Hilton Reports Fourth Quarter and Full Year Results

Hilton Reports Fourth Quarter and Full Year Results

MCLEAN, Va.--(BUSINESS WIRE)--Hilton Worldwide Holdings Inc. ("Hilton" or the "Company") (NYSE: HLT) today reported its fourth quarter and full year 2020 results. The following results reflect the material impact that the novel coronavirus ("COVID-19") pandemic has had on Hilton's business. Highlights include:

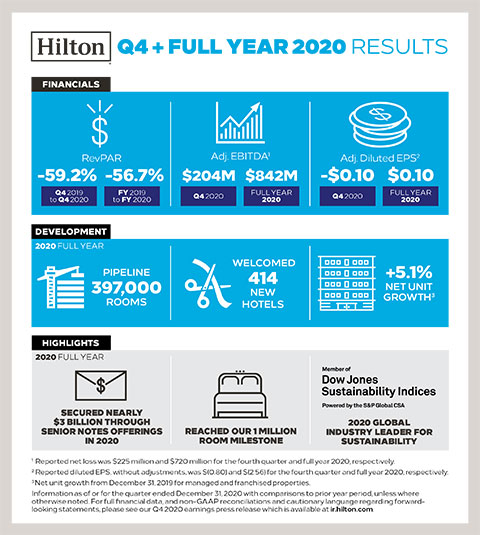

- Diluted EPS was $(0.80) for the fourth quarter and $(2.56) for the full year, and diluted EPS, adjusted for special items, was $(0.10) for the fourth quarter and $0.10 for the full year

- Net loss was $225 million for the fourth quarter and $720 million for the full year

- Adjusted EBITDA was $204 million for the fourth quarter and $842 million for the full year

- System-wide comparable RevPAR decreased 59.2 percent and 56.7 percent on a currency neutral basis for the fourth quarter and full year, respectively, from the same periods in 2019

- Approved 18,700 new rooms for development during the fourth quarter, bringing Hilton's development pipeline to 397,000 rooms as of December 31, 2020

- Opened 22,900 rooms in the fourth quarter, reaching the one million room milestone and contributing to 47,400 net additional rooms in Hilton's system for the full year, which represented approximately 5.1 percent net unit growth from December 31, 2019

- As of February 10, 2021, 97 percent of Hilton's system-wide hotels were open

- In December 2020, issued $1.9 billion of senior notes consisting of: (i) $800 million aggregate principal amount of 3.750% Senior Notes due 2029 and (ii) $1.1 billion aggregate principal amount of 4.000% Senior Notes due 2031; and used the net proceeds to redeem: (i) $1.0 billion in aggregate principal amount of outstanding 4.250% Senior Notes due 2024 and (ii) $900 million in aggregate principal amount of outstanding 4.625% Senior Notes due 2025

- In January 2021, repaid $250 million of the outstanding debt balance under the $1.75 billion senior secured revolving credit facility

- In February 2021, issued $1.5 billion aggregate principal amount of 3.625% Senior Notes due 2032 and used the net proceeds to redeem $1.5 billion in aggregate principal amount of outstanding 5.125% Senior Notes due 2026

Overview

Christopher J. Nassetta, President & Chief Executive Officer of Hilton, said, "Our fourth quarter results were largely in line with our expectations as rising COVID-19 cases and tightening travel restrictions disrupted the positive momentum we saw throughout the summer and fall. Yet even with a challenging environment, we celebrated our one million room milestone during the quarter and achieved net unit growth of more than five percent for the year. We continued this momentum into 2021 with the opening of our 900th Hilton Garden Inn and the conversion of Oceana Santa Monica, which marked the U.S. debut of LXR. We expect our industry-leading brands to continue driving new development and conversion opportunities, enabling us to further grow our network and capture a disproportionate share of demand as travel resumes."

On a global level, the pervasive impact of the COVID-19 pandemic began in late March, with its most significant adverse impact on occupancy and RevPAR in April. System-wide occupancy showed sequential month-over-month improvement from April through October and, in the fourth quarter, there was both occupancy and RevPAR improvement in the Americas (excluding U.S.), Middle East and Africa and Asia Pacific regions. However, travel restrictions re-imposed in late 2020 resulted in additional temporary suspensions and, in some cases, re-suspensions of hotel operations, particularly in Europe, which led to further declines in occupancy and RevPAR in that region in the fourth quarter.

