Strategy Analytics: Consumer Spending on Streaming Video To Exceed Pay TV For First Time In 2024

Strategy Analytics: Consumer Spending on Streaming Video To Exceed Pay TV For First Time In 2024

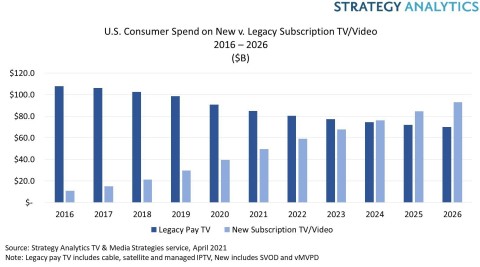

NEWTON, Mass.--(BUSINESS WIRE)--U.S. viewers will spend more on streaming video than pay TV for the first time in 2024, according to the latest research from Strategy Analytics. According to the report, U.S. Subscription TV Forecast, consumer spending on traditional pay TV services fell by 8% to $90.7B in 2020 and will decline further to $74.5B in 2023. By contrast, spending on streaming services (such as video-on-demand and internet-delivered subscription TV) rose by 34% to $39.5B in 2020 and will reach $76.3B in 2024, passing pay TV for the first time. By 2026 the report predicts that pay TV will account for only 40% of spending on video and TV services, compared to 81% ten years earlier. This continued shift in consumer expenditure is the most important sign of the transformation in the television and video business which is engulfing content producers, aggregators, distributors, and technology partners.

Growth metrics in subscription video-on-demand (SVOD) usually focus on numbers of subscriptions, but this ignores what matters most - money. In spite of the many challenges it has faced, pay TV still commands much higher monthly revenues from its declining base of customers than from any single SVOD service. Nevertheless, as more households add new SVOD services while cutting the pay TV cord, revenues will inevitably shift further away from legacy pay TV.

“The revenue picture gives the best illustration of the relative strength of new and old businesses,” says Michael Goodman, Director, TV & Media Strategies. “The fact that viewers are willing to divert an ever-increasing share of their entertainment wallet away from pay TV and towards new internet-based services demonstrates that the future lies with streaming video services rather than legacy pay TV players. This is a long-term transition, but there is no doubt that the writing is on the wall for pay TV as we have known it for more than 40 years.”

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include: industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in: smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com.

Source: Strategy Analytics, Inc.

#SA_Media&Services

For more information about Strategy Analytics

TV & Media Strategies

Contacts

Report contacts:

Michael Goodman, +1 617 614 0769, mgoodman@strategyanalytics.com

David Mercer, +44 7875 391218, dmercer@strategyanalytics.com