BOSTON--(BUSINESS WIRE)--The COVID-19 pandemic underscores the importance of health care benefits to both employers and employees, many of whom are overwhelmed with rising health care costs and the complexities of health care decisions. Today, Fidelity Investments® – a diversified financial services firm and leader in creating dynamic employee benefits programs – announces continued growth from its health care benefits business, driven by these customer needs:

- Health Savings Account (HSA): Fidelity has helped nearly 2 million people manage how they save and pay for their health care costs. These 1.76 million funded HSAs represent a 19% growth since last year, resulting in $10.2 billion in total assets (52% increase)1. There has also been growth in the assets held by Fidelity HSA® owners that are invested (42%).

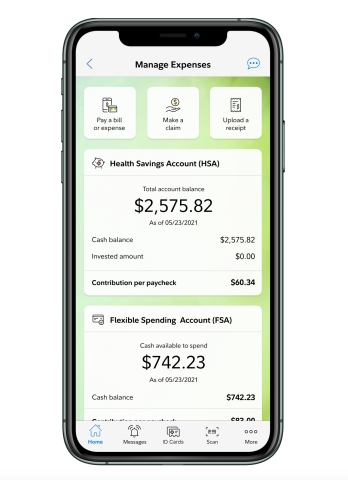

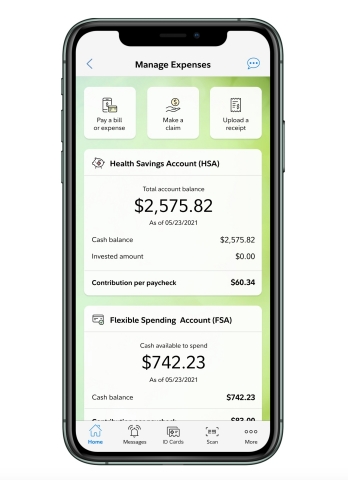

- Digital Health Benefits: Fidelity’s Health & Welfare benefits administrative services help employers offer health care decision support and guidance. With a commitment to building integrated, digital experiences, the firm introduces the new Fidelity Health App. The app allows employees to seamlessly manage their health needs on the go, from finding in-network providers and understanding coverage, to accessing digital ID cards. Those with a Fidelity HSA through their employer can view balances, transactions, and contributions, plus scan products to know if they are HSA-eligible. The client pilot begins later this month.

“The pandemic has further solidified the undeniable connection between a person’s health and their finances,” said Jim MacDonald, head of the Health Care Group at Fidelity Investments. “People are most secure when they are both financially stable and feel confident to manage a potential health-related issue. Our focus is on digital health benefits; from our industry-leading health savings accounts to expanding and piloting new offerings, we help individuals manage expenses, plan for retirement costs, and navigate health events at all stages of their lives.”

Fidelity Health Care Digital Solutions – Improving Access on the Go

The Fidelity Health App will allow employees to plan, track, and pay for health care expenses and view HSA and health Flexible Spending Account balances, recent transactions, and contributions. Initially in a client pilot, the free Fidelity Health App will be available on iOS this spring and Android™ in winter 2021 to employees of organizations with Fidelity-managed health care benefits.

“The Fidelity Health App is just one way we’re investing in our digital capabilities and creating personalized experiences – giving our employer clients the digital health care benefits their employees expect and demand so they can better navigate their health care journey,” said Tom McCarthy, head of Digital Health Experience, Fidelity Investments. “Data-driven insights inform our strategy to enhance the customer’s experience managing health care costs and benefits.”

Fidelity’s Industry-Leading2 HSA Helps Manage Today’s Costs While Investing for Tomorrow

Fidelity offers HSAs to its employer clients and in the past year reported a 31% growth, adding 265 new employers. To make HSAs more accessible, Fidelity’s retail offering is available to anyone with an HSA-eligible health plan or with an existing HSA they want to transfer. The Fidelity HSA retail business reported a 136% growth in assets year-over-year3 – further demonstrating an increased interest in saving and investing for health care costs. In January 2020, Fidelity introduced its HSA for financial intermediary clients to help advisors meet growing demand from their clients to save and invest in their long-term well-being; it’s currently in use with approximately 750 clearing and custody client firms.

