Elliott Advisors Publishes Letter on Taylor Wimpey

Elliott Advisors Publishes Letter on Taylor Wimpey

LONDON--(BUSINESS WIRE)--Elliott Advisors (UK) Limited sent the following letter to the Board of Taylor Wimpey plc today.

10 December 2021

The Board of Directors

Taylor Wimpey plc

Turnpike Road

High Wycombe HP12 3NR

Attn. Irene Mitchell Dorner, Chairman

Dear Members of the Board:

We are writing to you on behalf of funds advised by Elliott Advisors (UK) Limited (“Elliott” or “we”), which together are one of the top five investors in Taylor Wimpey plc (“Taylor Wimpey” or the “Company”). The size of our investment reflects our conviction in the substantial upside potential at Taylor Wimpey, which we believe is readily achievable.

The purpose of today’s letter is to share our perspectives on the opportunity at Taylor Wimpey. We are making these perspectives public in light of news reports regarding our views on the Company, which have left current and prospective Taylor Wimpey shareholders with incomplete information. Our hope is to foster a broad-based dialogue with market participants to form a consensus on the best path forward for Taylor Wimpey and its shareholders given the transition underway in the Company’s executive leadership.

Taylor Wimpey is a business with extraordinary potential, powered by talented employees dedicated to delivering high standards of product quality and customer satisfaction. Yet for all this promise, the Company continues to fall short of achieving the opportunity inherent in the business. In particular, a series of operational and strategic missteps has resulted in persistent share-price underperformance, leaving shareholders frustrated and lacking confidence in the Company.

With the recent resignation of the CEO following reports of Elliott’s involvement, the Company has taken an important first step toward the change that Taylor Wimpey needs to restore this lost confidence. However, the Board now finds itself at a critical juncture: To remedy its long-term underperformance and regain credibility with investors, the Board’s process to find a new CEO must be transparent and thorough; it must focus on external candidates who have not been a party to the underperformance to date; and it must be accompanied by governance enhancements to support the new CEO with the right kind of operational experience and expertise.

Given Taylor Wimpey’s recent and well-documented struggles, along with the fact that the most urgent change required pertains to the relatively straightforward need to optimise the Company’s leadership and governance, we have kept today’s letter brief. We would, however, be happy to present to you our detailed analysis of the Company, the issues it needs to overcome and the opportunities before it.

Taylor Wimpey Today

Taylor Wimpey today is one of the top-three homebuilders in the U.K. by number of completions. With nationwide scale, the Company meaningfully brings the U.K. closer to achieving its long-term housing goals. The Company has high customer1 and employee2 satisfaction levels, a strong strategic land pipeline and a landbank with great potential. Additionally, the Company has made considerable progress towards its ESG goals in relation to environmental targets and diversity, and has an AA ESG rating.3

The business is highly cash-generative and capable of providing substantial capital returns to shareholders. With the right operating company structure and an increased focus on outlet openings, the business should be capable of delivering sector-leading volume growth and margin expansion. However, in recent years, Taylor Wimpey — under its current leadership — has fallen short of its potential.

Failed large-sites strategy

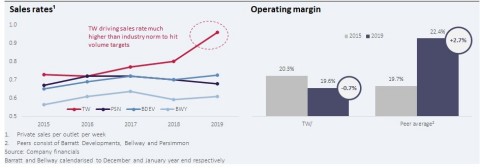

Presenting at the Capital Markets Day in May 2018, Taylor Wimpey’s management team laid out its strategy to focus on large sites. In order to meet annual volume targets, this strategy necessitated achieving sales and build rates far beyond the levels reported by peers. The strategy led to cost overruns and sale-price erosion, causing Taylor Wimpey to sacrifice margins for volume in 2019, significantly downgrading margin guidance and disappointing investors during a period where its closest sector peers experienced positive margin development.

