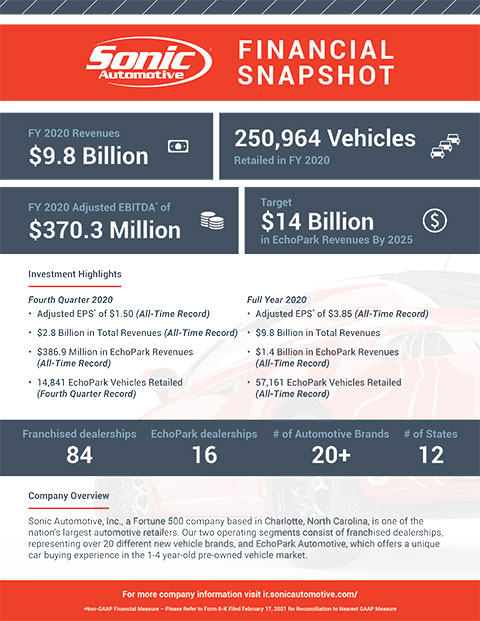

CHARLOTTE, N.C.--(BUSINESS WIRE)--Sonic Automotive, Inc. (“Sonic” or the “Company”) (NYSE:SAH), one of the nation’s largest automotive retailers, today reported financial results for the fourth quarter and full year ended December 31, 2020. The financial measures discussed below are results for the fourth quarter of 2020 compared to the fourth quarter of 2019, or full year 2020 compared to full year 2019, as applicable, unless otherwise noted.

Fourth Quarter Highlights

- All-time record quarterly revenues of $2.8 billion, up 1.8%, and all-time record quarterly income from continuing operations before taxes of $90.4 million, up 48.3%

- Reported earnings from continuing operations of $57.5 million ($1.31 per diluted share), compared to $46.3 million ($1.04 per diluted share) for the fourth quarter of 2019

- All-time record quarterly adjusted earnings from continuing operations* of $65.8 million ($1.50 per diluted share), an increase of 52.7% compared to $43.1 million ($0.97 per diluted share) for the fourth quarter of 2019

- Reported selling, general and administrative (“SG&A”) expenses as a percentage of gross profit were 66.6%, compared to 66.2% for the fourth quarter of 2019

- All-time record quarterly adjusted SG&A expenses as a percentage of gross profit* of 68.1%, compared to 73.7% for the fourth quarter of 2019, a 560-basis point improvement

- All-time record quarterly total Finance & Insurance (“F&I”) gross profit per retail unit of $2,031, up 12.3%

-

Reported EchoPark results include:

- All-time record quarterly EchoPark revenues of $386.9 million, up 25.4%

- EchoPark retail sales volume of 14,841, up 17.1%

-

Same store Franchised Dealerships Segment operating results include:

- Revenues up 1.5%, gross profit up 1.7%

- New vehicle unit sales volume down 6.9%; new vehicle gross profit per unit up 31.4%, to all-time record $2,932

- Retail used vehicle unit sales volume down 2.9%; retail used vehicle gross profit per unit down 24.2%, to $972

- Parts, service and collision repair gross profit down 3.2% (customer pay gross profit down 0.5%); gross margin up 180 basis points, to 50.7%

- F&I gross profit up 7.8%; all-time record quarterly reported Franchised Dealerships Segment F&I gross profit per retail unit of $1,965, up 14.9%

Full Year Highlights

- Total revenues of $9.8 billion, down 6.6%, and gross profit of $1.4 billion, down 6.4%,

- Reported loss from continuing operations of $50.7 million ($1.19 per diluted share), compared to earnings from continuing operations of $144.5 million ($3.31 per diluted share) for full year 2019

- All-time record annual adjusted earnings from continuing operations* of $168.9 million ($3.85 per diluted share), an increase of 45.9% compared to $115.8 million ($2.65 per diluted share) for full year 2019

- Reported SG&A expenses as a percentage of gross profit were 72.3%, compared to 72.3% for full year 2019

- Adjusted SG&A expenses as a percentage of gross profit* were 72.9%, compared to 76.9% for full year 2019, a 400-basis point improvement

- All-time record annual total F&I gross profit per retail unit of $1,952, up 12.0%

-

Reported EchoPark results include:

- All-time record annual EchoPark revenues of $1.4 billion, up 22.1%

- All-time record annual EchoPark retail sales volume of 57,161 units, up 15.4%

-

Same store Franchised Dealerships Segment operating results include:

- Revenues down 6.4%, gross profit down 3.9%

- New vehicle sales volume down 12.9%; new vehicle unit gross profit per unit up 19.0%, to all-time record $2,508

- Retail used vehicle unit sales volume down 4.4%; retail used vehicle gross profit per unit down 8.8%, to $1,168

- Parts, service and collision repair gross profit down 7.7% (customer pay gross profit down 3.6%); gross margin up 100 basis points, to 49.9%

- F&I gross profit up 1.2%; all-time record annual reported Franchised Dealerships Segment F&I gross profit per retail unit of $1,846, up 14.0%

Commentary

Jeff Dyke, Sonic’s and EchoPark’s President, commented, “We are extremely proud of our team for all they have accomplished in 2020, driving the highest adjusted earnings from continuing operations* in our Company’s history in the face of the challenges of a global pandemic. Our fourth quarter and full year 2020 results reflect the continued strength and resilience of both our EchoPark and franchised dealerships segments, a significant rebound in customer activity and increasing demand for both new and used vehicles during the second half of the year, as well as fundamental improvements in our operating cost structure. These trends have continued into early 2021 and we believe we are well on the path to more than double the Company’s total revenues and significantly increase profitability over the next five years.”

Mr. Dyke continued, “Our EchoPark business achieved strong top-line growth during the fourth quarter, with record quarterly revenues of $386.9 million, up 25.4% from the prior year period. EchoPark’s continued growth demonstrates the significant benefits we offer our guests, who continue to see value in the excellent pricing, inventory selection and buying experience that EchoPark offers. This in-store experience, combined with our hybrid approach between online and on-site, offers consumers a full range of buying options in order to provide their ideal pre-owned vehicle purchase experience. With the opening of four new EchoPark points in the fourth quarter and the recent acquisition of two pre-owned businesses in Maryland and New York, we remain committed to developing our nationwide distribution network, which we continue to expect to retail over half a million pre-owned vehicles annually and drive $14.0 billion in annual EchoPark revenues by 2025.”

Heath Byrd, Sonic’s and EchoPark’s Chief Financial Officer, commented, “In 2020, we took significant steps to improve operating efficiencies and manage expenses throughout our entire organization, which drove record adjusted SG&A expenses as a percentage of gross profit* of 68.1% for the fourth quarter of 2020. Our team met the hurdles of the COVID-19 pandemic head on, initiating cost control measures to meet these challenges and remaining disciplined in this focus even as consumer demand rebounded in the second half of the year. Additionally, our balance sheet position is stronger than it has ever been, with the lowest net debt to adjusted EBITDA* ratio in our Company’s history and total available liquidity of $526.4 million as of December 31, 2020, up 88.0% from the beginning of the year.”

