Strategy Analytics: Q1 2021: Xiaomi and Oppo Set to Capture Third and Fourth Spots in UK Smartphones

Strategy Analytics: Q1 2021: Xiaomi and Oppo Set to Capture Third and Fourth Spots in UK Smartphones

Operator Relationships will be rewarded by high single digit market share

BOSTON--(BUSINESS WIRE)--According to the latest research from Strategy Analytics, Xiaomi and Oppo, two leading Chinese OEM’s, are rising rapidly by working closely with UK operators, O2, Vodafone, EE/BT and Three. The two OEM’s are expected to win high-single-digit volume share in Q1 2021.

Woody OH, Director at Strategy Analytics, said, “Xiaomi and Oppo are cementing their smartphone market share in UK, being no.3 and no.4 OEM ahead of Huawei. The two Chinese vendors are prioritizing shipping their 4G and 5G-capable smartphones directly to operators in the UK. Operators are ramping up 5G service coverage across the country and prioritizing the sourcing of price-competitive 5G smartphones while Huawei is out of the game.”

Neil Mawston, Executive Director at Strategy Analytics, noted, “The UK smartphone market was dominated by Apple, Samsung and Huawei until 2019. However, Xiaomi and Oppo have been very quick to seize on the opportunity presented by Huawei’s geopolitical problems. UK operators need a mix of innovative OEMs to provide affordable high quality 4G/5G devices to support the transition to the next generation 5G technology.”

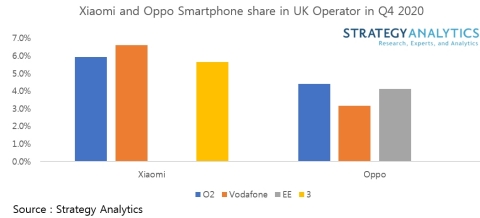

Rajeev Nair, Senior Analyst at Strategy Analytics, noted, “Xiaomi and Oppo achieved mid-single-digit share at each operator that they are working with in Q4 2020. We expect their share to get up to high-single-digits in Q1 and Q2 2021.”

Source: Strategy Analytics

#SA_Devices

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include: industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in: smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com.

For more information about Strategy Analytics

Smartphone Country Share Tracker: Click here

Contacts

Report contacts:

European Contact: Neil Mawston, +44 1908 423628, nmawston@strategyanalytics.com

Asia Contact: Woody OH, +44 1908 423665, woh@strategyanalytics.com