See Figure 1: Failed large-site strategy caused operating margin development to lag peers

Equity Raise in 2020

Many investors and sell-side analysts viewed the decision to raise new equity in 2020 with scepticism. The pretext for the equity raise was the supposed exceptional opportunistic land-purchasing opportunity.4 Yet the land purchasing behaviour of the other major homebuilders — and the indicated returns of Taylor Wimpey’s new land purchases since the equity raise — suggest that this exceptional buying opportunity did not materialise, which led some to view the equity raise as the speculative raising of a war-chest in the hope that the land market would become even more attractive.5 For others, the equity raise led to questions about the robustness of the balance sheet and the land-buying strategy, concerns about delays in the return of capital to shareholders, and doubts surrounding the veracity and transparency of the Company’s communication. Other homebuilders have been able to position for growth and re-enter the land market over this period without needing to raise new equity.

Worst financial performance during the Covid-19 pandemic

Under current management’s direction, the Company suffered the worst declines in volumes in 2020 across the entire sector, with a 39% decline compared to Barratt and Bellway at 28-29%6 and Persimmon at only 14%. As the construction sector resumed activity following lockdowns, other homebuilders showed that it was not necessary to sacrifice financial performance to the extent that Taylor Wimpey did. The outgoing CEO himself pointed out that the Company could have made better decisions during this period: “I think we could have, in July particularly, just have switched that financial performance message back on a little bit more… By September we were building that balance of performance pressure back on, but we could have been a month or two earlier with hindsight.”7

The resulting gaps in value and credibility

The poor financial performance resulting from management’s missteps has led to a widening gulf in share-price performance between the Company and its peers over the past five years. The Company currently has the worst TSR among its peers over that period:

See Figure 2: Management missteps have resulted in significant share-price underperformance

The share-price underperformance means that Taylor Wimpey is currently trading far below its historical discount to peers on a range of metrics:

See Figure 3: Taylor Wimpey currently trades far below its historical discount to peers

In short, Taylor Wimpey’s share price does not reflect the considerable potential of its business. We believe this share-price underperformance is primarily due to the collapse in investor confidence in the Company’s leadership in recent years, the aforementioned strategic failings, together with a history of overpromising and under-delivering.

We commissioned a shareholder survey,8 which yielded an unambiguous result: Shareholders believe Taylor Wimpey is the company that stands to benefit the most of any in the industry from a full overhaul of its leadership, scoring last among its peers in management quality, strategy, capital allocation, landbank policy, cost control and communication:

See Figure 4: Shareholders believe that Taylor Wimpey stands to benefit the most from a full overhaul of its leadership

We believe that a meaningful change in leadership, with top-tier external talent, is essential to rebuild investor confidence. It is clear that the status quo invariably leads to inadequate results and persistently impaired shareholder value. Fortunately, there are several readily achievable steps the Board can take to address the Company’s underperformance and restore its position in the industry.

A Stronger Taylor Wimpey

As made clear from the outcome of the survey, Taylor Wimpey should appoint a new CEO who will help realise the great potential of the business — a leader who will empower and incentivise its talented employees and execute a transformation to restore investor confidence in the Taylor Wimpey story. Additionally, in our view, this leader should be supported by an enhanced Board. With the right leadership and governance enhancements, we believe Taylor Wimpey can achieve sector-leading margins and volume growth.

The right leader to help Taylor Wimpey deliver best-in-class results

The successor must represent a clean break with the current management team and should possess the following attributes:

1. Deep operational knowledge: We believe that an experienced operator is needed to deliver sector-leading margins and volume growth. This person must have the attention to detail and insight into the construction process to be able to control build costs and optimise margins, tackle supply-chain challenges and deliver volumes in a continually evolving and inflationary environment;

2. An established track record in the U.K.: The next CEO should possess a demonstrated track record that gives stakeholders confidence in his or her judgement and ability to achieve stated targets as well as make wise capital allocation and strategic decisions;

3. Credibility with the investor base: The next CEO of Taylor Wimpey must be someone that the investor base can trust; ideally, an executive who has earned that trust in prior investor-facing senior leadership roles. Whilst there are talented members of the Taylor Wimpey team, any current leader would represent a continuation of the status quo, and have shared in the loss of trust and credibility with investors; and

4. Ability to develop their own successor: We believe that a CEO who brings external experience and insights on industry best practices into Taylor Wimpey will enhance the development of other senior managers within the firm, including a potential successor. The next CEO of Taylor Wimpey must be able to harness the existing talent at the Company and attract fresh talent to it, enabling it to attain the best-in-class status the underlying assets are capable of achieving.

