We Predict Deepview True Cost: After Higher First Year Costs, EV Service Costs Fall 30% Below Gas Vehicle Costs at Three Years

We Predict Deepview True Cost: After Higher First Year Costs, EV Service Costs Fall 30% Below Gas Vehicle Costs at Three Years

- Deepview data shows electric vehicle maintenance is three times lower and repairs are 22% lower than gas vehicle costs at three years

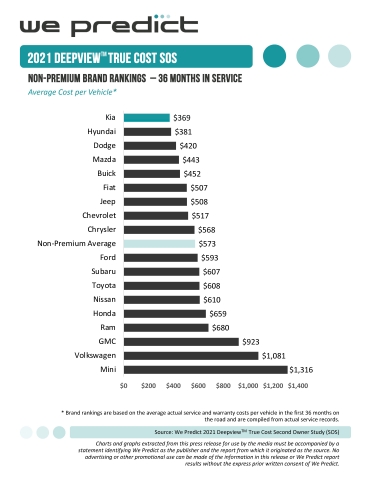

- Kia ranks best for lowest service costs among non-premium brands at three years

- Acura has the lowest service costs among premium brands for the same period

- Nissan Motor Corp. tops the brand award count with six segment-leading vehicles in the new We Predict Deepview True Cost study of service cost data at three years in service

ANN ARBOR, Mich.--(BUSINESS WIRE)--Service costs for electric cars and light trucks fall to 30% lower than their gasoline-powered counterparts at three years on the road, according to the Deepview™ True Cost Second Owner Study (SOS) published today by predictive analytics and data company We Predict.

Deepview True Cost SOS measures actual money spent by owners and manufacturers of 2018-model-year vehicles during their first three years on the road. The study reveals which brands and models across 24 segments – including electric vehicles (EVs) – have the lowest average service costs at three years on the road. Deepview True Cost service costs are based on the total money spent by manufacturers and vehicle owners on repairs, maintenance, service campaigns, diagnostics, software updates, recalls, and warranty on factory-installed options.

“The data bears out what many hoped would be true,” We Predict Founder and CEO James Davies said. “While EV service costs are higher than their gas counterparts early in ownership, the cumulative service costs for EVs fall over time to 30% less than gas vehicles at three years on the road – primarily due to lower maintenance costs.”

- At three months in service, EVs average service costs of $123; gas vehicles average $53. (EVs are 132% more)

- At 1 year in service, EVs average $306 in service costs per vehicle; gas vehicles average $189. (EVs are 62% more)

- At 36 months on the road, EV service costs average $514; gasoline vehicles average $749. (EVs are 31% less)

EVs have fewer mechanical parts than gasoline vehicles, contributing to 22% lower repair costs. The primary difference in cost, however, is maintenance. The average spent on maintenance per EV in the first three years is $77, significantly lower than the $228 average for gas vehicles.

“Consumers have high expectations for EVs in terms of cost of ownership,” said Renee Stephens, vice president of North American operations for We Predict. “While costs early in the ownership period are higher for EVs, they eventually become more economical – for both the owner and the manufacturer. Over time, less EV maintenance offsets the higher year-one costs for diagnosis, repair and campaigns.”

Vehicles Becoming More Costly to Service

Deepview True Cost data highlights trends that are seemingly at odds. Vehicle service costs are increasing even as industrywide vehicle quality continues to improve.

Deepview True Cost SOS reveals service costs for 2018-model-year vehicles average $731 in the first three years of service. That’s an 11% jump from 2016-model-year vehicles’ first three years on the road. The cost increase is seen across repairs (+4%), maintenance (+11%) and campaigns (+35%).

The increase is more pronounced among premium vehicles, where 2018-model-year vehicles recorded an 18% cost hike (since the 2016 model year) to $1,513 per vehicle. Non-premium vehicles recorded average service costs of $573 – a 4% increase – in the same period.

“New technologies and options tend to enter the market in premium vehicles, which means they are more costly to repair or replace,” Stephens said. “As the technologies and options move into non-premium segments, we anticipate service costs will increase for those vehicles, as well.”