*Adjusted earnings from continuing operations, adjusted earnings per diluted share from continuing operations, adjusted SG&A expenses, adjusted SG&A expenses as a percentage of gross profit, and adjusted EBITDA are non-GAAP financial measures. The tables included in this press release reconcile these non-GAAP financial measures to the most directly comparable GAAP financial measures.

Dividend

Sonic’s Board of Directors approved a quarterly cash dividend of $0.10 per share payable on April 15, 2021 to all stockholders of record on March 15, 2021.

Fourth Quarter 2020 Earnings Conference Call

Senior management will hold a conference call on Wednesday, February 17, 2021 at 11:00 A.M. (Eastern). Investor presentation and earnings press release materials will be accessible beginning the morning of the conference call on the Company’s website at ir.sonicautomotive.com.

To access the live broadcast of the call over the internet, please go to ir.sonicautomotive.com. For telephone access to this conference call, please register in advance using this link: http://www.directeventreg.com/registration/event/7083166. After registering, you will receive a confirmation email that includes dial-in numbers and unique conference call and registrant passcodes for entry. Registration remains available through the live call, however, to ensure you are connected for the full call we suggest registering at least 10 minutes before the start of the call.

A conference call replay will be available one hour following the call for 14 days at ir.sonicautomotive.com.

About Sonic Automotive

Sonic Automotive, Inc., a Fortune 500 company based in Charlotte, North Carolina, is one of the nation’s largest automotive retailers. Sonic can be reached on the web at www.sonicautomotive.com.

About EchoPark Automotive

EchoPark Automotive is a growing operating segment within the Company that specializes in pre-owned vehicle sales and provides a unique guest experience unlike traditional used car stores. More information about EchoPark Automotive can be found at www.echopark.com.

Forward-Looking Statements

Included herein are forward-looking statements, including statements regarding anticipated future revenue levels, future profitability, projected SG&A expense levels, pre-owned vehicle sales projections and the opening of additional EchoPark points. There are many factors that affect management’s views about future events and trends of the Company’s business. These factors involve risks and uncertainties that could cause actual results or trends to differ materially from management’s views, including, without limitation, economic conditions in the markets in which we operate, new and used vehicle industry sales volume, anticipated future growth in our EchoPark Segment, the success of our operational strategies, the rate and timing of overall economic expansion or contraction, the effect of the COVID-19 pandemic and related government-imposed restrictions on operations, and the risk factors described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019, the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2020, the Company’s Current Report on Form 8-K filed on February 12, 2021 and other reports and information filed with the Securities and Exchange Commission (the “SEC”). The Company does not undertake any obligation to update forward-looking information, except as required under federal securities laws and the rules and regulations of the SEC.

Non-GAAP Financial Measures

This press release and the attached financial tables contain certain non-GAAP financial measures as defined under SEC rules, such as adjusted earnings from continuing operations, adjusted earnings per diluted share from continuing operations, adjusted SG&A expenses, adjusted SG&A expenses as a percentage of gross profit and adjusted EBITDA. As required by SEC rules, the Company has provided reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures in the schedules included in this press release. The Company believes that these non-GAAP financial measures improve the transparency of the Company’s disclosures and provide a meaningful presentation of the Company’s results.

Sonic Automotive, Inc. Results of Operations (Unaudited) |

|||||||||||||||||||||||||||

Results of Operations |

|||||||||||||||||||||||||||

|

Three Months Ended

|

|

Better /

|

|

Twelve Months Ended

|

|

Better /

|

||||||||||||||||||||

|

2020 |

|

|

2019 |

|

|

% Change |

|

2020 |

|

|

2019 |

|

|

% Change |

||||||||||||

|

(In thousands, except per share amounts) |

|

|

||||||||||||||||||||||||

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

New vehicles |

$ |

1,323,429 |

|

|

|

$ |

1,360,064 |

|

|

|

(2.7 |

) |

% |

|

$ |

4,281,223 |

|

|

|

$ |

4,889,171 |

|

|

|

(12.4 |

) |

% |

Used vehicles |

959,875 |

|

|

|

869,708 |

|

|

|

10.4 |

|

% |

|

3,564,832 |

|

|

|

3,489,972 |

|

|

|

2.1 |

|

% |

||||

Wholesale vehicles |

59,156 |

|

|

|

46,596 |

|

|

|

27.0 |

|

% |

|

197,378 |

|

|

|

202,946 |

|

|

|

(2.7 |

) |

% |

||||

Total vehicles |

2,342,460 |

|

|

|

2,276,368 |

|

|

|

2.9 |

|

% |

|

8,043,433 |

|

|

|

8,582,089 |

|

|

|

(6.3 |

) |

% |

||||

Parts, service and collision repair |

319,068 |

|

|

|

346,514 |

|

|

|

(7.9 |

) |

% |

|

1,233,735 |

|

|

|

1,395,303 |

|

|

|

(11.6 |

) |

% |

||||

Finance, insurance and other, net |

137,026 |

|

|

|

125,522 |

|

|

|

9.2 |

|

% |

|

489,874 |

|

|

|

476,951 |

|

|

|

2.7 |

|

% |

||||

Total revenues |

2,798,554 |

|

|

|

2,748,404 |

|

|

|

1.8 |

|

% |

|

9,767,042 |

|

|

|

10,454,343 |

|

|

|

(6.6 |

) |

% |

||||

Cost of Sales: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

New vehicles |

(1,242,818 |

) |

|

|

(1,292,480 |

) |

|

|

3.8 |

|

% |

|

(4,047,132 |

) |

|

|

(4,656,084 |

) |

|

|

13.1 |

|

% |

||||

Used vehicles |

(941,413 |

) |

|

|

(832,877 |

) |

|

|

(13.0 |

) |

% |

|

(3,458,834 |

) |

|

|

(3,342,576 |

) |

|

|

(3.5 |

) |

% |

||||

Wholesale vehicles |

(61,988 |

) |

|

|

(47,941 |

) |

|

|

(29.3 |

) |

% |

|

(198,249 |

) |

|

|

(207,378 |

) |

|

|

4.4 |

|

% |

||||

Total vehicles |

(2,246,219 |

) |

|

|

(2,173,298 |

) |

|

|

(3.4 |

) |

% |

|

(7,704,215 |

) |

|

|

(8,206,038 |

) |

|

|

6.1 |

|

% |

||||

Parts, service and collision repair |

(163,218 |

) |

|

|

(181,222 |

) |

|

|

9.9 |

|

% |

|

(639,182 |

) |

|

|

(727,288 |

) |

|

|

12.1 |

|

% |

||||

Total cost of sales |

(2,409,437 |

) |

|

|

(2,354,520 |

) |

|

|

(2.3 |

) |

% |

|

(8,343,397 |

) |

|

|

(8,933,326 |

) |

|

|

6.6 |

|

% |

||||

Gross profit |

389,117 |

|

|

|

393,884 |

|

|

|

(1.2 |

) |

% |

|

1,423,645 |

|

|

|

1,521,017 |

|

|

|

(6.4 |

) |

% |

||||

Selling, general and administrative expenses |

(258,977 |

) |

|

|

(260,921 |

) |

|

|

0.7 |

|

% |

|

(1,028,666 |

) |

|

|

(1,099,374 |

) |

|

|

6.4 |

|

% |

||||

Impairment charges |

(1,158 |

) |

|

|

(17,692 |

) |

|

|

93.5 |

|

% |

|

(270,017 |

) |

|

|

(20,768 |

) |

|

|

(1,200.2 |

) |

% |

||||

Depreciation and amortization |

(23,145 |

) |

|

|

(23,048 |

) |

|

|

(0.4 |

) |

% |

|

(91,023 |

) |

|

|

(93,169 |

) |

|

|

2.3 |

|

% |

||||

Operating income (loss) |

105,837 |

|

|

|

92,223 |

|

|

|

14.8 |

|

% |

|

33,939 |

|

|

|

307,706 |

|

|

|

(89.0 |

) |

% |

||||

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Interest expense, floor plan |

