International Money Transfers at Your Fingertips With the DNBCnet App

International Money Transfers at Your Fingertips With the DNBCnet App

LONDON--(BUSINESS WIRE)--Sending money abroad has traditionally been an arduous and expensive task that frustrates users. Plus with the post-pandemic changes, people now need a faster yet cheaper contactless money transfer solution that can be done quickly on a mobile. That leads to the demand for payment apps.

But which ones are the best international payment apps? That depends. The best payment apps are the ones that work best for your business.

DNBCnet App - Powered by the leading Digital Banking Firm DNBC

Digital banking firm DNBC was founded by Le Hung Anh in 2017, professionally known as Jimmy Lee, headquartered in Singapore.

With the mission to support enterprises as well as individuals in financial transactions over the world, DNBC has developed the DNBCnet app in order to make the banking process easier yet cheaper by adapting more innovative changes right on the app.

“DNBCnet is an all-in-one tool for any user who wants to conduct international transactions, manage and control the cash flow of their business,” said Jimmy Lee, Founder & CEO of DNBC.

DNBCnet App offers exceptional benefits

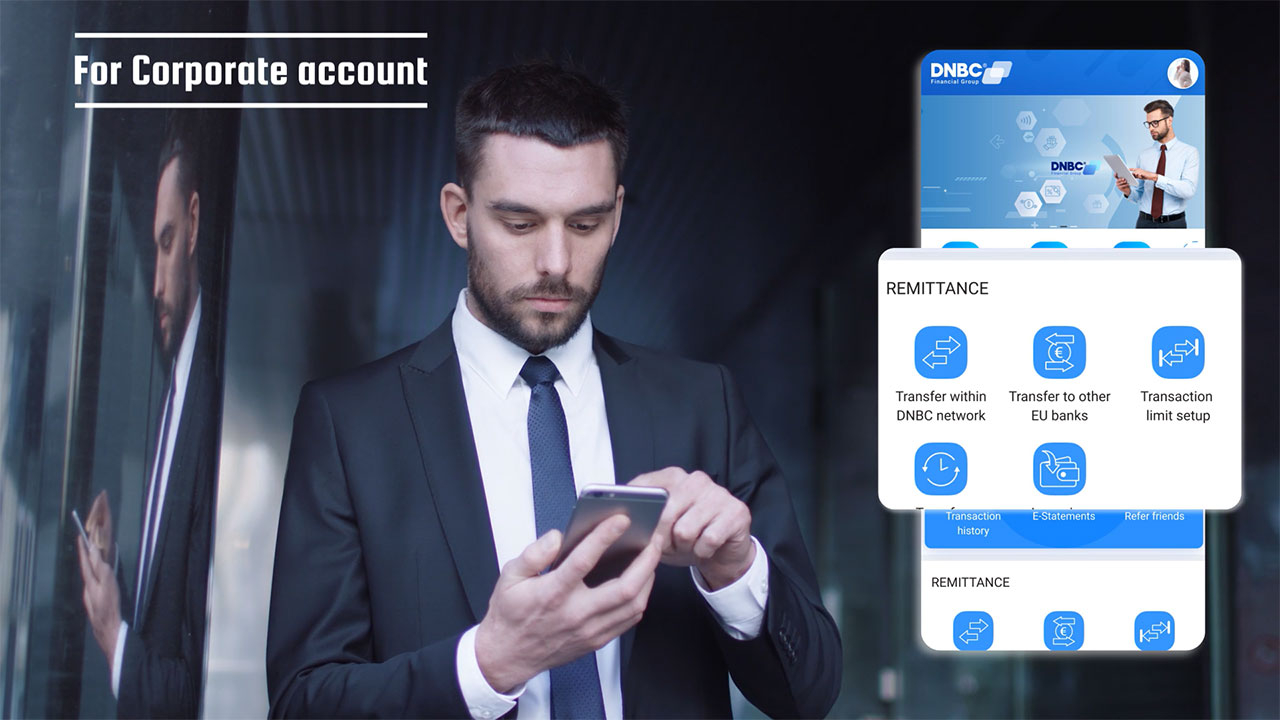

Best for corporate international money transfers

When it comes to international payments, companies just want to make quick transactions while keeping the costs as low as possible.

It can be difficult to find a provider that offers quick transfers and low fees. But if you want to keep your business straightforward, you don’t have to look very far because DNBC business accounts will fit the bill.

“If you structure payments properly, digital banking can create more predictable cash flow over the life of your business,” said CEO Jimmy Lee.

Fastest ways to send money abroad

When sending money globally, an important factor besides fees is the speed. Speedy transfer will accelerate the business, otherwise it will slow down the whole operation significantly.

With DNBCnet app, recipients will get the fund instantly if transferred in DNBC network. It only takes 1-2 business days to send to someone outside the system.

Ease of use

DNBCnet works as a mobile app, the signing up process can be done quickly with a few simple steps. It owns a seamless visual interface which allows users to handle payments in no time.

On top of that, you can keep track of your transfer and get updates along the way, so you’re always in the loop about your funds.

Utmost safety for mobile banking

Security is a must for any financial app. DNBC has raised its standard by adopting the latest technology such as two-factor authentication, data encryption for every transaction.

That will help protect account information and transactions to the fullest extent preventing any potential frauds for customers and businesses.

As a bonus perk

Besides the core function, DNBCnet also adds up a number of accompanying features to make it even more favorable. Users now can also check real-time exchange rate information, view financial statistics by charts, send mobile top up and many more.

Level up your payment practice with DNBCnet app

One of the key benefits of digital banking apps is that they allow users to manage payments anywhere and anytime. With that, business owners can focus on delivering services, not bothering with the payment process.

DNBCnet app offers exceptional convenience and transparency to its users. Via smartphones, you can find the IOS version for mobile banking on the App Store or mobile banking app for Android in the Google Store. Or simply search for DNBCnet.

Contacts

Name: Oliver Nguyen

Title: Vice Director

Email: oliver.ng@dnbcf.com

Phone: +370 5240 5555