Strategy Analytics: China's Dual Credit Policy - Winners and Losers in 2020

Strategy Analytics: China's Dual Credit Policy - Winners and Losers in 2020

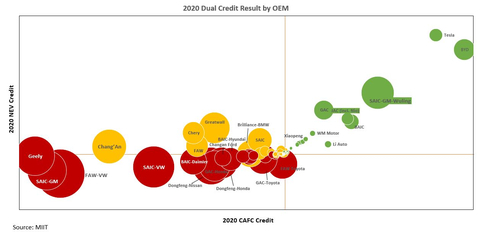

Variation Across the 2020 Dual Credit Results for Individual OEMs

BOSTON--(BUSINESS WIRE)--China's Dual Credit policy has been in place for the past several years and has been a key driver for the rapid growth of the New Energy Vehicle (NEV) segment in China. The latest Strategy Analytics Powertrain, Body, Safety & Chassis Service (PBCS) service report, China's Dual Credit Policy - Winners and Losers in 2020 analyzes the 2020 dual credit results at the national and OEM level, finding that only 44 OEMs reached dual credit compliance. OEMs like Tesla and BYD with a focus on BEVs (battery electric vehicles) posted the best results while traditional OEMs, including major international players such as Toyota, GM, VW and Honda struggled.

The Dual Credit policy considers Corporate Average Fuel Consumption (CAFC) and NEV (New Energy Vehicle) credits and requires all OEMs in China to achieve positive results for both. A failure to offset deficits after adopting all compliance approaches, including buying credits from the market, leads to China's Ministry of Industry and Information Technology (MIIT) denying approval for new model production. In 2020, Strategy Analytics’ analysis of the MIIT dual credit results showed a national CAFC deficit in 2020 of 7.45 million credits, offset by a surplus of 3.27 million NEV credits. Only 44 OEMs reached dual credit compliance and targets are becoming ever more stringent.

“After several years of implementation, China’s dual credit policy is starting to prove its significance in pushing OEMs towards electrification,” noted Julia An, report author and industry analyst in the PBCS Service. “It puts pressure on OEMs to proactively shape their future electrification strategies as compliance is now essentially a pre-condition of an OEM’s ability to expand in the China market.”

“The winners in 2020 were OEMs with an exclusive focus on BEVs led by Tesla and BYD,” observed Asif Anwar PBCS Service Director. “However, this doesn’t necessarily preclude the more traditional OEMs including Toyota, VW and GM from future success as long as they leverage their scale and expertise to optimize their xEV portfolios to meet future dual credit compliance requirements.”

#SA_Automotive

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com.

For more information about Strategy Analytics

Powertrain, Body, Safety & Chassis Service (PBCS): Click Here

Contacts

Report:

European Contact: Asif Anwar, +44 (0)1908 423 635, aanwar@strategyanalytics.com

US Contact: Mark Fitzgerald, +1 617 614 0773, mfitzgerald@strategyanalytics.com

China Contact: Kevin Li, +86 186 0110 3697, kli@strategyanalytics.com