(5,406 |

) |

|

|

(11,137 |

) |

|

|

51.5 |

|

% |

|

(27,228 |

) |

|

|

(48,519 |

) |

|

|

43.9 |

|

% |

||||

Interest expense, other, net |

(10,048 |

) |

|

|

(13,458 |

) |

|

|

25.3 |

|

% |

|

(41,572 |

) |

|

|

(52,953 |

) |

|

|

21.5 |

|

% |

||||

Other income (expense), net |

(5 |

) |

|

|

(6,680 |

) |

|

|

99.9 |

|

% |

|

97 |

|

|

|

(6,589 |

) |

|

|

101.5 |

|

% |

||||

Total other income (expense) |

(15,459 |

) |

|

|

(31,275 |

) |

|

|

50.6 |

|

% |

|

(68,703 |

) |

|

|

(108,061 |

) |

|

|

36.4 |

|

% |

||||

Income (loss) from continuing operations before taxes |

90,378 |

|

|

|

60,948 |

|

|

|

48.3 |

|

% |

|

(34,764 |

) |

|

|

199,645 |

|

|

|

(117.4 |

) |

% |

||||

Provision for income taxes for continuing operations - benefit (expense) |

(32,895 |

) |

|

|

(14,676 |

) |

|

|

(124.1 |

) |

% |

|

(15,900 |

) |

|

|

(55,108 |

) |

|

|

71.1 |

|

% |

||||

Income (loss) from continuing operations |

57,483 |

|

|

|

46,272 |

|

|

|

24.2 |

|

% |

|

(50,664 |

) |

|

|

144,537 |

|

|

|

(135.1 |

) |

% |

||||

Discontinued operations: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Income (loss) from discontinued operations before taxes |

(194 |

) |

|

|

62 |

|

|

|

(412.9 |

) |

% |

|

(1,002 |

) |

|

|

(554 |

) |

|

|

(80.9 |

) |

% |

||||

Provision for income taxes for discontinued operations - benefit (expense) |

50 |

|

|

|

(27 |

) |

|

|

285.2 |

|

% |

|

281 |

|

|

|

154 |

|

|

|

82.5 |

|

% |

||||

Income (loss) from discontinued operations |

(144 |

) |

|

|

35 |

|

|

|

(511.4 |

) |

% |

|

(721 |

) |

|

|

(400 |

) |

|

|

(80.3 |

) |

% |

||||

Net income (loss) |

$ |

57,339 |

|

|

|

$ |

46,307 |

|

|

|

23.8 |

|

% |

|

$ |

(51,385 |

) |

|

|

$ |

144,137 |

|

|

|

(135.7 |

) |

% |

Basic earnings (loss) per common share: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Earnings (loss) per share from continuing operations |

$ |

1.37 |

|

|

|

$ |

1.07 |

|

|

|

28.0 |

|

% |

|

$ |

(1.19 |

) |

|

|

$ |

3.36 |

|

|

|

(135.4 |

) |

% |

Earnings (loss) per share from discontinued operations |

— |

|

|

|

— |

|

|

|

— |

|

% |

|

(0.02 |

) |

|

|

(0.01 |

) |

|

|

(100.0 |

) |

% |

||||

Earnings (loss) per common share |

$ |

1.37 |

|

|

|

$ |

1.07 |

|

|

|

28.0 |

|

% |

|

$ |

(1.21 |

) |

|

|

$ |

3.35 |

|

|

|

(136.1 |

) |

% |

Weighted-average common shares outstanding |

41,874 |

|

|

|

43,078 |

|

|

|

2.8 |

|

% |

|

42,483 |

|

|

|

43,016 |

|

|

|

1.2 |

|

% |

||||

Diluted earnings (loss) per common share: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Earnings (loss) per share from continuing operations |

$ |

1.31 |

|

|

|

$ |

1.04 |

|

|

|

26.0 |

|

% |

|

$ |

(1.19 |

) |

|

|

$ |

3.31 |

|

|

|

(136.0 |

) |

% |

Earnings (loss) per share from discontinued operations |

(0.01 |

) |

|

|

— |

|

|

|

(100.0 |

) |

% |

|

(0.02 |

) |

|

|

(0.01 |

) |

|

|

(100.0 |

) |

% |

||||

Earnings (loss) per common share |

$ |

1.30 |

|

|

|

$ |

1.04 |

|

|

|

25.0 |

|

% |

|

$ |

(1.21 |

) |

|

|

$ |

3.30 |

|

|

|

(136.7 |

) |

% |

Weighted-average common shares outstanding(1) |

44,022 |

|

|

|

44,463 |

|

|

|

1.0 |

|

% |

|

42,483 |

|

|

|

43,710 |

|

|

|

2.8 |

|

% |

||||

Dividends declared per common share |

$ |

0.10 |

|

|

|

$ |

0.10 |

|

|

|

— |

|

% |

|

$ |

0.40 |

|

|

|

$ |

0.40 |

|

|

|

— |

|

% |

(1) Basic weighted-average shares used for twelve months ended December 31, 2020 due to net loss on reported GAAP basis. |