For the three months and year ended December 31, 2020, system-wide comparable RevPAR decreased 59.2 percent and 56.7 percent, respectively, compared to the same periods in 2019, due to both occupancy and ADR decreases. Additionally, fee revenues decreased 50 percent and 51 percent during the three months and year ended December 31, 2020, respectively, compared to the same periods in 2019. The decreases were due to the COVID-19 pandemic, which resulted in the complete or partial suspensions of hotel operations at approximately 20 percent of Hilton's global hotel properties for some portion of the year ended December 31, 2020. As of February 10, 2021, 97 percent of Hilton's global hotel properties were open, while approximately 220 hotels had temporarily suspended operations.

For the three months ended December 31, 2020, diluted EPS was $(0.80) and diluted EPS, adjusted for special items, was $(0.10) compared to $0.61 and $1.00, respectively, for the three months ended December 31, 2019. Net income (loss) and Adjusted EBITDA were $(225) million and $204 million, respectively, for the three months ended December 31, 2020, compared to $176 million and $586 million, respectively, for the three months ended December 31, 2019.

For the year ended December 31, 2020, diluted EPS was $(2.56) and diluted EPS, adjusted for special items, was $0.10 compared to $3.04 and $3.90, respectively, for the year ended December 31, 2019. Net income (loss) and Adjusted EBITDA were $(720) million and $842 million, respectively, for the year ended December 31, 2020, compared to $886 million and $2,308 million, respectively, for the year ended December 31, 2019.

Development

In the fourth quarter of 2020, Hilton opened 154 new hotels totaling 22,900 rooms, and achieved net unit growth of 20,900 rooms. During the full year 2020, Hilton opened 414 new hotels totaling 55,600 rooms and achieved net unit growth of 47,400 rooms. Hilton opened the Waldorf Astoria Xiamen, Hilton's 300th hotel in China, in December 2020, and continued to add to its luxury portfolio in 2021 with the opening of the Waldorf Astoria Monarch Beach Resort & Club.

As of December 31, 2020, Hilton's development pipeline totaled nearly 2,570 hotels consisting of more than 397,000 rooms throughout 116 countries and territories, including 31 countries and territories where Hilton does not currently have any open hotels. Additionally, of the rooms in the development pipeline, 233,000 rooms were located outside the U.S., and 204,000 rooms were under construction.

Balance Sheet and Liquidity

As of December 31, 2020, Hilton had $10.6 billion of long-term debt outstanding, excluding deferred financing costs and discount, with a weighted average interest rate of 3.77 percent. Excluding finance lease liabilities and other debt of Hilton's consolidated variable interest entities, Hilton had $10.3 billion of long-term debt outstanding with a weighted average interest rate of 3.72 percent and no maturities until 2024. Total cash and cash equivalents were $3,263 million as of December 31, 2020, including $45 million of restricted cash and cash equivalents.

In January 2021, Hilton repaid $250 million of the outstanding debt balance under its senior secured revolving credit facility (the "Revolving Credit Facility"), resulting in an outstanding debt balance of $1,440 million. In February 2021, Hilton issued $1.5 billion aggregate principal amount of 3.625% Senior Notes due 2032 (the "2032 Senior Notes") and used the net proceeds to redeem $1.5 billion in aggregate principal amount of outstanding 5.125% Senior Notes due 2026 (the "2026 Senior Notes"). Giving effect to the January 2021 repayment on the Revolving Credit Facility and the February 2021 issuance of the 2032 Senior Notes and redemption of the 2026 Senior Notes, Hilton's weighted average interest rate on its long-term debt outstanding would have been lowered to 3.61 percent, or 3.56 percent excluding finance lease liabilities and other debt of Hilton's consolidated variable interest entities, with the weighted average maturity extended by nearly one year.

In March 2020, Hilton suspended share repurchases and the payment of dividends to preserve capital and maintain liquidity. No share repurchases have been made since March 5, 2020, and no dividends have been declared or paid since March 31, 2020. The stock repurchase program remains authorized by the board of directors, and the amount remaining under Hilton's stock repurchase program is approximately $2.2 billion.

