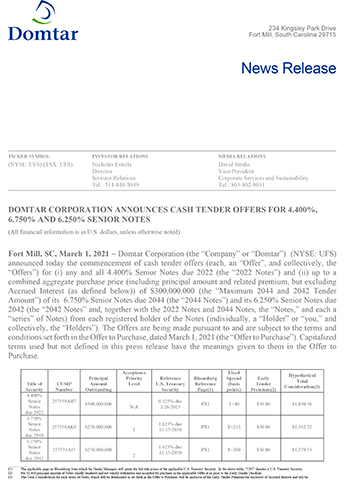

FORT MILL, S.C.--(BUSINESS WIRE)--Domtar Corporation (the “Company” or “Domtar”) (NYSE: UFS) announced today the commencement of cash tender offers (each, an “Offer”, and collectively, the “Offers”) for (i) any and all 4.400% Senior Notes due 2022 (the “2022 Notes”) and (ii) up to a combined aggregate purchase price (including principal amount and related premium, but excluding Accrued Interest (as defined below)) of $300,000,000 (the “Maximum 2044 and 2042 Tender Amount”) of its 6.750% Senior Notes due 2044 (the “2044 Notes”) and its 6.250% Senior Notes due 2042 (the “2042 Notes” and, together with the 2022 Notes and 2044 Notes, the “Notes,” and each a “series” of Notes) from each registered holder of the Notes (individually, a “Holder” or “you,” and collectively, the “Holders”). The Offers are being made pursuant to and are subject to the terms and conditions set forth in the Offer to Purchase, dated March 1, 2021 (the “Offer to Purchase”). Capitalized terms used but not defined in this press release have the meanings given to them in the Offer to Purchase.

Title of

|

CUSIP

|

Principal

|

Acceptance

|

Reference

|

Bloomberg

|

Fixed

|

Early

|

Hypothetical

|

4.400% Senior Notes due 2022 |

257559AH7 |

$300,000,000 |

N/A |

0.125% due 2/28/2023 |

PX1 |

T+40 |

$30.00 |

$1,030.36 |

6.750% Senior Notes due 2044 |

257559AK0 |

$250,000,000 |

1 |

1.625% due 11/15/2050 |

PX1 |

T+215 |

$30.00 |

$1,332.52 |

6.250% Senior Notes due 2042 |

257559AJ3 |

$250,000,000 |

2 |

1.625% due 11/15/2050 |

PX1 |

T+200 |

$30.00 |

$1,279.53 |

________ |

||

(1) |

The applicable page on Bloomberg from which the Dealer Managers will quote the bid side prices of the applicable U.S. Treasury Security. In the above table, “UST” denotes a U.S. Treasury Security. |

|

(2) |

Per $1,000 principal amount of Notes validly tendered and not validly withdrawn and accepted for purchase in the applicable Offer at or prior to the Early Tender Deadline. |

|

(3) |

The Total Consideration for each series of Notes, which will be determined as set forth in the Offer to Purchase, will be inclusive of the Early Tender Premium but exclusive of Accrued Interest and will be based on the fixed spread specified above plus the Reference Yield of the Reference U.S. Treasury Security, to be determined by the Dealer Managers based on certain quotes available at 10:00 a.m., New York City time, on the Tender Offer Price Determination Date, which is expected to be March 15, 2021. The hypothetical Total Consideration per $1,000 principal amount of each series of Notes validly tendered and not validly withdrawn and accepted for purchase in the applicable Offer, is based on a hypothetical Reference Yield determined as of 10:00 a.m., New York City time, on February 26, 2021, assuming an Early Settlement Date of March 16, 2021 for each series of Notes, and excludes Accrued Interest. The actual Reference Yield used to determine the actual Total Consideration for each series of Notes will be calculated on the Tender Offer Price Determination Date. This information is provided for illustrative purposes only. The Company makes no representation with respect to the actual Total Consideration that may be paid with respect to each series of Notes and such amounts may be greater or less than those shown depending on the Reference Yield as of the Tender Offer Price Determination Date. |

|

All documentation relating to the Offers, including the Offer to Purchase, together with any updates, are available from the Information Agent and the Tender Agent, as set forth below. The Offer to Purchase sets forth a complete description of the terms and conditions of the Offers. Holders are urged to read the Offer to Purchase carefully before making any decision with respect to the Offers.