Franchised Dealerships Segment - Reported |

|||||||||||||||||||||||||||

|

Three Months Ended

|

|

Better /

|

|

Twelve Months Ended

|

|

Better /

|

||||||||||||||||||||

|

2020 |

|

|

2019 |

|

|

% Change |

|

2020 |

|

|

2019 |

|

|

% Change |

||||||||||||

|

(In thousands, except unit and per unit data) |

||||||||||||||||||||||||||

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

New vehicles |

$ |

1,323,429 |

|

|

|

$ |

1,360,064 |

|

|

|

(2.7 |

) |

% |

|

$ |

4,281,223 |

|

|

|

$ |

4,889,171 |

|

|

|

(12.4 |

) |

% |

Used vehicles |

627,786 |

|

|

|

604,422 |

|

|

|

3.9 |

|

% |

|

2,345,936 |

|

|

|

2,493,467 |

|

|

|

(5.9 |

) |

% |

||||

Wholesale vehicles |

49,181 |

|

|

|

39,250 |

|

|

|

25.3 |

|

% |

|

168,655 |

|

|

|

180,020 |

|

|

|

(6.3 |

) |

% |

||||

Total vehicles |

2,000,396 |

|

|

|

2,003,736 |

|

|

|

(0.2 |

) |

% |

|

6,795,814 |

|

|

|

7,562,658 |

|

|

|

(10.1 |

) |

% |

||||

Parts, service and collision repair |

307,861 |

|

|

|

339,168 |

|

|

|

(9.2 |

) |

% |

|

1,194,394 |

|

|

|

1,366,550 |

|

|

|

(12.6 |

) |

% |

||||

Finance, insurance and other, net |

103,383 |

|

|

|

96,947 |

|

|

|

6.6 |

|

% |

|

357,848 |

|

|

|

363,117 |

|

|

|

(1.5 |

) |

% |

||||

Total revenues |

2,411,640 |

|

|

|

2,439,851 |

|

|

|

(1.2 |

) |

% |

|

8,348,056 |

|

|

|

9,292,325 |

|

|

|

(10.2 |

) |

% |

||||

Gross Profit: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

New vehicles |

80,611 |

|

|

|

67,583 |

|

|

|

19.3 |

|

% |

|

234,091 |

|

|

|

233,087 |

|

|

|

0.4 |

|

% |

||||

Used vehicles |

25,834 |

|

|

|

35,727 |

|

|

|

(27.7 |

) |

% |

|

122,948 |

|

|

|

147,541 |

|

|

|

(16.7 |

) |

% |

||||

Wholesale vehicles |

(2,905 |

) |

|

|

(1,254 |

) |

|

|

(131.7 |

) |

% |

|

(789 |

) |

|

|

(4,100 |

) |

|

|

80.8 |

|

% |

||||

Total vehicles |

103,540 |

|

|

|

102,056 |

|

|

|

1.5 |

|

% |

|

356,250 |

|

|

|

376,528 |

|

|

|

(5.4 |

) |

% |

||||

Parts, service and collision repair |

156,070 |

|

|

|

165,647 |

|

|

|

(5.8 |

) |

% |

|

595,342 |

|

|

|

668,958 |

|

|

|

(11.0 |

) |

% |

||||

Finance, insurance and other, net |

103,383 |

|

|

|

96,947 |

|

|

|

6.6 |

|

% |

|

357,848 |

|

|

|

363,117 |

|

|

|

(1.5 |

) |

% |

||||

Total gross profit |

362,993 |

|

|

|

364,650 |

|

|

|

(0.5 |

) |

% |

|

1,309,440 |

|

|

|

1,408,603 |

|

|

|

(7.0 |

) |

% |

||||

Selling, general and administrative expenses |

(235,941 |

) |

|

|

(237,849 |

) |

|

|

0.8 |

|

% |

|

(933,738 |

) |

|

|

(1,011,763 |

) |

|

|

7.7 |

|

% |

||||

Impairment charges |

(1,158 |

) |

|

|

(1,075 |

) |

|

|

(7.7 |

) |

% |

|

(270,017 |

) |

|

|

(1,101 |

) |

|

|

NM |

|

|||||

Depreciation and amortization |

(20,275 |

) |

|

|

(20,288 |

) |

|

|

0.1 |

|

% |

|

(79,929 |

) |

|

|

(82,636 |

) |

|

|

3.3 |

|

% |

||||

Operating income (loss) |

105,619 |

|

|

|

105,438 |

|

|

|

0.2 |

|

% |

|

25,756 |

|

|

|

313,103 |

|

|

|

(91.8 |

) |

% |

||||

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Interest expense, floor plan |

(4,549 |

) |

|

|

(10,275 |

) |

|

|

55.7 |

|

% |

|

(24,066 |

) |

|

|

(45,055 |

) |

|

|

46.6 |

|

% |

||||

Interest expense, other, net |

(9,853 |

) |

|

|

(13,019 |

) |

|

|

24.3 |

|

% |

|

(40,624 |

) |

|

|

(51,231 |

) |

|

|

20.7 |

|

% |

||||

Other income (expense), net |

(5 |

) |

|

|

(6,680 |

) |

|

|

99.9 |

|

% |

|

92 |

|

|

|

(6,651 |

) |

|

|

101.4 |

|

% |

||||

Total other income (expense) |

(14,407 |

) |

|

|

(29,974 |

) |

|

|

51.9 |

|

% |

|

(64,598 |

) |

|

|

(102,937 |

) |

|

|

37.2 |

|

% |

||||

Income (loss) before taxes |

91,212 |

|

|

|

75,464 |

|

|

|

20.9 |

|

% |

|

(38,842 |

) |

|

|

210,166 |

|

|

|

(118.5 |

) |

% |

||||

Add: impairment charges |

1,158 |

|

|

|

1,075 |

|

|

|

NM |

|

|

270,017 |

|

|

|

1,101 |

|

|

|

NM |

|

||||||

Segment income (loss) |

$ |

92,370 |

|

|

|

$ |

76,539 |

|

|

|

20.7 |

|

% |

|

$ |

231,175 |

|

|

|

$ |

211,267 |

|

|

|

9.4 |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Unit Sales Volume: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

New vehicles |

27,566 |

|

|

|

30,591 |

|

|

|

(9.9 |

) |

% |

|

93,281 |

|

|

|

114,131 |

|

|

|

(18.3 |

) |

% |

||||

Used vehicles |

25,490 |

|

|

|

27,099 |

|

|

|

(5.9 |

) |

% |

|

101,864 |

|

|

|

112,629 |

|

|

|

(9.6 |

) |

% |

||||

Wholesale vehicles |

6,463 |

|

|

|

6,148 |

|

|

|

5.1 |

|

% |

|

24,879 |

|

|

|

28,379 |

|

|

|

(12.3 |

) |

% |

||||

Retail new & used vehicles |

53,056 |

|

|

|

57,690 |

|

|

|

(8.0 |

) |

% |

|

195,145 |

|

|

|

226,760 |

|

|

|

(13.9 |

) |

% |

||||

Used:New Ratio |

0.92 |

|

|

|

0.89 |

|

|

|

4.4 |

|

% |

|

1.09 |

|

|

|

0.99 |

|

|

|

10.7 |

|

% |

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Gross Profit Per Unit: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