Conference Call

Hilton will host a conference call to discuss fourth quarter and full year 2020 results on February 17, 2021 at 10:00 a.m. Eastern Time. Participants may listen to the live webcast by logging on to the Hilton Investor Relations website at https://ir.hilton.com/events-and-presentations. A replay and transcript of the webcast will be available within 24 hours after the live event at https://ir.hilton.com/financial-reporting/quarterly-results/2020.

Alternatively, participants may listen to the live call by dialing 1-888-317-6003 in the United States ("U.S.") or 1-412-317-6061 internationally using the conference ID 1737754. Participants are encouraged to dial into the call or link to the webcast at least fifteen minutes prior to the scheduled start time. A telephone replay will be available for seven days following the call. To access the telephone replay, dial 1-877-344-7529 in the U.S. or 1-412-317-0088 internationally using the conference ID 10151277.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements related to the expectations regarding the impact of the COVID-19 pandemic, the performance of Hilton's business, financial results, liquidity and capital resources and other non-historical statements. In some cases, these forward-looking statements can be identified by the use of words such as "outlook," "believes," "expects," "potential," "continues," "may," "will," "should," "could," "seeks," "projects," "predicts," "intends," "plans," "estimates," "anticipates" or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties, including, among others, risks related to the impact of the COVID-19 pandemic, risks inherent to the hospitality industry, macroeconomic factors beyond Hilton's control, competition for hotel guests and management and franchise contracts, risks related to doing business with third-party hotel owners, performance of Hilton's information technology systems, growth of reservation channels outside of Hilton's system, risks of doing business outside of the U.S. and Hilton's indebtedness. Additional factors that could cause Hilton's results to differ materially from those described in the forward-looking statements can be found under the sections entitled "Part I—Item 1A. Risk Factors" of Hilton's Annual Report on Form 10-K for the fiscal year ended December 31, 2019 and "Part II—Item 1A. Risk Factors" of Hilton's Quarterly Report on Form 10-Q for the quarter ended September 30, 2020, filed with the Securities and Exchange Commission (the "SEC"), as such factors may be further updated from time to time in Hilton's periodic filings with the SEC, including Hilton's Annual Report on Form 10-K for the fiscal year ended December 31, 2020, which is expected to be filed on or about the date of this press release, which are accessible on the SEC's website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this press release and in Hilton's filings with the SEC. The Company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

Non-GAAP Financial Measures

The Company refers to certain financial measures that are not recognized under U.S. generally accepted accounting principles ("GAAP") in this press release, including: net income (loss), adjusted for special items; diluted EPS, adjusted for special items; Adjusted EBITDA; Adjusted EBITDA margin; net debt; and net debt to Adjusted EBITDA ratio. See the schedules to this press release, including the "Definitions" section, for additional information and reconciliations of such non-GAAP financial measures.

About Hilton

Hilton (NYSE: HLT) is a leading global hospitality company with a portfolio of 18 world-class brands comprising more than 6,400 properties and more than one million rooms in 119 countries and territories. Dedicated to fulfilling its founding vision to fill the earth with the light and warmth of hospitality, Hilton has welcomed more than 3 billion guests in its more than 100-year history, earned a top spot on the 2020 World's Best Workplaces list and was named the 2020 Global Industry Leader on the Dow Jones Sustainability Indices. In 2020, Hilton CleanStay was introduced, bringing an industry-defining standard of cleanliness and disinfection to hotels worldwide. Through the award-winning guest loyalty program Hilton Honors, the more than 112 million members who book directly with Hilton can earn Points for hotel stays and experiences money can't buy, plus enjoy instant benefits, including contactless check-in with room selection, Digital Key and Connected Room. Visit newsroom.hilton.com for more information, and connect with Hilton on facebook.com/hiltonnewsroom, twitter.com/hiltonnewsroom, linkedin.com/company/hilton, instagram.com/hiltonnewsroom and youtube.com/hiltonnewsroom.

