French Business Leaders Are Optimistic About Growth Despite Labor Shortages, Inaugural J.P. Morgan Survey Finds

French Business Leaders Are Optimistic About Growth Despite Labor Shortages, Inaugural J.P. Morgan Survey Finds

PARIS--(BUSINESS WIRE)--French business leaders are optimistic about the economy and their company’s performance for the year ahead, despite facing challenges rooted in labor shortages, according to J.P. Morgan’s inaugural France Business Leaders Outlook survey released today.

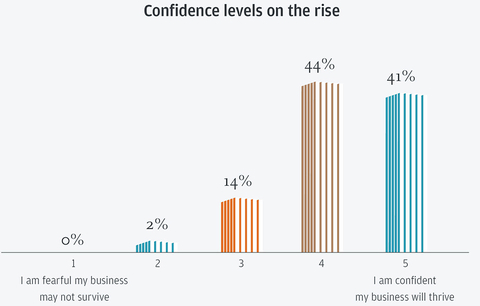

In a survey of nearly 250 senior executives from French midsize companies, business leaders are feeling upbeat and remaining resilient. About 60% are optimistic about the global, European and French economies, and that optimism jumps to nearly 80% around their industry performance. With that backdrop, 85% are either moderately or greatly confident that their business will thrive in 2022. In fact, 71% expect their revenues to increase this year, and 68% expect profits to climb. On current profit levels, 84% of business leaders reported their profits have either returned or exceeded to pre-pandemic levels, while 16% are not yet there.

“It’s no secret businesses have faced many unforeseen challenges over the past two years—and that doesn’t seem to be changing anytime soon,” said Olivier Simon, Head of Commercial Banking, J.P. Morgan France. “The good news is that business leaders have shown time and time again their ability to quickly adapt, proving just how resilient they are.”

Navigating Around Today’s Labor Shortage

While confidence levels may be on the rise, these decision-makers expect the labor shortages to be their toughest challenge in the year ahead. Nearly one-third (31%) cited recruiting and hiring as the biggest growing pain for French businesses—however, they are adapting to how work is being done.

The effects of the labor shortages are far-reaching, from businesses having to reduce or adjust hours of operation (39%), to delays in new launches or business updates (29%). But the top consequence is that nearly half (47%) of French businesses reported that current employees are working more hours.

To help retain top talent, French employers are being intentional and getting creative to help keep staff and incentivize new hires by offering:

- Flexible Work Arrangements: Nearly half of businesses have or plan to offer flexible hours (44%), or give employees flexibility on where they work from (41%).

- Expanded Training: Nearly four-in-ten (39%) businesses have or plan to offer up-skilling or training opportunities for current and new employees.

- Better Benefits: More than one-third (37%) of businesses have or plan to increase employee benefits, like healthcare, retirement planning, childcare, medical leave, sign-on bonuses, tuition reimbursement and more.

- Stronger Compensation Packages: More than one-third of businesses have or plan to increase wages (33%) or pay retention bonuses (35%).

Shifting to Digital

Financial technology (fintech) is increasing in importance for business leaders and two-thirds of businesses (67%) now use fintech tools in their daily operations.

There’s a strong correlation in digital adoption and business growth as 90% of business leaders expect their company to grow over the next year—most likely through new technology automating manual processes (55%) and leaning into digital channels, like e-commerce and contactless payments (46%).

Remaining ‘Busines as Usual’ Amid Geopolitical Shifts

Despite changes in geopolitics, the French business community is largely unconcerned.

- Post-Brexit Era: Following the United Kingdom’s withdrawal from the European Union, more than half of French business leaders cited that it’s business as usual—employee productivity (56%), company culture (56%), top-line revenues (51%), trade bureaucracy (51%) and supply chain issues (50%) have all remained the same. Businesses that have experienced change in these areas were more likely to experience it positively. Overall, the large majority (87%) of business leaders are very confident or confident about a post-Brexit era.

- French Elections: Almost three quarters (74%) of business leaders anticipate the French elections positively impacting their company. While its effect on strategic project timelines are varied, 41% of business leaders cite the election will accelerate their project timelines.

- Environmental and Social Accountability: More than three quarters (79%) of business leaders expect an increased focus on corporate responsibility factors this year. While four-in-ten (44%) have a positive outlook about environmental, social and corporate governance (ESG) because they are already meeting the requirements, almost one-third are worried about not meeting the requirements and 15% are unsure how to begin adapting to the ESG focus.

“In addition to the ongoing pandemic, French business leaders have dealt with many other external circumstances, such as Brexit, elections and a deeper focus on corporate responsibility—issues that affect their business at every level,” said Kyril Courboin, Head of J.P. Morgan France, Senior Country Officer. “Although the majority of business leaders feel confident about these factors in the year to come, it’s important for business leaders to continue to be nimble and adapt as changes will continue to arise.”

For more information on the 2022 J.P. Morgan Business Leaders Outlook in France, visit https://www.jpmorgan.com/commercial-banking/insights/2022-france-business-leaders-outlook

Survey Methodology

J.P. Morgan’s Business Leaders Outlook survey was conducted online from November 23–December 6, 2021. In total, 239 business leaders (CEOs, CFOs, heads of finance and owners) from French midsized companies (annual revenues ranging from €20 million to €2 billion) across various industries. Results are within statistical parameters for validity, and the error rate is +/- 6.4% with a 95% confidence level.

About JPMorgan Chase

JPMorgan Chase & Co. (NYSE: JPM) is a leading financial services firm based in the United States of America (“U.S.”), with operations worldwide. JPMorgan Chase had $3.7 trillion in assets and $294.1 billion in stockholders’ equity as of December 31, 2021. The Firm is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing and asset management. Under the J.P. Morgan and Chase brands, the Firm serves millions of customers in the U.S. and many of the world’s most prominent corporate, institutional and government clients globally. Information about JPMorgan Chase & Co. is available at www.jpmorganchase.com

© 2022 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, N.A. Member FDIC. JPMorgan Chase Bank, N.A. is organized under the laws of USA with limited liability. Visit jpmorgan.com/cb-disclaimer for full disclosures and disclaimers related to this content.

Contacts

J.P. Morgan France: Anne Roppé, anne.roppe@jpmorgan.com

J.P. Morgan Commercial Banking: Bentley Weisel, Bentley.r.weisel@chase.com