New vehicles |

$ |

2,924 |

|

|

|

$ |

2,209 |

|

|

|

32.4 |

|

% |

|

$ |

2,510 |

|

|

|

$ |

2,042 |

|

|

|

22.9 |

|

% |

Used vehicles |

$ |

1,014 |

|

|

|

$ |

1,318 |

|

|

|

(23.1 |

) |

% |

|

$ |

1,207 |

|

|

|

$ |

1,310 |

|

|

|

(7.9 |

) |

% |

Finance, insurance and other, net |

$ |

1,965 |

|

|

|

$ |

1,710 |

|

|

|

14.9 |

|

% |

|

$ |

1,846 |

|

|

|

$ |

1,620 |

|

|

|

14.0 |

|

% |

NM = Not Meaningful |

|||||||||||||||||||||||||||

Franchised Dealerships Segment - Same Store |

||||||||||||||||||||||||||

|

Three Months Ended

|

|

Better /

|

|

Twelve Months Ended

|

|

Better /

|

|||||||||||||||||||

|

2020 |

|

|

2019 |

|

|

% Change |

|

2020 |

|

|

2019 |

|

|

% Change |

|||||||||||

|

(In thousands, except unit and per unit data) |

|||||||||||||||||||||||||

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

New vehicles |

$ |

1,322,958 |

|

|

|

$ |

1,326,947 |

|

|

|

(0.3 |

)% |

|

$ |

4,258,098 |

|

|

|

$ |

4,654,982 |

|

|

|

(8.5 |

)% |

|

Used vehicles |

627,656 |

|

|

|

582,582 |

|

|

|

7.7 |

% |

|

2,332,150 |

|

|

|

2,376,141 |

|

|

|

(1.9 |

)% |

|||||

Wholesale vehicles |

49,165 |

|

|

|

38,419 |

|

|

|

28.0 |

% |

|

167,794 |

|

|

|

172,306 |

|

|

|

(2.6 |

)% |

|||||

Total vehicles |

1,999,779 |

|

|

|

1,947,948 |

|

|

|

2.7 |

% |

|

6,758,042 |

|

|

|

7,203,429 |

|

|

|

(6.2 |

)% |

|||||

Parts, service and collision repair |

308,098 |

|

|

|

330,337 |

|

|

|

(6.7 |

)% |

|

1,184,428 |

|

|

|

1,309,201 |

|

|

|

(9.5 |

)% |

|||||

Finance, insurance and other, net |

97,570 |

|

|

|

90,550 |

|

|

|

7.8 |

% |

|

335,695 |

|

|

|

331,860 |

|

|

|

1.2 |

% |

|||||

Total revenues |

$ |

2,405,447 |

|

|

|

$ |

2,368,835 |

|

|

|

1.5 |

% |

|

$ |

8,278,165 |

|

|

|

$ |

8,844,490 |

|

|

|

(6.4 |

)% |

|

Gross Profit: |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

New vehicles |

$ |

80,776 |

|

|

|

$ |

66,011 |

|

|

|

22.4 |

% |

|

$ |

231,871 |

|

|

|

$ |

223,661 |

|

|

|

3.7 |

% |

|

Used vehicles |

24,768 |

|

|

|

33,646 |

|

|

|

(26.4 |

)% |

|

117,903 |

|

|

|

135,259 |

|

|

|

(12.8 |

)% |

|||||

Wholesale vehicles |

(2,868 |

) |

|

|

(1,255 |

) |

|

|

(128.5 |

)% |

|

(520 |

) |

|

|

(3,382 |

) |

|

|

84.6 |

% |

|||||

Total vehicles |

102,676 |

|

|

|

98,402 |

|

|

|

4.3 |

% |

|

349,254 |

|

|

|

355,538 |

|

|

|

(1.8 |

)% |

|||||

Parts, service and collision repair |

156,321 |

|

|

|

161,500 |

|

|

|

(3.2 |

)% |

|

590,946 |

|

|

|

640,015 |

|

|

|

(7.7 |

)% |

|||||

Finance, insurance and other, net |

97,570 |

|

|

|

90,550 |

|

|

|

7.8 |

% |

|

335,695 |

|

|

|

331,860 |

|

|

|

1.2 |

% |

|||||

Total gross profit |

$ |

356,567 |

|

|

|

$ |

350,452 |

|

|

|

1.7 |

% |

|

$ |

1,275,895 |

|

|

|

$ |

1,327,413 |

|

|

|

(3.9 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Unit Sales Volume: |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

New vehicles |

27,552 |

|

|

|

29,586 |

|

|

|

(6.9 |

)% |

|

92,445 |

|

|

|

106,170 |

|

|

|

(12.9 |

)% |

|||||

Used vehicles |

25,479 |

|

|

|

26,251 |

|

|

|

(2.9 |

)% |

|

100,983 |

|

|

|

105,639 |

|

|

|

(4.4 |

)% |

|||||

Wholesale vehicles |

6,460 |

|

|

|

5,871 |

|

|

|

10.0 |

% |

|

24,701 |

|

|

|

26,114 |

|

|

|

(5.4 |

)% |

|||||

Retail new & used vehicles |

53,031 |

|

|

|

55,837 |

|

|

|

(5.0 |

)% |

|

193,428 |

|

|

|

211,809 |

|

|

|

(8.7 |

)% |

|||||

Used:New Ratio |

0.92 |

|

|

|

0.89 |

|

|

|

4.2 |

% |

|

1.09 |

|

|

|

0.99 |

|

|

|

9.8 |

% |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Gross Profit Per Unit: |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

