LegalShield June Consumer Stress Index Increases as Consumer Protection Measures Approach Expiration Date

LegalShield June Consumer Stress Index Increases as Consumer Protection Measures Approach Expiration Date

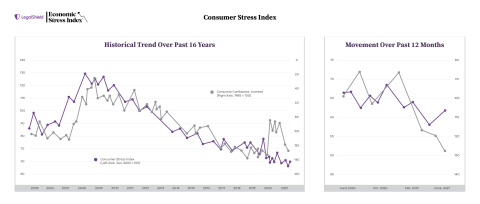

ADA, Okla.--(BUSINESS WIRE)--LegalShield, the company that protects and empowers people with tools and services needed to affordably live a just and secure life, today released its June Economic Stress Index, a suite of leading indicators of the economic and financial status of U.S. households and small businesses. The LegalShield Consumer Stress Index, one of five sub-indices, rose in June for the second consecutive month, with the index’s consumer finance component reaching its highest point since June of last year. LegalShield plan members sought assistance with credit reports and repair, vehicle financing, payday loans/title loans, and billing disputes causing The LegalShield Consumer Stress Index to increase (worsen) 1.7 points in June to 61.5.

“While stimulus payments, federal protections, and forbearance programs have kept consumer stress muted throughout the pandemic, financial strain appears to be increasing as government interventions are being phased out,” said LegalShield CEO Jeff Bell.

Despite the rise in Consumer Stress, LegalShield’s Bankruptcy Index remains at its second-lowest reading on record. The data do not suggest that a wave of bankruptcies is imminent, but instead should stay low in the coming months. Bankruptcies and foreclosures also bear close surveillance upon the expiration of federal protection programs.

The LegalShield Economic Stress Index™ is the only index of its kind that reflects prevailing economic conditions and likely developments for the months ahead based on actual demand for various legal services. Our index comprises five sub-indices – Consumer Stress, Bankruptcy, Foreclosure, Housing Construction, and Housing Sales – constructed from the company’s proprietary data, accumulated over the past 16 years. Each time a provider law firm, in all 50 states, receives a member request for services, the request is logged as an “intake” in one of roughly 70 unique areas of law (e.g. real estate, LLC formation, etc.). The company on average receives 185,000 intakes per month from over 1.8 million paid memberships, including individuals and small businesses, a statistically meaningful sample.

Keybridge LLC, a longstanding economic and public policy consulting firm based in Washington D.C., is responsible for independently compiling and analyzing the LegalShield data and developing the accompanying economic narrative. A PDF of LegalShield’s full April Economic Stress Index can be downloaded here: www.legalshield.com/economic-stress-index

About PPLSI Inc.

A trailblazer in the democratization of affordable access to legal protection, PPLSI is the world's largest platform for legal, identity, and reputation management services. For 49 years the PPLSI brand and its operating brands LegalShield and IDShield, have provided individuals, families, businesses, and employers with the tools and services needed to affordably live a just and secure life. To learn more about the brands that currently protect over 4.5M individuals and 140K businesses, visit: www.legalshield.com and www.idshield.com .

Contacts

Media:

Jennifer Gaglione

PH: 216-870-6333

Email: jennifergaglione@legalshieldcorp.com