Dodge Momentum Index Loses Steam in June

Dodge Momentum Index Loses Steam in June

Pullback in commercial and institutional planning ends six-month string of gains

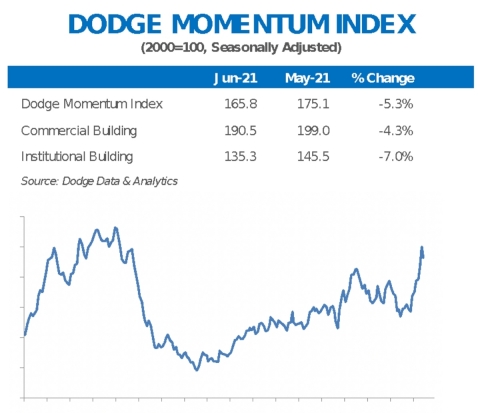

HAMILTON, N.J.--(BUSINESS WIRE)--Following six months of consecutive gains, the Dodge Momentum Index fell to 165.8 (2000=100) in June, down 5% from the revised May reading of 175.1. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year.

The decline in June was the result of losses in both institutional planning, which fell 7%, and commercial planning, which lost 4%.

Uncertain demand for some building types (such as retail and hotels), higher material prices, and continued labor shortages are weighing down new project planning. Even with June’s decline, however, the Momentum Index remains near a 13-year high and well above last year. Compared to a year earlier, both commercial and institutional planning were significantly higher than in June 2020 (39% and 46% respectively). Overall, the Momentum Index was 41% higher.

A total of 13 projects with a value of $100 million or more entered planning during June. The leading commercial projects were a $194 million data center in Dulles VA and the $109 million FedEx warehouse in Cedar Rapids IA. The leading institutional projects were the $300 million Mt. Edgecumbe Medical Center replacement in Sitka AK and the $200 million renovation of the New York Public Library SNFL Branch in New York NY.

June’s retreat in planning activity is another sign that the recovery from the pandemic-led recession will be nonlinear. The current level of the Momentum Index and its underlying components, however, continue to signal that a more broad-based recovery in nonresidential construction starts will occur in 2022.

About Dodge Data & Analytics

Dodge Data & Analytics is North America’s leading provider of commercial construction project data, market forecasting & analytics services and workflow integration solutions for the construction industry. Building product manufacturers, architects, engineers, contractors, and service providers leverage Dodge to identify and pursue unseen growth opportunities that help them grow their business. On a local, regional or national level, Dodge empowers its customers to better understand their markets, uncover key relationships, seize growth opportunities, and pursue specific sales opportunities with success. The company’s construction project information is the most comprehensive and verified in the industry.

As of April 15th, Dodge Data & Analytics and The Blue Book -- the largest, most active network in the U.S. commercial construction industry -- combined their businesses in a merger. The Blue Book Network delivers three unparalleled databases of companies, projects, and people.

Dodge and The Blue Book offer 10+ billion data elements and 14+ million project and document searches. Together, they provide a unified approach for new business generation, business planning, research, and marketing services users can leverage to find the best partners to complete projects and to engage with customers and prospects to promote projects, products, and services. To learn more, visit: construction.com and thebluebook.com.

Contacts

Nicole Sullivan | AFFECT Public Relations & Social Media | +1-212-398-9680, nsullivan@affectstrategies.com