New vehicles |

$ |

2,932 |

|

|

|

$ |

2,231 |

|

|

|

31.4 |

% |

|

$ |

2,508 |

|

|

|

$ |

2,107 |

|

|

|

19.0 |

% |

|

Used vehicles |

$ |

972 |

|

|

|

$ |

1,282 |

|

|

|

(24.2 |

)% |

|

$ |

1,168 |

|

|

|

$ |

1,280 |

|

|

|

(8.8 |

)% |

|

Finance, insurance and other, net |

$ |

1,855 |

|

|

|

$ |

1,650 |

|

|

|

12.4 |

% |

|

$ |

1,748 |

|

|

|

$ |

1,587 |

|

|

|

10.1 |

% |

|

EchoPark Segment - Reported |

|||||||||||||||||||||||||||

|

Three Months Ended

|

|

Better /

|

|

Twelve Months Ended

|

|

Better /

|

||||||||||||||||||||

|

2020 |

|

|

2019 |

|

|

% Change |

|

2020 |

|

|

2019 |

|

|

% Change |

||||||||||||

|

(In thousands, except unit and per unit data) |

||||||||||||||||||||||||||

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Used vehicles |

$ |

332,089 |

|

|

|

$ |

265,286 |

|

|

|

25.2 |

|

% |

|

$ |

1,218,896 |

|

|

|

$ |

996,505 |

|

|

|

22.3 |

|

% |

Wholesale vehicles |

9,975 |

|

|

|

7,346 |

|

|

|

35.8 |

|

% |

|

28,723 |

|

|

|

22,926 |

|

|

|

25.3 |

|

% |

||||

Total vehicles |

342,064 |

|

|

|

272,632 |

|

|

|

25.5 |

|

% |

|

1,247,619 |

|

|

|

1,019,431 |

|

|

|

22.4 |

|

% |

||||

Parts, service and collision repair |

11,207 |

|

|

|

7,346 |

|

|

|

52.6 |

|

% |

|

39,341 |

|

|

|

28,753 |

|

|

|

36.8 |

|

% |

||||

Finance, insurance and other, net |

33,643 |

|

|

|

28,575 |

|

|

|

17.7 |

|

% |

|

132,026 |

|

|

|

113,834 |

|

|

|

16.0 |

|

% |

||||

Total revenues |

386,914 |

|

|

|

308,553 |

|

|

|

25.4 |

|

% |

|

1,418,986 |

|

|

|

1,162,018 |

|

|

|

22.1 |

|

% |

||||

Gross Profit: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Used |

(7,372 |

) |

|

|

1,104 |

|

|

|

(767.8 |

) |

% |

|

(16,950 |

) |

|

|

(145 |

) |

|

|

(11,589.7 |

) |

% |

||||

Wholesale |

73 |

|

|

|

(92 |

) |

|

|

179.3 |

|

% |

|

(82 |

) |

|

|

(332 |

) |

|

|

75.3 |

|

% |

||||

Total vehicles |

(7,299 |

) |

|

|

1,012 |

|

|

|

(821.2 |

) |

% |

|

(17,032 |

) |

|

|

(477 |

) |

|

|

(3,470.6 |

) |

% |

||||

Parts, service and collision repair |

(220 |

) |

|

|

(354 |

) |

|

|

37.9 |

|

% |

|

(789 |

) |

|

|

(943 |

) |

|

|

16.3 |

|

% |

||||

Finance & insurance |

33,643 |

|

|

|

28,576 |

|

|

|

17.7 |

|

% |

|

132,026 |

|

|

|

113,834 |

|

|

|

16.0 |

|

% |

||||

Total gross profit |

26,124 |

|

|

|

29,234 |

|

|

|

(10.6 |

) |

% |

|

114,205 |

|

|

|

112,414 |

|

|

|

1.6 |

|

% |

||||

SG&A |

(23,036 |

) |

|

|

(23,072 |

) |

|

|

0.2 |

|

% |

|

(94,928 |

) |

|

|

(87,611 |

) |

|

|

(8.4 |

) |

% |

||||

Impairment |

— |

|

|

|

(16,617 |

) |

|

|

100.0 |

|

% |

|

— |

|

|

|

(19,667 |

) |

|

|

100.0 |

|

% |

||||

Depreciation |

(2,870 |

) |

|

|

(2,760 |

) |

|

|

(4.0 |

) |

% |

|

(11,094 |

) |

|

|

(10,533 |

) |

|

|

(5.3 |

) |

% |

||||

Operating income |

218 |

|

|

|

(13,215 |

) |

|

|

101.6 |

|

% |

|

8,183 |

|

|

|

(5,397 |

) |

|

|

251.6 |

|

% |

||||

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Interest floor plan |

(857 |

) |

|

|

(862 |

) |

|

|

0.6 |

|

% |

|

(3,162 |

) |

|

|

(3,464 |

) |

|

|

8.7 |

|

% |

||||

Interest other |

(195 |

) |

|

|

(439 |

) |

|

|

55.6 |

|

% |

|

(948 |

) |

|

|

(1,722 |

) |

|

|

44.9 |

|

% |

||||

Other income (expense) |

— |

|

|

|

— |

|

|

|

— |

|

% |

|

5 |

|

|

|

62 |

|

|

|

(91.9 |

) |

% |

||||

Total other income (expense) |

(1,052 |

) |

|

|

(1,301 |

) |

|

|

19.1 |

|

% |

|

(4,105 |

) |

|

|

(5,124 |

) |

|

|

19.9 |

|

% |

||||

Income (loss) before taxes |

(834 |

) |

|

|

(14,516 |

) |

|

|

94.3 |

|

% |

|

4,078 |

|

|

|

(10,521 |

) |

|

|

138.8 |

|

% |

||||

Less: impairment charges |

— |

|

|

|

(16,617 |

) |

|

|

NM |

|

|

— |

|

|

|

(19,667 |

) |

|

|

NM |

|

||||||

Segment income (loss) |

$ |

(834 |

) |

|

|

$ |

2,101 |

|

|

|

(139.7 |

) |

% |

|

$ |

4,078 |

|

|

|

$ |

9,146 |

|

|

|

(55.4 |

) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Unit Sales Volume: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Used vehicles |

14,841 |

|

|

|

12,676 |

|

|

|

17.1 |

|

% |

|

57,161 |

|

|

|

49,520 |

|

|

|

15.4 |

|

% |

||||

Wholesale vehicles |

2,004 |

|

|

|

1,751 |

|

|

|

14.4 |

|

% |

|

7,178 |

|

|

|

5,774 |

|

|

|

24.3 |

|

% |

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Gross Profit Per Unit: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Total used vehicle and F&I |

$ |

1,770 |

|

|

|

$ |

2,341 |

|

|

|

(24.4 |

) |

% |

|

$ |

2,013 |

|

|

|

$ |

2,296 |

|

|

|

(12.3 |

) |

% |

NM = Not Meaningful |

|||||||||||||||||||||||||||

EchoPark Segment - Same Store |

|||||||||||||||||||||

|

Three Months Ended

|

|

Better /

|

|

Twelve Months Ended

|

|

Better /

|

||||||||||||||

|

2020 |

|

2019 |

|

% Change |

|

2020 |

|

2019 |

|

% Change |

||||||||||

|

(In thousands, except unit and per unit data) |

||||||||||||||||||||

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Used vehicles |

$ |

236,074 |

|

|

$ |

262,913 |

|

|

(10.2) |

% |

|

$ |

1,026,377 |

|

|

$ |

994,131 |

|

|

3.2 |

% |

Wholesale vehicles |

7,319 |

|

|

7,346 |

|

|

(0.4) |

% |

|

24,737 |

|

|

22,927 |

|

|

7.9 |

% |

||||

Total vehicles |

243,393 |

|

|

270,259 |

|

|

(9.9) |

% |

|

1,051,114 |

|

|

1,017,058 |

|

|

3.3 |

% |

||||

Parts, service and collision repair |

9,243 |

|

|

7,104 |

|

|

30.1 |

% |

|

34,768 |

|

|

28,510 |

|

|

22.0 |

% |

||||

Finance, insurance and other, net |

24,607 |

|

|

28,052 |

|

|

(12.3) |

% |

|

112,403 |

|

|

112,891 |

|

|

(0.4) |

% |

||||

Total revenues |

$ |

277,243 |

|

|

$ |

305,415 |

|

|

(9.2) |

% |

|

$ |

1,198,285 |

|

|

$ |

1,158,459 |

|

|

3.4 |

% |

Gross Profit: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Used vehicles |

$ |

(6,785) |

|

|

$ |

(609) |

|

|

(1,014.1) |

% |

|

$ |

(19,983) |

|

|

$ |

(5,831) |

|

|

(242.7) |

% |

Wholesale vehicles |

(2) |

|

|

(92) |

|

|

97.8 |

% |

|

(158) |

|

|

(332) |

|

|

52.4 |

% |

||||

Total vehicles |

(6,787) |

|

|

(701) |

|

|

(868.2) |

% |

|

(20,141) |

|

|

(6,163) |

|

|

(226.8) |

% |

||||

Parts, service and collision repair |

(138) |

|

|

(325) |

|

|

57.5 |

% |

|

(533) |

|

|

(894) |

|

|

40.4 |

% |

||||

Finance, insurance and other, net |

24,607 |

|

|

28,052 |

|

|

(12.3) |

% |

|

112,403 |

|

|

112,891 |

|

|

(0.4) |

% |

||||

Total gross profit |

$ |

17,682 |

|

|

$ |

27,026 |

|

|

(34.6) |

% |

|

$ |

91,729 |

|

|

$ |

105,834 |

|

|

(13.3) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Unit Sales Volume: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Used vehicles |

10,794 |

|

|

12,548 |

|

|

(14.0) |

% |

|

48,446 |

|

|

49,392 |

|

|

(1.9) |

% |

||||

Wholesale vehicles |

1,673 |

|

|

1,751 |

|

|

(4.5) |

% |

|

6,388 |

|

|

5,774 |

|

|

10.6 |

% |

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Gross Profit Per Unit: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Total used vehicle and F&I |

