NEWARK, Del.--(BUSINESS WIRE)--Eight in ten college-bound juniors and seniors (81%) view higher education as a path to better opportunities, yet fewer than half (42%) of families feel confident about financing that education, according to “College Confidence: What America Knows About Paying for College,” the latest national study from Sallie Mae® and Ipsos. In addition, 42% of college-bound families agree they need help planning to pay for college, and 43% believe there are too few resources to help pay for higher education.

“As we have seen in our extensive research portfolio with Sallie Mae, students and families continue to agree college is a worthwhile investment. However, with this research we learned that just 11% of college-bound families feel very knowledgeable about the different ways to pay for college, and many aren’t aware of the different funding sources available to them,” said Jennifer Berg, Research Director, Ipsos. “The lack of understanding is even greater for first-generation families — just 35% feel confident about paying for college. This all speaks to a broader recommendation that college financing topics should be introduced in high school or earlier to provide families with tools, knowledge, and confidence to meet the cost of higher education.”

Some of the key findings from the research include:

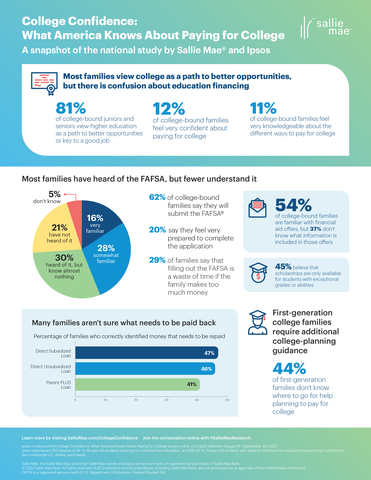

- While nearly three-quarters of families (74%) have started thinking about how they will cover the cost of higher education by the time their child is a high school junior, fewer than half of college-bound families (44%) are very or somewhat familiar with the FAFSA – the gateway to billions of dollars in scholarships, grants, and federal financial aid. In fact, just 62% of families plan to complete the FAFSA, with 29% feeling it’s a waste of time if the family makes too much money.

- Nearly half of families (45%) believe scholarships are only available for students with exceptional grades or abilities.

- While about half of families (54%) are familiar with financial aid offers from colleges and universities, 37% of them don’t know what information is included in these offers.

- Nearly half (47%) of college-bound families are planning to borrow to pay for college, but many are unclear on what types of aid needs to be paid back. Less than half of college-bound families correctly identified direct subsidized loans (47%), direct unsubsidized loans (46%), and the Parent PLUS loans (41%) as money that needs to be repaid.

“Higher education opens doors and opportunities for students and families, but it’s clear planning and preparing for that significant investment can be confusing and stressful,” said Nicolas Jafarieh, senior vice president, Sallie Mae. “Students and families need clear and consistent information, and support to fill these confidence gaps and we’re committed to doing just that at Sallie Mae. Through new tools and resources, and our recent acquisition of Nitro College, we are putting more solutions in the hands of college-bound families so they can make informed and confident decisions about their higher education journey.”

To help more students and families navigate their higher education journey, Sallie Mae entered into an agreement to acquire education solutions company Nitro College. Together, Sallie Mae and Nitro will provide a variety of free financial aid tools and resources, including a scholarship finder and FAFSA support as well calculators, research, and education to help students and families make informed decisions about college.

“College Confidence: What America Knows About Paying for College” reports the results of online interviews conducted from Aug. 19, 2021, through September 20, 2021, with 550 parents of high school juniors and seniors planning to continue their education and 585 high school juniors and seniors with plans to continue their education beyond high school.

The complete report and related infographic are available at SallieMae.com/CollegeConfidence.

Sallie Mae (Nasdaq: SLM) believes education and life-long learning, in all forms, help people achieve great things. As the leader in private student lending, we provide financing and know-how to support access to college and offer products and resources to help customers make new goals and experiences, beyond college, happen. Learn more at SallieMae.com. Commonly known as Sallie Mae, SLM Corporation and its subsidiaries are not sponsored by or agencies of the United States of America.

Ipsos is a global independent market research company ranking third worldwide among research firms. At Ipsos, we are passionately curious about people, markets, brands, and society. We make our changing world easier and faster to navigate and inspire clients to make smarter decisions. We deliver research with security, speed, simplicity, and substance. We believe it’s time to change the game — it’s time for Game Changers! Visit http://www.ipsos-na.com to learn more.

Category: Corporate and Financial