HILTON WORLDWIDE HOLDINGS INC. EARNINGS RELEASE SCHEDULES TABLE OF CONTENTS |

||

|

|

|

Consolidated Statements of Operations |

|

|

Comparable and Currency Neutral System-Wide Hotel Operating Statistics |

|

|

Property Summary |

|

|

Capital Expenditures and Contract Acquisition Costs |

|

|

Reconciliations of Non-GAAP Financial Measures |

|

|

Definitions |

|

HILTON WORLDWIDE HOLDINGS INC. CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited, in millions, except per share data) |

|||||||||||||||

|

Three Months Ended |

|

Year Ended |

||||||||||||

|

December 31, |

|

December 31, |

||||||||||||

|

2020 |

|

2019 |

|

2020 |

|

2019 |

||||||||

Revenues |

|

|

|

|

|

|

|

||||||||

Franchise and licensing fees |

$ |

233 |

|

|

$ |

412 |

|

|

$ |

945 |

|

|

$ |

1,681 |

|

Base and other management fees |

31 |

|

|

83 |

|

|

123 |

|

|

332 |

|

||||

Incentive management fees |

13 |

|

|

63 |

|

|

38 |

|

|

230 |

|

||||

Owned and leased hotels |

86 |

|

|

362 |

|

|

421 |

|

|

1,422 |

|

||||

Other revenues |

21 |

|

|

26 |

|

|

73 |

|

|

101 |

|

||||

|

384 |

|

|

946 |

|

|

1,600 |

|

|

3,766 |

|

||||

Other revenues from managed and franchised properties |

506 |

|

|

1,423 |

|

|

2,707 |

|

|

5,686 |

|

||||

Total revenues |

890 |

|

|

2,369 |

|

|

4,307 |

|

|

9,452 |

|

||||

|

|

|

|

|

|

|

|

||||||||

Expenses |

|

|

|

|

|

|

|

||||||||

Owned and leased hotels |

142 |

|

|

312 |

|

|

620 |

|

|

1,254 |

|

||||

Depreciation and amortization |

62 |

|

|

90 |

|

|

331 |

|

|

346 |

|

||||

General and administrative |

122 |

|

|

114 |

|

|

311 |

|

|

441 |

|

||||

Reorganization costs |

3 |

|

|

— |

|

|

41 |

|

|

— |

|

||||

Impairment losses |

122 |

|

|

— |

|

|

258 |

|

|

— |

|

||||

Other expenses |

12 |

|

|

26 |

|

|

60 |

|

|

72 |

|

||||

|

463 |

|

|

542 |

|

|

1,621 |

|

|

2,113 |

|

||||

Other expenses from managed and franchised properties |

622 |

|

|

1,479 |

|

|

3,104 |

|

|

5,763 |

|

||||

Total expenses |

1,085 |

|

|

2,021 |

|

|

4,725 |

|

|

7,876 |

|

||||

|

|

|

|

|

|

|

|

||||||||

Gain on sale of assets, net |

— |

|

|

— |

|

|

— |

|

|

81 |

|

||||

|

|

|

|

|

|

|

|

||||||||

Operating income (loss) |

(195 |

) |

|

348 |

|

|

(418 |

) |

|

1,657 |

|

||||

|

|

|

|

|

|

|

|

||||||||

Interest expense |

(113 |

) |

|

(110 |

) |

|

(429 |

) |

|

(414 |

) |

||||

Loss on foreign currency transactions |

(11 |

) |

|

(6 |

) |

|

(27 |

) |

|

(2 |

) |

||||

Loss on debt extinguishments |

(48 |

) |

|

— |

|

|

(48 |

) |

|

— |

|

||||

Other non-operating income (loss), net |

18 |

|

|

11 |

|

|

(2 |

) |

|

3 |

|

||||

|

|

|

|

|

|

|

|

||||||||

Income (loss) before income taxes |

(349 |

) |

|

243 |

|

|

(924 |

) |

|

1,244 |

|

||||

|

|

|

|

|

|

|

|

||||||||

Income tax benefit (expense) |

124 |

|

|

(67 |

) |

|

204 |