$ |

1,651 |

|

|

$ |

2,187 |

|

|

(24.5) |

% |

|

$ |

1,908 |

|

|

$ |

2,168 |

|

|

(12.0) |

% |

Selling, General and Administrative (“SG&A”) Expenses - Non-GAAP Reconciliation |

||||||||||||||

|

Three Months Ended December 31, |

|

Better / (Worse) |

|||||||||||

|

2020 |

|

2019 |

|

Change |

|

% Change |

|||||||

|

(In thousands) |

|||||||||||||

Reported: |

|

|

|

|

|

|

|

|||||||

Compensation |

$ |

176,050 |

|

|

$ |

184,455 |

|

|

$ |

8,405 |

|

|

4.6 |

% |

Advertising |

10,509 |

|

|

14,522 |

|

|

4,013 |

|

|

27.6 |

% |

|||

Rent |

13,560 |

|

|

13,303 |

|

|

(257) |

|

|

(1.9) |

% |

|||

Other |

58,858 |

|

|

48,641 |

|

|

(10,217) |

|

|

(21.0) |

% |

|||

Total SG&A expenses |

$ |

258,977 |

|

|

$ |

260,921 |

|

|

$ |

1,944 |

|

|

0.7 |

% |

Items of interest: |

|

|

|

|

|

|

|

|||||||

Gain on franchise and real estate disposals |

$ |

6,039 |

|

|

$ |

29,303 |

|

|

|

|

|

|||

Total SG&A adjustments |

$ |

6,039 |

|

|

$ |

29,303 |

|

|

|

|

|

|||

Adjusted: |

|

|

|

|

|

|

|

|||||||

Total adjusted SG&A expenses |

$ |

265,016 |

|

|

$ |

290,224 |

|

|

$ |

25,208 |

|

|

8.7 |

% |

Reported: |

|

|

|

|

|

|

|

|||||||

SG&A expenses as a % of gross profit: |

|

|

|

|

|

|

|

|||||||

Compensation |

45.2 |

% |

|

46.8 |

% |

|

160 |

|

bps |

|||||

Advertising |

2.7 |

% |

|

3.7 |

% |

|

100 |

|

bps |

|||||

Rent |

3.5 |

% |

|

3.4 |

% |

|

(10) |

|

bps |

|||||

Other |

15.2 |

% |

|

12.3 |

% |

|

(290) |

|

bps |

|||||

Total SG&A expenses as a % of gross profit |

66.6 |

% |

|

66.2 |

% |

|

(40) |

|

bps |

|||||

Items of interest: |

|

|

|

|

|

|

||||||||

Gain on franchise and real estate disposals |

1.5 |

% |

|

7.5 |

% |

|

|

|

||||||

Total effect of adjustments |

1.5 |

% |

|

7.5 |

% |

|

|

|

||||||

Adjusted: |

|

|

|

|

|

|

||||||||

Total adjusted SG&A expenses as a % of gross profit |

68.1 |

% |

|

73.7 |

% |

|

560 |

|

bps |

|||||

SG&A Expenses - Non-GAAP Reconciliation (Continued) |

||||||||||||||

|

Twelve Months Ended December 31, |

|

Better / (Worse) |

|||||||||||

|

2020 |

|

2019 |

|

Change |

|

% Change |

|||||||

|

(In thousands) |

|||||||||||||

Reported: |

|

|

|

|

|

|

|

|||||||

Compensation |

$ |

659,834 |

|

|

$ |

733,925 |

|

|

$ |

74,091 |

|

|

10.1 |

% |

Advertising |

42,186 |

|

|

60,831 |

|

|

18,645 |

|

|

30.7 |

% |

|||

Rent |

54,494 |

|

|

54,611 |

|

|

117 |

|

|

0.2 |

% |

|||

Other |

272,152 |

|

|

250,007 |

|

|

(22,145) |

|

|

(8.9) |

% |

|||

Total SG&A expenses |

$ |

1,028,666 |

|

|

$ |

1,099,374 |

|

|

$ |

70,708 |

|

|

6.4 |

% |

Items of interest: |

|

|

|

|

|

|

|

|||||||

Executive transition costs |

$ |

— |

|

|

$ |

(6,264) |

|

|

|

|

|

|||

Gain on franchise and real estate disposals |

9,188 |

|

|

75,983 |

|

|

|

|

|

|||||

Total SG&A adjustments |

$ |

9,188 |

|

|

$ |

69,719 |

|

|

|

|

|

|||

Adjusted: |

|

|

|

|

|

|

|

|||||||

Total adjusted SG&A expenses |

$ |

1,037,854 |

|

|

$ |

1,169,093 |

|

|

$ |

131,239 |

|

|

11.2 |

% |

Reported: |

|

|

|

|

|

|

|

|||||||

SG&A expenses as a % of gross profit: |

|

|

|

|

|

|

|

|||||||

Compensation |

46.3 |

% |

|

48.3 |

% |

|

200 |

|

bps |

|||||

Advertising |

3.0 |

% |

|

4.0 |

% |

|

100 |

|

bps |

|||||

Rent |

3.8 |

% |

|

3.6 |

% |

|

(20) |

|

bps |

|||||

Other |

19.2 |

% |

|

16.4 |

% |

|

(280) |

|

bps |

|||||

Total SG&A expenses as a % of gross profit |

72.3 |

% |

|

72.3 |

% |

|

— |

|

bps |

|||||

Items of interest: |

|

|

|

|

|

|

||||||||

Executive transition costs |

— |

% |

|

(0.4) |

% |

|

|

|

|

|||||

Gain on franchise and real estate disposals |

0.6 |

% |

|

5.0 |

% |

|

|

|

||||||

Total effect of adjustments |

0.6 |

% |

|

4.6 |

% |

|

|

|

||||||

Adjusted: |

|

|

|

|

|

|

||||||||

Total adjusted SG&A expenses as a % of gross profit |

72.9 |

% |

|

76.9 |

% |

|

400 |

|

bps |

|||||

Earnings Per Share from Continuing Operations - Non-GAAP Reconciliation |

|||||||||||||||||||||||

|

Three Months Ended December 31, 2020 |

|

Three Months Ended December 31, 2019 |

||||||||||||||||||||

|

Weighted-

|

|

Amount |

|

Per

|

|

Weighted-

|

|

Amount |

|

Per

|

||||||||||||

|

(In thousands, except per share amounts) |

||||||||||||||||||||||

Diluted earnings (loss) and shares from continuing operations |

44,022 |

|

|

$ |

57,483 |

|

|

|

$ |

1.31 |

|

|

44,463 |

|

|

$ |

46,272 |

|

|

|

$ |

1.04 |

|

Pre-tax items of interest: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Gain on franchise and real estate disposals |

