Strategy Analytics: Global Smartphone Shipments Surge to 340 Million units, Up +24% YoY in Q1 2021

Strategy Analytics: Global Smartphone Shipments Surge to 340 Million units, Up +24% YoY in Q1 2021

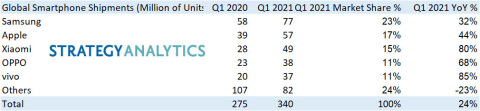

BOSTON--(BUSINESS WIRE)--According to the latest research from Strategy Analytics, global smartphone shipments were 340 million units in Q1 2021, up +24% YoY representing the highest growth since 2015. The smartphone market rebound was driven by the healthy demand of consumers with aging devices and a phenomenal 5G push from Chinese vendors.

Linda Sui, Senior Director, at Strategy Analytics, said, “The China smartphone market had a sensational quarter driven by 5G product success across multiple price tiers. China smartphone shipments were up +35% YoY reaching 94 million units in Q1 2021. Globally, the top five vendors combined took a 76% market share in Q1 2021, up from 71% one year ago. Chip shortages and supply side constraints did not have a significant impact in Q1 among the top 5 brands but was and will be a concern for smaller vendors over the next few quarters in our view.”

Neil Mawston, Executive Director at Strategy Analytics, added: “Samsung remains the largest vendor shipping 77 million smartphones globally in the first quarter, growing +32% YoY from 58 million units in Q1 2020. Samsung’s newly launched more affordable A series 4G and 5G phones, and the earlier launched Galaxy S21 series combined drove solid performance in the quarter. Apple shipped 57 million units iPhones worldwide, capturing second place with a 17% volume market share. The strong momentum behind the 5G iPhone 12 series continued across multiple markets.”

Yiwen Wu, Senior Analyst at Strategy Analytics, noted: “Xiaomi held third place in terms of volume of smartphones shipped for the second quarter in a row. It shipped 49 million smartphones globally and took a 15% market share in Q1 2021, up from 10% one year ago. The vendor maintained strong momentum in both India and China, and the expansion in Europe, Latin America and Africa region also started to bear fruit. OPPO (not including Realme and OnePlus) won 11% market share and remained the fourth largest smartphone vendor in the first quarter, followed by vivo. vivo grew an impressive 85% YOY in Q1 2021.”

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com.

Contacts

For more information about Strategy Analytics

Smartphone Strategies: Click Here

Report contacts:

Linda Sui, Senior Director, lsui@strategyanalytics.com

Neil Mawston, Executive Director, nmawston@strategyanalytics.com

Yiwen Wu, Senior Analyst, ywu@strategyanalytics.com