|

|

(358 |

) |

||||

|

|

|

|

|

|

|

|

||||||||

Net income (loss) |

(225 |

) |

|

176 |

|

|

(720 |

) |

|

886 |

|

||||

Net loss (income) attributable to noncontrolling interests |

1 |

|

|

(1 |

) |

|

5 |

|

|

(5 |

) |

||||

Net income (loss) attributable to Hilton stockholders |

$ |

(224 |

) |

|

$ |

175 |

|

|

$ |

(715 |

) |

|

$ |

881 |

|

|

|

|

|

|

|

|

|

||||||||

Weighted average shares outstanding: |

|

|

|

|

|

|

|

||||||||

Basic |

278 |

|

|

281 |

|

|

277 |

|

|

287 |

|

||||

Diluted |

279 |

|

|

284 |

|

|

279 |

|

|

290 |

|

||||

|

|

|

|

|

|

|

|

||||||||

Earnings (loss) per share: |

|

|

|

|

|

|

|

||||||||

Basic |

$ |

(0.81 |

) |

|

$ |

0.62 |

|

|

$ |

(2.58 |

) |

|

$ |

3.07 |

|

Diluted |

$ |

(0.80 |

) |

|

$ |

0.61 |

|

|

$ |

(2.56 |

) |

|

$ |

3.04 |

|

|

|

|

|

|

|

|

|

||||||||

Cash dividends declared per share |

$ |

— |

|

|

$ |

0.15 |

|

|

$ |

0.15 |

|

|

$ |

0.60 |

|

HILTON WORLDWIDE HOLDINGS INC. COMPARABLE AND CURRENCY NEUTRAL SYSTEM-WIDE HOTEL OPERATING STATISTICS BY REGION (unaudited) |

|||||||||||||||||||

|

Three Months Ended December 31, |

||||||||||||||||||

|

Occupancy |

|

ADR |

|

RevPAR |

||||||||||||||

|

2020 |

|

vs. 2019 |

|

2020 |

|

vs. 2019 |

|

2020 |

|

vs. 2019 |

||||||||

U.S. |

41.2 |

% |

|

(30.4 |

)% pts. |

|

$ |

103.03 |

|

|

(27.8 |

)% |

|

$ |

42.45 |

|

|

(58.5 |

)% |

Americas (excluding U.S.) |

27.7 |

|

|

(38.4 |

) |

|

83.94 |

|

|

(25.3 |

) |

|

23.22 |

|

|

(68.7 |

) |

||

Europe |

22.5 |

|

|

(53.2 |

) |

|

88.44 |

|

|

(36.0 |

) |

|

19.90 |

|

|

(81.0 |

) |

||

Middle East & Africa |

39.9 |

|

|

(35.4 |

) |

|

122.18 |

|

|

(11.5 |

) |

|

48.73 |

|

|

(53.2 |

) |

||

Asia Pacific |

55.7 |

|

|

(15.8 |

) |

|

96.50 |

|

|

(19.1 |

) |

|

53.73 |

|

|

(37.0 |

) |

||

System-wide |

40.1 |

|

|

(31.7 |

) |

|

101.39 |

|

|

(26.9 |

) |

|

40.68 |

|

|

(59.2 |

) |

||

|

Year Ended December 31, |

||||||||||||||||||

|

Occupancy |

|

ADR |

|

RevPAR |

||||||||||||||

|

2020 |

|

vs. 2019 |

|

2020 |

|

vs. 2019 |

|

2020 |

|

vs. 2019 |

||||||||

U.S. |

42.2 |

% |

|

(33.5 |

)% pts. |

|

$ |

117.40 |

|

|

(20.0 |

)% |

|

$ |

49.53 |

|

|

(55.4 |

)% |

Americas (excluding U.S.) |

29.4 |

|

|

(39.6 |

) |

|

98.55 |

|

|

(15.1 |

) |

|

28.98 |

|

|

(63.8 |

) |

||

Europe |

28.6 |

|

|

(47.8 |

) |

|

107.37 |

|

|

(22.0 |

) |

|

30.71 |

|

|

(70.8 |

) |

||

Middle East & Africa |

35.6 |

|

|

(34.4 |

) |

|

125.30 |

|

|

(10.1 |

) |

|

44.59 |

|

|

(54.3 |

) |

||

Asia Pacific |

43.9 |

|

|

(26.3 |

) |

|

93.85 |

|

|

(19.3 |

) |

|

41.21 |

|

|

(49.5 |

) |

||

System-wide |

40.3 |

|

|

(34.4 |

) |

|

114.03 |

|

|

(19.6 |

) |

|

46.00 |

|

|

(56.7 |

) |

||

HILTON WORLDWIDE HOLDINGS INC. COMPARABLE AND CURRENCY NEUTRAL SYSTEM-WIDE HOTEL OPERATING STATISTICS BY BRAND (unaudited) |

