Strategy Analytics: Global Smart Speaker Sales Cross 150 Million Units for 2020 Following Robust Q4 Demand

Strategy Analytics: Global Smart Speaker Sales Cross 150 Million Units for 2020 Following Robust Q4 Demand

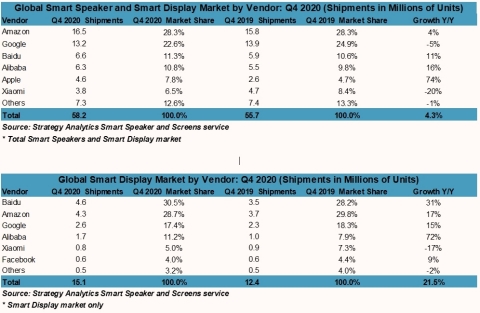

HomePod Mini helps drive record quarterly share for Apple while Amazon and Google combine for more than 50% of the market

BOSTON--(BUSINESS WIRE)--Global smart speaker sales reached a record level in 2020 in spite of the challenging conditions precipitated by the Covid 19 pandemic, according to the latest research from Strategy Analytics’ Smart Speakers and Screens service. New model introductions from Apple, Amazon, Google, Alibaba and Baidu, that hit the market in time for the all-important holiday shopping season, contributed to a positive end to a difficult year. Smart displays accounted for 26% of the total smart speaker market during the quarter, up from 22% in Q4 2019. The growing availability of models across different sizes and price points is contributing to strong growth for smart displays.

Amazon led the overall smart speaker market in Q4 with a 28.3% share of global shipments as the delayed Prime Day and strong seasonal demand resulted in a return to year-over-year growth for Echo speakers following two quarters of volume decline. Google finished second with a 22.6% share of the market but its shipments declined slightly versus the previous year. Baidu and Alibaba finished the year strongly, with both posting solid double-digit shipment growth as they put the challenges of the first half of the year behind them. Apple was the standout performer in the quarter as its global shipments grew by 74% year-over-year following the launch of the $99 HomePod Mini in November. Apple’s market share reached a record 7.8% in Q4 2020, an increase of 3.1% over the previous year.

“Considering all of the obstacles put in front of smart speaker vendors this year, the market has held up remarkably well,” notes David Watkins, Director, Smart Speakers and Screens. “The delayed Prime Day shopping event delivered a boost to year end demand and if it were not for component supply shortages the market would have fared even better. Stock supplies are expected to remain tight through early 2021 as the global shortage in electronics components lingers on. Assuming smart speaker manufacturers can weather that storm then the continued recovery in China and high growth opportunities in markets with low smart speaker penetration across Europe, Asia and Latin America should present them with a solid platform for growth in 2021.”

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include: industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in: smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com.

Source: Strategy Analytics, Inc.

#SA_IntelligentHome

Contacts

European Contacts:

David Watkins, +33 153 409 952, dwatkins@strategyanalytics.com

David Mercer, +44 1908 423 610, dmercer@strategyanalytics.com

US Contacts:

Bill Ablondi, +1 617 614 0744, wablondi@strategyanalytics.com

Jack Narcotta, +1 617 614 0798, jnarcotta@strategyanalytics.com