The right Board to help the next CEO succeed

In addition, to give the next CEO the best chances of success, we believe Taylor Wimpey’s Board should be enhanced with the addition of at least two new independent directors and the formation of a new committee of the Board to advise on operations. Taylor Wimpey’s Board currently lacks homebuilding experience — a critical deficit given that homebuilding is a highly specialised industry. Further, given that the Company’s historical challenges and future opportunities are primarily operational in nature, we believe that the formation of an operations committee of the Board would help oversee management’s initiatives to drive operational efficiencies.

The extraordinary potential for shareholder value creation

Our work with industry experts, including significant time spent with former C-Suite executives and managing directors, and a leading international consulting firm, suggests that the Company is capable of achieving margins significantly in excess of its medium-term guidance. The reversal of sale-price dilution and build-cost overruns corresponding to the failed large site strategy, coupled with the process of landbank evolution, can help the Company achieve operating margins consistent with the higher end of its medium-term targets. And additional measures — including the optimisation of the product mix, further standardisation of house types and greater plotting efficiency — have the potential to drive operating margins in excess of 26% in the medium-term, with EPS upside of over 40% from 2021 consensus levels. When one adds in the multiple re-rating that such an operational transformation would catalyse, we see greater than 70% total return potential over the medium term.

Working Together

With the right leadership in place, we believe Taylor Wimpey has the potential to establish itself as a best-in-class operator, delivering for customers, employees and shareholders. By contrast, the wrong decision at this juncture would represent a large setback. As our diligence and survey work makes clear, shareholders are unlikely to support a CEO candidate that represents an extension of the status quo at Taylor Wimpey. It is time for the Board to chart a bold new course for the Company by bringing in an experienced operator and putting in place the right corporate governance for this new leader to succeed.

Elliott has a long track record of working with companies on leadership succession and governance enhancement, and we look forward to engaging in a dialogue with the Board with a view to finding the right leader to help Taylor Wimpey unlock its full potential. We thank you in advance for your consideration of these perspectives and we would be happy to meet with the Board to discuss any aspect of this letter.

Yours sincerely,

Elliott Advisors (UK) Limited

DISCLAIMER

THIS DOCUMENT HAS BEEN ISSUED BY ELLIOTT ADVISORS (UK) LIMITED (“EAUK”), WHICH IS AUTHORISED AND REGULATED BY THE UNITED KINGDOM’S FINANCIAL CONDUCT AUTHORITY (“FCA”). NOTHING WITHIN THIS DOCUMENT PROMOTES, OR IS INTENDED TO PROMOTE, AND MAY NOT BE CONSTRUED AS PROMOTING, ANY FUNDS ADVISED DIRECTLY OR INDIRECTLY BY EAUK (THE “ELLIOTT FUNDS”).

THIS DOCUMENT IS FOR DISCUSSION AND INFORMATIONAL PURPOSES ONLY. THE VIEWS EXPRESSED HEREIN REPRESENT THE OPINIONS OF EAUK AND ITS AFFILIATES (COLLECTIVELY, “ELLIOTT MANAGEMENT”) AS OF THE DATE HEREOF. ELLIOTT MANAGEMENT RESERVES THE RIGHT TO CHANGE OR MODIFY ANY OF ITS OPINIONS EXPRESSED HEREIN AT ANY TIME AND FOR ANY REASON AND EXPRESSLY DISCLAIMS ANY OBLIGATION TO CORRECT, UPDATE OR REVISE THE INFORMATION CONTAINED HEREIN OR TO OTHERWISE PROVIDE ANY ADDITIONAL MATERIALS.