Purpose of the Offers

The purpose of the Offers is to reduce the Company’s indebtedness and interest expense.

Details of the Offers

The Offers will expire at 11:59 p.m., New York City time, on March 26, 2021, or any other date and time to which Domtar extends the applicable Offer (such date and time, as it may be extended with respect to a series, the applicable “Expiration Date”), unless earlier terminated. You must validly tender your Notes on or prior to 5:00 p.m., New York City time, on March 12, 2021 to be eligible to receive the applicable Total Consideration (as defined below). If you tender your Notes following the Early Tender Date (as defined below) but on or prior to the Expiration Date (as defined below), you will be eligible to receive only the applicable Tender Offer Consideration (as defined below), which is an amount equal to the applicable Total Consideration minus the Early Tender Premium (as defined below). If the Company extends the Expiration Time, Early Tender Deadline, Tender Offer Price Determination Date or the Withdrawal Deadline with respect to either Offer, it may or may not extend it with respect to the other Offer in its sole discretion.

Tendered Notes may be withdrawn on or prior to, but not after, 5:00 p.m. New York City time, on March 12, 2021 (such date and time, as may be extended with respect to a series, the “Withdrawal Deadline”).

The “Total Consideration” for each $1,000 principal amount of Notes validly tendered and accepted for purchase pursuant to the Offers will be determined by reference to the fixed spread specified for the applicable series of Notes plus the yield based on the bid side price of the applicable U.S. Treasury Security specified in the table above for each series of Notes, as described in the Offer to Purchase, as calculated by BofA Securities, Inc., Deutsche Bank Securities Inc. and Goldman Sachs & Co. LLC (the “Dealer Managers”) at 10:00 a.m., New York City time, on March 15, 2021 (subject to certain exceptions, such time and date, as the same may be extended with respect to each series of Notes, the “Tender Offer Price Determination Date”). In addition to the Tender Offer Consideration or the Total Consideration, as applicable, all Holders of Notes accepted for purchase will also receive accrued and unpaid interest rounded to the nearest cent, on such $1,000 principal amount of Notes from the last applicable interest payment date up to, but not including, the applicable Settlement Date (“Accrued Interest”).

If an Offer is not fully subscribed as of the Early Tender Deadline, Notes of the applicable series validly tendered and not validly withdrawn at or prior to the Early Tender Deadline will be accepted for purchase in priority to Notes of such series validly tendered after such Early Tender Deadline. If an Offer is fully subscribed as of the Early Tender Deadline, no Notes of the applicable series tendered after the Early Tender Deadline will be accepted for purchase.

Notes of a series may be subject to proration (rounded down to the nearest $1,000 and to avoid the purchase of Notes in a principal amount other than $2,000 or in an integral multiple of $1,000 in excess thereof). Maximum Tender Amount Securities of a series may be subject to proration if the aggregate principal amount of the Maximum Tender Amount Securities of such series validly tendered would cause the Maximum 2044 and 2042 Tender Amount to be exceeded.

Payment for Notes that are validly tendered and not validly withdrawn at or prior to the Early Tender Deadline and accepted for purchase will be made promptly following such Early Tender Deadline on the Early Settlement Date. The Company anticipates that the Early Settlement Date for the Offers will be March 16, 2021. Payment for Notes that are validly tendered after the Early Tender Deadline but at or prior to the Expiration Time and accepted for purchase will be made promptly following such Expiration Time on the Final Settlement Date. If any Notes validly tendered after the Early Tender Deadline are accepted for purchase, the Company anticipates that the Final Settlement Date for the Offers will be March 30, 2021. No tenders will be valid if submitted after the Expiration Time.