“Whether it’s at home taking care of a family, traveling to a workplace as an essential worker, or operating at a makeshift desk at home – we have all been working hard this year. And with two things top of mind – our health and our finances – it is increasingly important that our money works just as hard,” said Begonya Klumb, head of Health Savings Accounts, Fidelity Investments. “We are thrilled to see more HSA customers investing their money to help it potentially grow. We continue to educate on this benefit, as this is the industry’s ‘secret power’ in managing health care expenses.”

As a leader in workplace benefits, retirement savings, and brokerage trading – Fidelity’s strength is its diversified services, which all ultimately help the individual. The Fidelity HSA exemplifies this commitment to the customer, and the retail offering was called Morningstar’s “best all-around HSA for individuals” with high assessments as a spending and investing account4. Also, the Fidelity HSA for advisors received the 2020 WealthManagement.com Industry Award for New Product Development in the Asset Manager Category5.

To continue making the Fidelity HSA valuable for managing health care savings and expenses, Fidelity has introduced these enhancements to employees:

- HSA Contribution Advance: Gives employees access to their annual HSA contributions on the first day of the year in the event of unplanned qualified medical expenses. For employer clients who have elected to offer this to their workforce, employees can opt in or out of the feature.

- Digital Design Makes Selecting Funds Easy: Fidelity Funds to Consider debuted in 2018, and the new digital interface makes it easier for customers to select funds. Nearly 40% of invested accounts have selected Fidelity Funds to Consider (more than $1 billion in assets).

- Fractional Share Trading: Fidelity offers a broad range of investing options for account holders, and fractional share trading makes it simpler for HSA customers to move from saving to investing regardless of the dollar amount they have available.

For more information, visit www.fidelity.com/hsa and view the 2021 Fidelity HSA Fact Sheet.

Additional Fidelity Resources for Managing Your Health Care Journey

- Power of Confidence podcast series focuses on confidence and its relation to health and finance. Hear from expert scientists as they share their insights and best practices.

- Fidelity’s Pulse on Health Care is a digital magazine sharing small steps everyone can take to tend to their mental health and set themselves on a path for a better year.

- Online HSA hub answers the most frequently asked questions and prevalent misconceptions about HSAs and HSA-eligible health plans.

- Viewpoints articles on planning for health care: 3 healthy habits for health care savings accounts; How to plan for rising health care costs; 5 ways HSAs can fortify your retirement.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $9.9 trillion, including discretionary assets of $3.8 trillion as of January 31, 2021, we focus on meeting the unique needs of a diverse set of customers: helping more than 35 million people invest their own life savings, 22,000 businesses manage employee benefit programs, as well as providing more than 13,500 institutions with investment and technology solutions to invest their own clients’ money. Privately held for more than 70 years, Fidelity employs more than 47,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

In identifying investment options to include in the Fidelity HSA Funds to Consider, Fidelity only considered Fidelity open-end mutual funds and open-end mutual funds offered by a limited universe of third-party fund companies that participate in an exclusive marketing, engagement and analytics program with Fidelity for which they pay Fidelity an annual fee. The only third-party fund companies whose funds were eligible for this program were companies that generally have a track record of generating the strongest customer demand for their products from across Fidelity's customer channels and have been paying Fidelity a sufficient level of compensation for the shareholder servicing performed by Fidelity.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company, LLC

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC,

200 Seaport Boulevard, Boston, MA 02110

___________________________

1 Source: Fidelity record kept data of HSAs through January 31, 2021

2 Source: Morningstar, The Top HSA Providers of 2020, October 14, 2020

3 Source: Fidelity retail HSA data through January 31, 2021

4 Source: Morningstar, The Top HSA Providers of 2020, October 14, 2020

5 Source: WealthManagement.com, WM Industry Awards, September 2020

©2021 FMR LLC. All rights reserved.

970209.1.0