Fidelity Investments to Add 9,000 New Jobs, Doubling Hiring Efforts Year-Over-Year to Serve Growing Customer Base

Fidelity Investments to Add 9,000 New Jobs, Doubling Hiring Efforts Year-Over-Year to Serve Growing Customer Base

Fidelity Continues to Increase its Client-Facing and Technology Expertise in Record Numbers

The Company Plans for a Work Strategy that Blends Both In-Person and Remote Working to Deliver the Flexibility its Associates Want

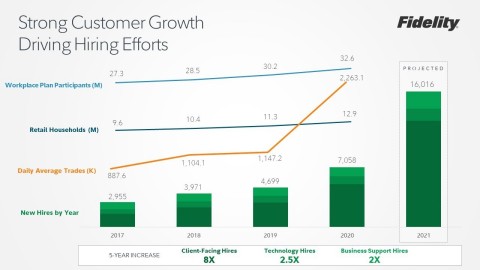

BOSTON--(BUSINESS WIRE)--Fidelity Investments,® one of the industry’s most diversified and largest financial services companies committed to strengthening and securing its clients’ financial well-being, today announced the creation of 9,000 new jobs across the United States. The jobs, in combination with the thousands announced earlier this year, will increase hiring twofold by year-end compared to 2020, which saw an increase of 7,200 jobs, and fivefold compared to 2017. These increases come at a time when Fidelity continues to see record growth and business results across its businesses.

"Fidelity continues to achieve strong growth and results for our 38 million customers because of the hard work and commitment of our associates,” said Abigail P. Johnson, Chairman and CEO, Fidelity Investments. “Our financial strength and stability allow us to make significant investments in our businesses and create value for the people we are privileged to serve.”

Fidelity’s hiring is across all job functions, particularly client-facing positions (44 percent) and technology (9 percent), helping to create new products, like Fidelity’s Youth Account, and digital asset capabilities, like enhancing the digital asset trading experience. All of Fidelity’s jobs help people live better lives by making financial expertise broadly accessible and effective. “At Fidelity, caring about the well-being of customers is at our core, and we are looking for people who share in this passion,” said Bill Ackerman, head of human resources, Fidelity Investments. “If you care about helping people, there’s a job here for you.”

Fidelity is planning for a hybrid work strategy that combines in-person and remote working where associates work flexibly based on personal and professional needs. This dynamic working style may vary for associates based on their role, the type of work they do, and their team needs. “We are always actively listening and collecting feedback from our people, and we continue to test and learn. We’re especially focused on those populations who have been most impacted by the pandemic,” continued Ackerman. “We hear loud and clear about the benefits that come with remote work and the benefits of in-person work. Our flexible approach to work will give our associates the best of both.”

Fidelity, a 2021 LinkedIn Top Company, continues to test and innovate with new associate benefits, such as work-from-home allowances, enhanced matching gifts programs, and a new working caregiver pilot designed to help associates find reliable and affordable childcare for the days and weeks they need it. Fidelity continues to also offer expedited hiring, onboarding, and training processes as well as new entry level programs, all of which prioritize the safety of candidates and associates. To get more information or to apply to join the Fidelity team, visit https://jobs.fidelity.com.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $11.0 trillion, including discretionary assets of $4.1 trillion as of June 30, 2021, we focus on meeting the unique needs of a diverse set of customers: helping more than 35 million people invest their own life savings, 22,000 businesses manage employee benefit programs, as well as providing more than 13,500 wealth management firms and institutions with investment and technology solutions to drive growth. Privately held for 75 years, Fidelity employs more than 47,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

Fidelity Investments and Fidelity are registered service marks of FMR LLC.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC, 500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC, 200 Seaport Boulevard, Boston, MA 02110

993791.1.0

© 2021 FMR LLC. All rights reserved.

Contacts

Media Only:

Corporate Communications

(617) 563-5800

fidelitycorporateaffairs@fmr.com

Cait Burke

(401) 292-7540

cait.burke@fmr.com

Follow us on Twitter @FidelityNews

Visit About Fidelity and our online newsroom

Subscribe to email alerts from news from Fidelity