ALL OF THE INFORMATION CONTAINED HEREIN IS BASED ON PUBLICLY AVAILABLE INFORMATION WITH RESPECT TO TAYLOR WIMPEY PLC (THE “COMPANY”), INCLUDING PUBLIC FILINGS AND DISCLOSURES MADE BY THE COMPANY AND OTHER SOURCES, AS WELL AS ELLIOTT MANAGEMENT’S ANALYSIS OF SUCH PUBLICLY AVAILABLE INFORMATION. ELLIOTT MANAGEMENT HAS RELIED UPON AND ASSUMED, WITHOUT INDEPENDENT VERIFICATION, THE ACCURACY AND COMPLETENESS OF ALL DATA AND INFORMATION AVAILABLE FROM PUBLIC SOURCES, AND NO REPRESENTATION OR WARRANTY IS MADE THAT ANY SUCH DATA OR INFORMATION IS ACCURATE. ELLIOTT MANAGEMENT RECOGNISES THAT THERE MAY BE CONFIDENTIAL OR OTHERWISE NON-PUBLIC INFORMATION WITH RESPECT TO THE COMPANY THAT COULD ALTER THE OPINIONS OF ELLIOTT MANAGEMENT WERE SUCH INFORMATION KNOWN.

NO REPRESENTATION, WARRANTY OR UNDERTAKING, EXPRESS OR IMPLIED, IS GIVEN AND NO RESPONSIBILITY OR LIABILITY OR DUTY OF CARE IS OR WILL BE ACCEPTED BY ELLIOTT MANAGEMENT OR ANY OF ITS DIRECTORS, OFFICERS, EMPLOYEES, AGENTS, OR ADVISORS (EACH AN “ELLIOTT PERSON”) CONCERNING: (I) THIS DOCUMENT AND ITS CONTENTS, INCLUDING WHETHER THE INFORMATION AND OPINIONS CONTAINED HEREIN ARE ACCURATE, FAIR, COMPLETE OR CURRENT; (II) THE PROVISION OF ANY FURTHER INFORMATION, WHETHER BY WAY OF UPDATE TO THE INFORMATION AND OPINIONS CONTAINED IN THIS DOCUMENT OR OTHERWISE TO THE RECIPIENT AFTER THE DATE OF THIS DOCUMENT; OR (III) THAT ELLIOTT MANAGEMENT’S INVESTMENT PROCESSES OR INVESTMENT OBJECTIVES WILL OR ARE LIKELY TO BE ACHIEVED OR SUCCESSFUL OR THAT ELLIOTT MANAGEMENT’S INVESTMENTS WILL MAKE ANY PROFIT OR WILL NOT SUSTAIN LOSSES. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. TO THE FULLEST EXTENT PERMITTED BY LAW, NONE OF THE ELLIOTT PERSONS WILL BE RESPONSIBLE FOR ANY LOSSES, WHETHER DIRECT, INDIRECT OR CONSEQUENTIAL, INCLUDING LOSS OF PROFITS, DAMAGES, COSTS, CLAIMS OR EXPENSES RELATING TO OR ARISING FROM THE RECIPIENT’S OR ANY PERSON’S RELIANCE ON THIS DOCUMENT.

EXCEPT FOR THE HISTORICAL INFORMATION CONTAINED HEREIN, THE INFORMATION AND OPINIONS INCLUDED IN THIS DOCUMENT CONSTITUTE FORWARD-LOOKING STATEMENTS, INCLUDING ESTIMATES AND PROJECTIONS PREPARED WITH RESPECT TO, AMONG OTHER THINGS, THE COMPANY’S ANTICIPATED OPERATING PERFORMANCE, THE VALUE OF THE COMPANY’S SECURITIES, DEBT OR ANY RELATED FINANCIAL INSTRUMENTS THAT ARE BASED UPON OR RELATE TO THE VALUE OF SECURITIES OF THE COMPANY (COLLECTIVELY, “COMPANY SECURITIES”), GENERAL ECONOMIC AND MARKET CONDITIONS AND OTHER FUTURE EVENTS. YOU SHOULD BE AWARE THAT ALL FORWARD-LOOKING STATEMENTS, ESTIMATES AND PROJECTIONS ARE INHERENTLY UNCERTAIN AND SUBJECT TO SIGNIFICANT ECONOMIC, COMPETITIVE, AND OTHER UNCERTAINTIES AND CONTINGENCIES AND HAVE BEEN INCLUDED SOLELY FOR ILLUSTRATIVE PURPOSES. ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THE INFORMATION CONTAINED HEREIN DUE TO REASONS THAT MAY OR MAY NOT BE FORESEEABLE. THERE CAN BE NO ASSURANCE THAT THE COMPANY SECURITIES WILL TRADE AT THE PRICES THAT MAY BE IMPLIED HEREIN, AND THERE CAN BE NO ASSURANCE THAT ANY ESTIMATE, PROJECTION OR ASSUMPTION HEREIN IS, OR WILL BE PROVEN, CORRECT.

