Auto Insurance Shopping Surged during Pandemic in 2020 but Little Brand Differentiation Apparent, J.D. Power Finds

Auto Insurance Shopping Surged during Pandemic in 2020 but Little Brand Differentiation Apparent, J.D. Power Finds

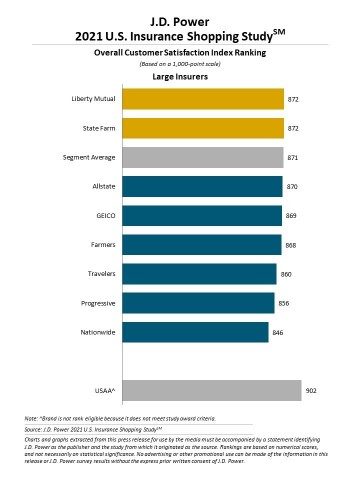

Liberty Mutual and State Farm Rank Highest in a Tie among Large Insurers; American Family Ranks Highest among Midsize Insurers

TROY, Mich.--(BUSINESS WIRE)--A 55% decrease in the average number of miles driven and a record 15% unemployment rate sent many auto insurance customers shopping for a new policy after the onset of the pandemic in 2020. What they found was an increasingly homogenized marketplace differentiated primarily by price. According to the J.D. Power 2021 U.S. Insurance Shopping Study,SM released today, insurers’ efforts to differentiate themselves in the marketplace will increasingly hinge on bringing more innovative customer solutions to market.

“The pandemic has revealed a lot about insurance shopping behaviors in 2020, as there was a significant surge in shopping activity among customers who were financially affected and many gravitated to big, well-known brands and offers for lower rates,” said Tom Super, head of property & casualty insurance at J.D. Power. “The experience shines a spotlight on the need for more sophisticated acquisition and retention tools. Ironically, while the industry’s estimated annual ad spend now nears $10 billion, consumers say they see less differentiation among the top brands. Following a period of massive disruption and a prolonged, uneven recovery, auto insurance customers have a heightened expectation about factors such as price, flexibility and coverages. Insurers need to get more creative around customer service and delivery because the current incremental changes are missing the mark.”

Following are some key findings of the 2021 study:

- A tale of two auto insurance customers: More than half (54%) of auto insurance customers have taken no action to manage their insurance costs during the pandemic. Among the 46% who have made changes, the most frequent are reducing coverage (17%); shopping for another carrier (15%); increasing deductible (12%); or switching to another carrier (12%). There has been a 6-percentage-point increase in shopping activity among customers who have had a pandemic-related change in their financial circumstances.

- Many customers unaware of insurance industry relief efforts: The auto insurance industry returned an unprecedented $18 billion in auto insurance premiums—representing approximately 7% of total industry premiums—to customers who have driven significantly less miles since the beginning of the pandemic. Despite the size and scale of this relief effort, 43% of shoppers were not aware of their insurer making any changes because of the pandemic.

- Customers continue migration to big brands: The top five insurers—in terms of total premiums—now account for 60% of all auto insurance premiums, up from 44% two decades ago. This past year saw another 3% year-over-year increase in auto insurance customer migration to the five biggest insurers. Unaided brand awareness—despite an estimated $10 billion in consumer advertising—has been a major driver of this trend.

- Customer lifetime value becomes critical metric for carriers: One-fourth (25%) of auto insurance shoppers are projected to have higher customer lifetime value by virtue of strong credit scores and high likelihood of adding additional insurance products. According to this year’s study, MetLife (33%), Travelers (32%) and Erie Insurance (31%) have the highest mix of high lifetime value shoppers.

Study Rankings

Liberty Mutual and State Farm rank highest in a tie among large auto insurers in providing a satisfying purchase experience, each with a score of 872 (on a 1,000-point scale). The segment average is 871.

American Family ranks highest among midsize auto insurers, with a score of 899. Amica Mutual (891) ranks second and Erie Insurance (882) ranks third. The segment average is 858.

Now in its 15th year, the U.S. Insurance Shopping Study captures advanced insight into each stage of the shopping funnel and is based on responses from 12,971 insurance customers who requested an auto insurance price quote from at least one competitive insurer in the previous nine months. The study was fielded from March 2020 through January 2021.

For more information about the U.S. Insurance Shopping Study, visit https://www.jdpower.com/business/resource/jd-power-us-insurance-shopping-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2021038.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power is headquartered in Troy, Mich., and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com