Merritt Hawkins Report: Nurse Practitioners Top List of Most Recruited Providers

Merritt Hawkins Report: Nurse Practitioners Top List of Most Recruited Providers

Market Softens for Primary Care Physicians, More Robust for Specialists

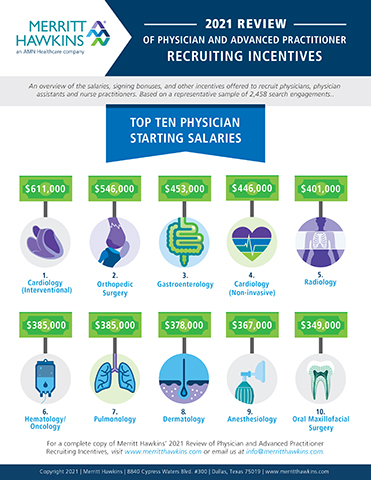

Nurse practitioners topped the list of most recruited providers in the annual report on physician and advanced practitioner recruiting trends, the 2021 Review of Physician and Advanced Practitioner Recruiting Incentives, produced by Merritt Hawkins, a leading medical search firm and a company of AMN Healthcare. (Graphic: Business Wire)

DALLAS--(BUSINESS WIRE)--Nurse practitioners topped the list of most recruited providers in the annual report on physician and advanced practitioner recruiting trends produced by Merritt Hawkins, a leading medical search firm and a company of AMN Healthcare.

The 2021 Review of Physician and Advanced Practitioner Recruiting Incentives indicates that over a 12-month period, Merritt Hawkins conducted more search engagements for nurse practitioners (NPs) than for any other type of provider. In the 27 prior years the report was conducted, physicians held the top spot. For the previous 14 years, the number one position was held by family physicians.

“COVID-19 and other forces are changing the dynamics of physician and advanced practitioner recruiting,” said Tom Florence, president of Merritt Hawkins. “NPs are coming into their own in a market that puts a premium on easy access to care and cost containment.”

According to Florence, NPs are being used to staff a growing number of urgent care centers and outpatient clinics that offer convenient access to care. They also are being recruited to provide telehealth services that feature direct access to care givers. Younger patients, in particular, are foregoing visits to traditional, office-based primary care physicians in favor of more convenient settings, Merritt Hawkins’ report indicates, softening demand for primary care physicians.

“Primary care physicians are still a vital part of team-based care and will be increasingly responsible for coordinating the care of older patients with multiple chronic conditions,” Florence said. “But the recruiting frenzy in primary care is over.”

Older Population Driving Need for Specialists

While family physicians were second on Merritt Hawkins’ list of most recruited providers, primary care physicians comprised only 18% of the firm’s search engagements over 12 months, compared to 20% the prior year and 22% two years ago. By contrast, specialist physicians comprised 64% of the firm’s search engagements over 12 months, while advanced practitioners, including NPs, physician assistants (PAs), and certified registered nurse anesthetists (CRNAs) comprised 18%, up from 13% the previous year.

With more than 10,000 Baby Boomers turning 65 every day, a growing number of older patients require the services of specialists to treat aging organ systems, bones and brains. Specialists, on average, are older than primary care doctors and many are on the verge of retirement, according to Florence, limiting supply. In addition, while NPs and PAs can perform many of the duties of primary care physicians, they cannot perform many of the complex procedures done by specialists. It is for these reasons that the Association of American Medical Colleges (AAMC), in its June 2021 report The Complexities of Physician Supply and Demand, projected a shortage of up to 48,000 primary care physicians by 2034, but an even greater shortage of more than 77,000 specialist physicians.

COVID-19 Suppressed Demand for Physicians

Merritt Hawkins’ report indicates that COVID-19 had a severely inhibiting effect on demand for physicians. The number of search engagements Merritt Hawkins conducted declined by 25% year-over-year, as many hospitals, medical groups, and other healthcare facilities shut down services and lost revenue. Nevertheless, the number of NP search engagements the firm conducted increased year-over-year, signaling strong demand for these providers.

The decrease in demand for doctors is likely to be temporary, Merritt Hawkins’ report indicates. The various underlying dynamics driving physician supply and demand remain in place, including a growing and aging population, a limited supply of newly trained physicians, and an aging physician workforce. COVID-19 will not permanently change these market conditions, and demand for physicians already is rebounding, according to Florence.

Starting Salaries Decrease

As a result of reduced demand, starting salaries tracked in the report decreased for many types of providers. Both NPs and PAs were an exception, however. The average starting salary for NPs as tracked in the report was $140,000, a 12% year-over-year increase, while the average starting salary for PAs was $128,000, a 14% increase. The highest average starting salary for physicians as tracked in the report was $611,000 for interventional cardiologists, while the lowest was $236,000 for pediatricians.

More information about physician and advanced practitioner compensation and recruiting trends, and a copy of Merritt Hawkins’ 2021 Review of Physician and Advanced Practitioner Recruiting Incentives, may be accessed at https://www.merritthawkins.com/uploadedFiles/Merritt-Hawkins-2021-incentive-review.pdf.

About Merritt Hawkins

Merritt Hawkins is the largest physician search and consulting firm in the United States and is a company of AMN Healthcare (NYSE: AMN). More information about Merritt Hawkins can be accessed at www.merritthawkins.com.

About AMN Healthcare

AMN Healthcare is the leader and innovator in total talent solutions for healthcare organizations across the nation. The Company provides access to the most comprehensive network of quality healthcare professionals through its innovative recruitment strategies and breadth of career opportunities. With insights and expertise, AMN Healthcare helps providers optimize their workforce to successfully reduce complexity, increase efficiency and improve patient outcomes. AMN total talent solutions include managed services programs, clinical and interim healthcare leaders, temporary staffing, executive search solutions, vendor management systems, recruitment process outsourcing, predictive modeling, language interpretation services, revenue cycle solutions, credentialing and other services. Clients include acute-care hospitals, community health centers and clinics, physician practice groups, retail and urgent care centers, home health facilities, schools and many other healthcare settings. AMN Healthcare is committed to fostering and maintaining a diverse team that reflects the communities we serve. Our commitment to the inclusion of many different backgrounds, experiences and perspectives enables our innovation and leadership in the healthcare services industry. For more information about AMN Healthcare, visit www.amnhealthcare.com.

Contacts

Phillip Miller

Merritt Hawkins/AMN Healthcare

(469) 524-1420

phil.miller@amnhealthcare.com