The study finds that manufacturers are incurring slightly more of the burden for overall service expenses for 2018 vehicles, paying an average of $364 per vehicle, 11% more than they paid for 2016 vehicles. Meanwhile owners are spending an average of $309, just $1 more than what owners of 2016 vehicles paid during the first three years of ownership. The increased cost to manufacturers is due in large part to labor charges, which have increased to $199 per 2018 vehicle from $168 for 2016 vehicles. Campaign costs to manufacturers have also increased, rising to $105 per vehicle from $84.

“While manufacturers’ average service costs per vehicle may seem relatively small, cumulatively they add up very quickly when you consider the volume of vehicles sold per brand,” Davies said. “Having an industrywide view of the market and being able to anticipate problems, and intervene quickly, can help automakers avoid millions of dollars in repairs. Those savings can then be applied elsewhere in the company.”

Award-Winning Brands and Models

Hyundai Corporation’s Kia and Hyundai brands rank first and second among non-premium brands for the lowest average actual service and warranty costs per vehicle in the first 36 months on the road at $369 and $381, respectively. Dodge ranks third at $420.

Among premium brands, Acura models have the lowest service and warranty costs with an average of $600. Lincoln models are second at $879, followed by Genesis at $1,181.

Nissan Motor Corp. leads all automotive manufacturers with six vehicles at the top of their respective segments for the lowest service and warranty costs. Nissan’s six segment leaders are: Infiniti Q70 (midsize premium car); Infiniti QX80 (large premium SUV): Nissan 370Z (compact premium sporty car); Nissan Armada (large SUV); Nissan Frontier (midsize pickup); and Nissan NV (commercial vehicle).

Stellantis has five segment-leading vehicles: Chrysler 300 (large car); Dodge Challenger (midsize sporty car); Dodge Grand Caravan (midsize van); Dodge Journey (midsize SUV); and Ram 1500 (large pickup).

General Motors Corp. and Hyundai Motor Corp. each have four segment-leading vehicles. GM vehicles that lead their segments: Cadillac CT6 (large premium car); Chevrolet Corvette (midsize premium sporty car); Chevrolet Silverado 2500 HD (large HD pickup); and Chevrolet Spark (small car). Hyundai’s highest-ranked models: Kia Forte (compact car); Kia Optima (midsize car); Kia Soul (compact MPV); and Kia Sportage (compact SUV).

Honda North America and Ford Motor Co. each have two vehicles that rank highest in their respective segments. Honda’s highest-ranked vehicles are the Acura RDX (compact premium SUV) and Honda Clarity (electric vehicle), while Ford’s segment leaders are the Lincoln MKX (midsize premium SUV) and Lincoln MKZ (compact premium car).

The Mazda MX5 (compact sporty car) also topped its segment.

Actual service costs per vehicle for the first three years on the road range broadly from $202 to $5,012.

The study includes more than 13 million vehicles across 400 models, with results based on 65 million service or repair orders that totaled more than $7.7 billion in parts and $9.5 billion in labor costs. Included in the calculations are maintenance, unplanned repairs, warranty and recalls, service campaigns, diagnostics, software updates, and warranty on factory-installed options. Items such as gas, local and state inspections, seasonal tire changes, and insurance are not included.

We Predict released its first study, the Deepview™ True Cost Report, in May 2021. The initial study examined similar costs among 2021-model-year vehicles at three months in service.

About We Predict

Formed in 2009, We Predict uses machine learning and unique predictive methodologies to assist global blue-chip customers in anticipating and accelerating decisions on product, on market, as well as on financial performance. Our top-notch data scientists, mathematicians, computer scientists, and industry experts work together with our clients to explore and gain new insights into where your business is headed, creating the opportunity to course-correct with confidence. Using our service, clients gain insights into huge amounts of data at the touch of a button so they can take action – fast. Some guess, we know. www.wepredict.com

Contacts

John Tews

The Millerschin Group

(248) 326-8317

jtews@millerschingroup.com