THIS DOCUMENT IS FOR INFORMATIONAL PURPOSES ONLY, AND DOES NOT CONSTITUTE (A) AN OFFER OR INVITATION TO BUY OR SELL, OR A SOLICITATION OF AN OFFER TO BUY OR SELL, ANY SECURITY OR OTHER FINANCIAL INSTRUMENT AND NO LEGAL RELATIONS SHALL BE CREATED BY ITS ISSUE, (B) A “FINANCIAL PROMOTION” FOR THE PURPOSES OF THE FINANCIAL SERVICES AND MARKETS ACT 2000, (C) “INVESTMENT ADVICE” AS DEFINED BY THE FCA HANDBOOK, (D) “INVESTMENT RESEARCH” AS DEFINED BY THE FCA HANDBOOK, OR (E) AN “INVESTMENT RECOMMENDATION” AS DEFINED BY REGULATION (EU) 596/2014AND BY REGULATION (EU) NO. 596/2014 AS IT FORMS PART OF U.K. DOMESTIC LAW BY VIRTUE OF SECTION 3 OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 (“EUWA 2018”) INCLUDING AS AMENDED BY REGULATIONS ISSUED UNDER SECTION 8 OF EUWA 2018. THIS DOCUMENT IS NOT (AND MAY NOT BE CONSTRUED TO BE) LEGAL, TAX, INVESTMENT, FINANCIAL OR OTHER ADVICE. EACH RECIPIENT SHOULD CONSULT THEIR OWN LEGAL COUNSEL AND TAX AND FINANCIAL ADVISERS AS TO LEGAL AND OTHER MATTERS CONCERNING THE INFORMATION CONTAINED HEREIN. THIS DOCUMENT DOES NOT PURPORT TO BE ALL-INCLUSIVE OR TO CONTAIN ALL OF THE INFORMATION THAT MAY BE RELEVANT TO AN EVALUATION OF THE COMPANY, COMPANY SECURITIES OR THE MATTERS DESCRIBED HEREIN.

NO AGREEMENT, COMMITMENT, UNDERSTANDING OR OTHER LEGAL RELATIONSHIP EXISTS OR MAY BE DEEMED TO EXIST BETWEEN OR AMONG ELLIOTT MANAGEMENT AND ANY OTHER PERSON BY VIRTUE OF FURNISHING THIS DOCUMENT. ELLIOTT MANAGEMENT IS NOT ACTING FOR OR ON BEHALF OF, AND IS NOT PROVIDING ANY ADVICE OR SERVICE TO, ANY RECIPIENT OF THIS DOCUMENT. ELLIOTT MANAGEMENT IS NOT RESPONSIBLE TO ANY PERSON FOR PROVIDING ADVICE IN RELATION TO THE SUBJECT MATTER OF THIS DOCUMENT. BEFORE DETERMINING ON ANY COURSE OF ACTION, ANY RECIPIENT SHOULD CONSIDER ANY ASSOCIATED RISKS AND CONSEQUENCES AND CONSULT WITH ITS OWN INDEPENDENT ADVISORS AS IT DEEMS NECESSARY.

THE ELLIOTT FUNDS HAVE A DIRECT OR INDIRECT INVESTMENT IN THE COMPANY]. ELLIOTT MANAGEMENT THEREFORE HAS A FINANCIAL INTEREST IN THE PROFITABILITY OF THE ELLIOTT FUNDS’ POSITIONS IN THE COMPANY. ACCORDINGLY ELLIOTT MANAGEMENT MAY HAVE CONFLICTS OF INTEREST AND THIS DOCUMENT SHOULD NOT BE REGARDED AS IMPARTIAL. NOTHING IN THIS DOCUMENT SHOULD BE TAKEN AS ANY INDICATION OF ELLIOTT MANAGEMENT’S CURRENT OR FUTURE TRADING OR VOTING INTENTIONS WHICH MAY CHANGE AT ANY TIME.