|

|

$ |

(6,039 |

) |

|

|

|

|

|

|

$ |

(29,303 |

) |

|

|

|

||||||

Loss on debt extinguishment |

|

|

— |

|

|

|

|

|

|

|

7,157 |

|

|

|

|

||||||||

Impairment charges |

|

|

1,158 |

|

|

|

|

|

|

|

17,692 |

|

|

|

|

||||||||

Total pre-tax items of interest |

|

|

$ |

(4,881 |

) |

|

|

|

|

|

|

$ |

(4,454 |

) |

|

|

|

||||||

Tax effect of above items |

|

|

1,281 |

|

|

|

|

|

|

|

1,292 |

|

|

|

|

||||||||

Non-recurring tax items |

|

|

11,941 |

|

|

|

|

|

|

|

— |

|

|

|

|

||||||||

Adjusted diluted earnings (loss) and shares from continuing operations |

44,022 |

|

|

$ |

65,824 |

|

|

|

$ |

1.50 |

|

|

44,463 |

|

|

$ |

43,110 |

|

|

|

$ |

0.97 |

|

|

Twelve Months Ended December 31, 2020 |

|

Twelve Months Ended December 31, 2019 |

|||||||||||||||||||||

|

Weighted-

|

|

Amount |

|

Per

|

|

Weighted-

|

|

Amount |

|

Per

|

|||||||||||||

|

(In thousands, except per share amounts) |

|||||||||||||||||||||||

Diluted earnings (loss) and shares from continuing operations(1) |

42,483 |

|

|

$ |

(50,664 |

) |

|

|

$ |

(1.19 |

) |

|

|

43,710 |

|

|

$ |

144,537 |

|

|

|

$ |

3.31 |

|

Pre-tax items of interest: |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Gain on franchise and real estate disposals |

|

|

$ |

(9,188 |

) |

|

|

|

|

|

|

$ |

(75,983 |

) |

|

|

|

|||||||

Executive transition costs |

|

|

— |

|

|

|

|

|

|

|

6,264 |

|

|

|

|

|||||||||

Loss on debt extinguishment |

|

|

— |

|

|

|

|

|

|

|

7,157 |

|

|

|

||||||||||

Impairment charges |

|

|

269,158 |

|

|

|

|

|

|

|

19,618 |

|

|

|

||||||||||

Total pre-tax items of interest |

|

|

$ |

259,970 |

|

|

|

|

|

|

|

$ |

(42,944 |

) |

|

|

|

|||||||

Tax effect of above items |

|

|

(40,421 |

) |

|

|

|

|

|

|

14,193 |

|

|

|

|

|||||||||

Adjusted diluted earnings (loss) and shares from continuing operations |

43,903 |

|

|

$ |

168,885 |

|

|

|

$ |

3.85 |

|

|

|

43,710 |

|

|

$ |

115,786 |

|

|

|

$ |

2.65 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

(1) Basic weighted-average shares used for twelve months ended December 31, 2020 due to net loss on reported GAAP basis. |

Adjusted EBITDA - Non-GAAP Reconciliation |

|||||||||||||||||||||||||||||||||||||||

|

Twelve Months Ended December 31, 2020 |

|

Twelve Months Ended December 31, 2019 |

||||||||||||||||||||||||||||||||||||

|

Franchised

|

|

EchoPark

|

|

Discontinued

|

|

Total |

|

Franchised

|

|

EchoPark

|

|

Discontinued

|

|

Total |

||||||||||||||||||||||||

|

(In thousands) |

||||||||||||||||||||||||||||||||||||||

Net income (loss) |

|

|

|

|

|

|

$ |

(51,385 |

) |

|

|

|

|

|

|

|

|

$ |

144,137 |

|

|

||||||||||||||||||

Provision for income taxes |

|

|

|

|

|

|

15,619 |

|

|

|

|

|

|

|

|

|

54,954 |

|

|

||||||||||||||||||||

Income (loss) before taxes |

$ |

(38,842 |

) |

|

|

$ |

4,078 |

|

|

|

$ |

(1,002 |

) |

|

|

$ |

(35,766 |

) |

|

|

$ |

210,167 |

|

|

|

$ |

(10,522 |

) |

|

|

$ |

(554 |

) |

|

|

$ |

199,091 |

|

|

Non-floor plan interest (1) |

37,746 |

|

|

|

926 |

|

|

|

— |

|

|

|

38,672 |

|

|

|

48,774 |

|

|

|

1,701 |

|

|

|

— |

|

|

|

50,475 |

|

|

||||||||

Depreciation and amortization (2) |

82,807 |

|

|

|

11,115 |

|

|

|

— |

|

|

|

93,922 |

|

|

|

85,093 |

|

|

|

10,553 |

|

|

|

— |

|

|

|

95,646 |

|

|

||||||||

Stock-based compensation expense |

11,704 |

|

|

|

— |

|

|

|

— |

|

|

|

11,704 |

|

|

|

10,797 |

|

|

|

— |

|

|

|

— |

|

|

|

10,797 |

|

|

||||||||

Loss (gain) on exit of leased dealerships |

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(170 |

) |

|

|

— |

|

|

|

— |

|

|

|

(170 |

) |

|

||||||||

Asset impairment charges |

270,017 |

|

|

|

— |

|

|

|

— |

|

|

|

270,017 |

|

|

|

1,101 |

|

|

|

19,667 |

|

|

|

— |

|

|

|

20,768 |

|

|

||||||||

Loss (gain) on debt extinguishment |

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6,690 |

|

|

|

— |

|

|

|

— |

|

|

|

6,690 |

|

|

||||||||

Loss (gain) on franchise and real estate disposals |

(3,095 |

) |

|

|

(5,152 |

) |

|

|

— |

|

|

|

(8,247 |

) |

|

|

(74,812 |

) |

|

|

— |

|

|

|

— |

|

|

|

(74,812 |

) |

|

||||||||

Adjusted EBITDA |

$ |

360,337 |

|

|

|

$ |

10,967 |

|

|

|

$ |

(1,002 |

) |

|

|

$ |

370,302 |

|

|

|

$ |

287,640 |

|

|

|

$ |

21,399 |

|

|

|

$ |

(554 |

) |

|

|

$ |

308,485 |

|

|

Long-term debt (including current portion) |

|

|

|

|

|

|

$ |

720,067 |

|

|

|

|

|

|

|

|

|

$ |

706,886 |

|

|

||||||||||||||||||

Cash and equivalents |

|

|

|

|

|

|

(170,313 |

) |

|

|

|

|

|

|

|

|

(29,103 |

) |

|

||||||||||||||||||||

Floor plan deposit balance |

|

|

|

|

|

|

(73,180 |

) |

|

|

|

|

|

|

|

|

— |

|

|

||||||||||||||||||||

Net debt |

|

|

|

|

|

|

$ |

476,574 |

|

|

|

|

|

|

|

|

|

$ |

677,783 |

|

|

||||||||||||||||||

Net debt to adjusted EBITDA ratio |

|

|

|

|

|

|

1.29 |

|

|

|

|

|

|

|

|

|

2.20 |

|

|

||||||||||||||||||||

(1) |

Includes interest expense, other, net in the accompanying consolidated statements of operations, net of any amortization of debt issuance costs or net debt discount/premium included in (2) below. |

|

(2) |

Includes the following line items from the accompanying consolidated statements of cash flows: depreciation and amortization of property and equipment; debt issuance cost amortization; and debt discount amortization, net of premium amortization. |