Strategy Analytics: Another Record Quarter for Smart Speakers in 3Q21, Though Supply Chain Woes are on the Horizon

Strategy Analytics: Another Record Quarter for Smart Speakers in 3Q21, Though Supply Chain Woes are on the Horizon

Even Amazon, Google, Baidu, Alibaba, and Apple Will Need to Weather the Storm

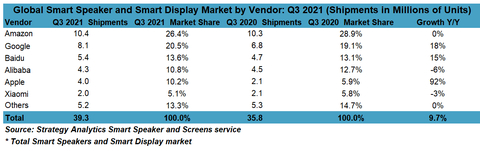

BOSTON--(BUSINESS WIRE)--The effects of the global component shortage have worked their way into the smart speaker supply chain, impacting Chinese vendors more acutely than others, according to the latest research from Strategy Analytics’ Smart Speakers and Screens service. Strategy Analytics estimates total smart speaker and smart display shipments grew 10% year-over-year to 39.3 million units, a record for a third calendar quarter though essentially flat from Q2 2021’s 39 million as market uncertainties persist, particularly with regards to the impacts of new COVID variants. While the ongoing and intensifying shortage of semiconductors and other components are not yet a crippling concern for vendors, smaller vendors that typically operate on the fringes of the market will face more challenges than others. Sales of Smart Displays in Q3 surged year-on-year by almost 19% to 11.2 million units, while sales of basic smart speakers (without a display) increased about 7% over the same period. Eighteen of the top 50 models sold in Q3 2021 were smart displays, with Google’s Nest Hub taking the smart display crown in Q3 2021 with 1.5 million units shipped, followed by the second generation of Amazon’s Echo Show 5 and Baidu’s Xiaodu Zaijia 1c. Google’s Nest Mini was the top-selling device overall in Q3 2021, at just over 5 million units, followed by Apple’s HomePod Mini and then Amazon’s fourth-generation Echo Dot.

In the overall smart speaker and smart display market in Q2 2021, the leaderboard remained unchanged, with Amazon at No. 1 followed by Google, Baidu, Alibaba, and Apple, respectively. The gap between the top five and the rest of the market continued to expand as these companies dominate entry-level ($50 to $99) and ultra-low ($49 and less) price bands, with Apple’s surge powered by its HomePod Mini.

“While our earlier forecasts showed we expected the market to return to stronger growth levels in 2021 if component supply constraints eased, this scenario is not playing out,” noted David Watkins, Director, Intelligent Home. “China alone typically accounts for 30% to 40% of the global market each quarter, so challenges experienced by Alibaba, Baidu, and Xiaomi will be indicators for how well – or not – China is managing its supply chain issues. The contract manufacturers partnered with these three, and dozens of other smart speaker and smart display brands, are settling in for a prolonged period of supply chain issues.”

Jack Narcotta, Principal Industry Analyst, Smart Home, added, “While the first half of 2021 in the global smart speaker and smart display market was a return to form as vendors capitalized on pent-up demand from 2020, the lingering, if not intensifying, issues of shipping and logistics challenges, component shortages, and the Delta and Omicron variants of the COVID-19 virus in the second half of 2021 are hanging heavy on this market. It is likely this market’s growth will not return to pre-COVID levels until at least 2023.”

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include: industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in: smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com.

Source: Strategy Analytics, Inc.

#SA_IntelligentHome

Contacts

European Contacts:

David Watkins, +33 153 409 952, dwatkins@strategyanalytics.com

US Contacts:

Bill Ablondi, +1 617 614 0744, wablondi@strategyanalytics.com

Jack Narcotta, +1 617 614 0798, jnarcotta@strategyanalytics.com