If you validly tender your Notes at or prior to the Withdrawal Deadline, you may validly withdraw those tendered Notes at any time at or prior to the Withdrawal Deadline, but not thereafter, except in certain limited circumstances where additional withdrawal rights are required by law (as determined by the Company in its sole discretion). In the event of termination of an Offer, Notes of the applicable series tendered pursuant to such Offer will be promptly returned. Notes tendered pursuant to an Offer and not purchased due to proration or a defect in the tender will be returned to the tendering Holders promptly following the Expiration Time.

Each Offer is subject to the satisfaction or waiver of the conditions set forth in the Offer to Purchase. The Company reserves the absolute right, subject to applicable law, to: (i) waive any and all conditions to the Offers; (ii) extend, terminate or withdraw the Offers; (iii) increase or decrease the Maximum Tender Amount; or (iv) otherwise amend any of the Offers in any respect. Neither of the Offers is conditioned upon consummation of the other Offer nor on any minimum amount of Notes being tendered.

BofA Securities, Inc., Deutsche Bank Securities Inc. and Goldman Sachs & Co. LLC are acting as Dealer Managers for the Offers. Questions regarding terms and conditions of the Offers should be directed to BofA Securities, Inc. by calling collect at (981) 387-3907, Deutsche Bank Securities Inc. by calling toll free at (866) 627-0391 or collect at (212) 250-2955 or Goldman Sachs & Co. LLC by calling toll free at (800) 828-3182 or collect at (212) 902-5962.

Global Bondholder Services Corporation. has been appointed as information agent (the “Information Agent”) and tender agent (the “Tender Agent”) in connection with the Offers. Questions or requests for assistance in connection with the Offers or the delivery of tender instructions, or for additional copies of the Offer to Purchase, may be directed to Global Bondholder Services Corporation by calling collect at (212) 430-3774 (for banks and brokers) or toll free at (866) 470-4200 (for all others) or by email at contact@gbsc-usa.com. You may also contact your broker, dealer, commercial bank, trust company or other nominee for assistance concerning the Offers.

None of the Company, the Company's Board of Directors, the Dealer Managers, the Information Agent, the trustee under the indenture governing the Notes or any of their respective affiliates is making any recommendation as to whether Holders should tender any Notes in response to an Offer. Holders must make their own decision as to whether to tender any of their Notes and, if so, the principal amounts of Notes to tender.

This press release shall not constitute an offer to sell, a solicitation to buy, or an offer to purchase or sell any securities. The Offers are being made only pursuant to the Offer to Purchase and only in such jurisdictions as is permitted under applicable law.

About Domtar

Domtar is a leading provider of a wide variety of fiber-based products including communication, specialty and packaging papers, market pulp and airlaid nonwovens. With approximately 6,600 employees serving more than 50 countries around the world, Domtar is driven by a commitment to turn sustainable wood fiber into useful products that people rely on every day. Domtar’s annual sales are approximately $3.7 billion, and its common stock is traded on the New York and Toronto Stock Exchanges. Domtar’s principal executive office is in Fort Mill, South Carolina. To learn more, visit www.domtar.com.

Forward-Looking Statements

Certain statements contained in this press release, the information incorporated herein by reference, and other written and oral statements made from time to time by us or on our behalf are based on current projections about operations, industry conditions, financial condition, and liquidity, may not relate strictly to historical or current facts and may contain forward-looking statements that reflect our current views with respect to future events and financial performance. As such, they are considered “forward-looking statements” which provide current expectations or forecasts of future events. Such statements can be identified by the use of terminology such as “anticipate”, “believe”, “expect”, “intend”, “aim”, “target”, “plan”, “continue”, “estimate”, “project”, “may”, “will”, “should” and similar expressions. These forward-looking statements should be considered with the understanding that such statements involve a variety of risks and uncertainties, known and unknown, and may be affected by inaccurate assumptions. Consequently, no forward-looking statement can be guaranteed and actual results may vary materially. Many risks, contingencies and uncertainties could cause actual results to differ materially from our forward-looking statements.