|||||||||||||||||||

|

Three Months Ended December 31, |

||||||||||||||||||

|

Occupancy |

|

ADR |

|

RevPAR |

||||||||||||||

|

2020 |

|

vs. 2019 |

|

2020 |

|

vs. 2019 |

|

2020 |

|

vs. 2019 |

||||||||

Waldorf Astoria Hotels & Resorts |

28.9 |

% |

|

(45.7 |

)% pts. |

|

$ |

352.37 |

|

|

(6.5 |

)% |

|

$ |

101.81 |

|

|

(63.8 |

)% |

Conrad Hotels & Resorts |

36.7 |

|

|

(38.7 |

) |

|

216.95 |

|

|

(18.1 |

) |

|

79.69 |

|

|

(60.1 |

) |

||

Canopy by Hilton |

24.9 |

|

|

(46.5 |

) |

|

133.02 |

|

|

(28.5 |

) |

|

33.06 |

|

|

(75.1 |

) |

||

Hilton Hotels & Resorts |

29.7 |

|

|

(44.1 |

) |

|

119.33 |

|

|

(28.5 |

) |

|

35.40 |

|

|

(71.2 |

) |

||

Curio Collection by Hilton |

28.3 |

|

|

(41.0 |

) |

|

140.97 |

|

|

(28.4 |

) |

|

39.83 |

|

|

(70.8 |

) |

||

DoubleTree by Hilton |

34.2 |

|

|

(36.2 |

) |

|

91.65 |

|

|

(27.7 |

) |

|

31.33 |

|

|

(64.9 |

) |

||

Tapestry Collection by Hilton |

39.4 |

|

|

(30.6 |

) |

|

111.77 |

|

|

(30.5 |

) |

|

44.06 |

|

|

(60.9 |

) |

||

Embassy Suites by Hilton |

35.6 |

|

|

(38.3 |

) |

|

113.91 |

|

|

(27.8 |

) |

|

40.51 |

|

|

(65.3 |

) |

||

Hilton Garden Inn |

40.5 |

|

|

(31.0 |

) |

|

89.32 |

|

|

(29.3 |

) |

|

36.14 |

|

|

(60.0 |

) |

||

Hampton by Hilton |

46.2 |

|

|

(23.5 |

) |

|

91.48 |

|

|

(20.7 |

) |

|

42.28 |

|

|

(47.4 |

) |

||

Tru by Hilton |

49.9 |

|

|

(14.9 |

) |

|

85.89 |

|

|

(13.2 |

) |

|

42.88 |

|

|

(33.2 |

) |

||

Homewood Suites by Hilton |

57.8 |

|

|

(18.4 |

) |

|

104.51 |

|

|

(22.2 |

) |

|

60.37 |

|

|

(41.1 |

) |

||

Home2 Suites by Hilton |

57.9 |

|

|

(14.2 |

) |

|

94.51 |

|

|

(16.1 |

) |

|

54.75 |

|

|

(32.6 |

) |

||

System-wide |

40.1 |

|

|

(31.7 |

) |

|

101.39 |

|

|

(26.9 |

) |

|

40.68 |

|

|

(59.2 |

) |

||

|

Year Ended December 31, |

||||||||||||||||||

|

Occupancy |

|

ADR |

|

RevPAR |

||||||||||||||

|

2020 |

|

vs. 2019 |

|

2020 |

|

vs. 2019 |

|

2020 |

|

vs. 2019 |

||||||||

Waldorf Astoria Hotels & Resorts |

30.0 |

% |

|

(42.5 |

)% pts. |

|

$ |

351.06 |

|

|

(7.9 |

)% |

|

$ |

105.37 |

|

|

(61.9 |

)% |

Conrad Hotels & Resorts |

33.4 |

|

|

(42.7 |

) |

|

210.11 |

|

|

(20.8 |

) |

|

70.23 |

|

|

(65.2 |

) |

||

Canopy by Hilton |

29.2 |

|

|

(42.3 |

) |

|

156.82 |

|

|

(20.5 |

) |

|

45.76 |

|

|

(67.5 |

) |

||

Hilton Hotels & Resorts |

31.5 |

|

|

(43.8 |

) |

|

138.07 |

|

|

(18.3 |

) |

|

43.48 |

|

|

(65.8 |

) |

||

Curio Collection by Hilton |

30.9 |