ELLIOTT MANAGEMENT INTENDS TO REVIEW ITS INVESTMENTS IN THE COMPANY ON A CONTINUING BASIS AND DEPENDING UPON VARIOUS FACTORS, INCLUDING WITHOUT LIMITATION, THE COMPANY’S FINANCIAL POSITION AND STRATEGIC DIRECTION, THE OUTCOME OF ANY DISCUSSIONS WITH THE COMPANY, OVERALL MARKET CONDITIONS, OTHER INVESTMENT OPPORTUNITIES AVAILABLE TO ELLIOTT MANAGEMENT, AND THE AVAILABILITY OF COMPANY SECURITIES AT PRICES THAT WOULD MAKE THE PURCHASE OR SALE OF COMPANY SECURITIES DESIRABLE, ELLIOTT MANAGEMENT MAY FROM TIME TO TIME (IN THE OPEN MARKET OR IN PRIVATE TRANSACTIONS, INCLUDING SINCE THE INCEPTION OF ELLIOTT MANAGEMENT’S POSITION) BUY, SELL, COVER, HEDGE OR OTHERWISE CHANGE THE FORM OR SUBSTANCE OF ANY OF ITS INVESTMENTS (INCLUDING COMPANY SECURITIES) TO ANY DEGREE IN ANY MANNER PERMITTED BY LAW AND EXPRESSLY DISCLAIMS ANY OBLIGATION TO NOTIFY OTHERS OF ANY SUCH CHANGES. ELLIOTT MANAGEMENT ALSO RESERVES THE RIGHT TO TAKE ANY ACTIONS WITH RESPECT TO ITS INVESTMENTS IN THE COMPANY AS IT MAY DEEM APPROPRIATE.

ELLIOTT MANAGEMENT HAS NOT SOUGHT OR OBTAINED CONSENT FROM ANY THIRD PARTY TO USE ANY STATEMENTS OR INFORMATION CONTAINED HEREIN. ANY SUCH STATEMENTS OR INFORMATION SHOULD NOT BE VIEWED AS INDICATING THE SUPPORT OF SUCH THIRD PARTY FOR THE VIEWS EXPRESSED HEREIN. ALL TRADEMARKS AND TRADE NAMES USED HEREIN ARE THE EXCLUSIVE PROPERTY OF THEIR RESPECTIVE OWNERS.

1 Winner of the ‘Five Star Award’ awarded by the UK Home Builders Federation in 2021

2 Taylor Wimpey is the top-ranked homebuilder in Glassdoor’s “Best Places to Work in the U.K.” list.

3 MSCI rating

4 “Disruption in land market as result of COVID-19 pandemic creating short term opportunities to acquire land from a broad range of sources at attractive returns and prices below pre-COVID-19 levels” – June 2020 Prospectus

5 Per the 2020 Annual Report, the 22,600 plots approved post the equity raise and by the end of the year were at an average return on capital employed of 34%; lower than the 36% and 35% for 2019 and 2018 respectively. This does not appear to reflect a dislocated land market.

6 Completions calendarised to Dec 2020 for Barratt and Jan 2021 for Bellway

7 “Taylor Wimpey ‘slow’ in response to summer market surge, Redfern admits.” Housing Today, 31 March 2021.

8 The study, conducted by a leading global consultancy, had 41 respondents, all of whom are investors in UK homebuilders and 80% of whom are holders of Taylor Wimpey, representing over 40% of its shares.

***

About Elliott

Elliott Investment Management L.P. manages approximately $48 billion of assets. Its flagship fund, Elliott Associates, L.P., was founded in 1977, making it one of the oldest funds under continuous management. The Elliott funds' investors include pension plans, sovereign wealth funds, endowments, foundations, funds-of-funds, high net worth individuals and families, and employees of the firm. Elliott Advisors (UK) Limited is an affiliate of Elliott Investment Management L.P.

Contacts

Media Contacts

Elliott Advisors (UK) Limited

Sarah Rajani CFA

T: +44 (0)20 3009 1475

srajani@elliottadvisors.co.uk

Camarco

Billy Clegg

T: +44 (0)20 3757 4983

billy.clegg@camarco.co.uk