contacts

PR for Stable Auto: amy@talesplash.com