|

|

(37.8 |

) |

|

166.96 |

|

|

(17.4 |

) |

|

51.61 |

|

|

(62.9 |

) |

||

DoubleTree by Hilton |

35.0 |

|

|

(38.2 |

) |

|

106.64 |

|

|

(17.1 |

) |

|

37.30 |

|

|

(60.4 |

) |

||

Tapestry Collection by Hilton |

40.8 |

|

|

(30.3 |

) |

|

114.54 |

|

|

(25.6 |

) |

|

46.73 |

|

|

(57.3 |

) |

||

Embassy Suites by Hilton |

37.4 |

|

|

(40.5 |

) |

|

133.47 |

|

|

(18.5 |

) |

|

49.86 |

|

|

(60.9 |

) |

||

Hilton Garden Inn |

40.6 |

|

|

(34.2 |

) |

|

102.73 |

|

|

(20.8 |

) |

|

41.74 |

|

|

(57.0 |

) |

||

Hampton by Hilton |

45.2 |

|

|

(28.4 |

) |

|

100.26 |

|

|

(16.6 |

) |

|

45.28 |

|

|

(48.8 |

) |

||

Tru by Hilton |

47.2 |

|

|

(19.5 |

) |

|

89.08 |

|

|

(14.4 |

) |

|

42.01 |

|

|

(39.5 |

) |

||

Homewood Suites by Hilton |

56.7 |

|

|

(23.4 |

) |

|

113.73 |

|

|

(18.2 |

) |

|

64.43 |

|

|

(42.1 |

) |

||

Home2 Suites by Hilton |

56.2 |

|

|

(20.1 |

) |

|

100.28 |

|

|

(14.0 |

) |

|

56.34 |

|

|

(36.6 |

) |

||

System-wide |

40.3 |

|

|

(34.4 |

) |

|

114.03 |

|

|

(19.6 |

) |

|

46.00 |

|

|

(56.7 |

) |

||

HILTON WORLDWIDE HOLDINGS INC. COMPARABLE AND CURRENCY NEUTRAL SYSTEM-WIDE HOTEL OPERATING STATISTICS BY SEGMENT (unaudited) |

|||||||||||||||||||

|

Three Months Ended December 31, |

||||||||||||||||||

|

Occupancy |

|

ADR |

|

RevPAR |

||||||||||||||

|

2020 |

|

vs. 2019 |

|

2020 |

|

vs. 2019 |

|

2020 |

|

vs. 2019 |

||||||||

Management and franchise |

40.5 |

% |

|

(31.2) |

% pts. |

|

$ |

100.72 |

|

|

(26.7) |

% |

|

$ |

40.77 |

|

|

(58.6) |

% |

Ownership(1) |

21.0 |

|

|

(56.9) |

|

|

170.31 |

|

|

(14.6) |

|

|

35.75 |

|

|

(77.0) |

|

||

System-wide |

40.1 |

|

|

(31.7) |

|

|

101.39 |

|

|

(26.9) |

|

|

40.68 |

|

|

(59.2) |

|

||

|

Year Ended December 31, |

||||||||||||||||||

|

Occupancy |

|

ADR |

|

RevPAR |

||||||||||||||

|

2020 |

|

vs. 2019 |

|

2020 |

|

vs. 2019 |

|

2020 |

|

vs. 2019 |

||||||||

Management and franchise |

40.6 |

% |

|

(34.1) |

% pts. |

|

$ |

113.48 |

|

|

(19.4) |

% |

|

$ |

46.10 |

|

|

(56.2) |

% |

Ownership(1) |

25.2 |

|

|

(52.7) |

|

|

162.03 |

|

|

(17.9) |

|

|

40.76 |

|

|

(73.5) |

|

||

System-wide |

40.3 |

|

|

(34.4) |

|

|

114.03 |

|

|

(19.6) |

|

|

46.00 |

|

|

(56.7) |

|

||

| (1) | Includes leased hotels, as well as hotels owned or leased by entities in which Hilton owns a noncontrolling financial interest. |

HILTON WORLDWIDE HOLDINGS INC. PROPERTY SUMMARY As of December 31, 2020 |

|||||||||||||||||||||||

|

Owned / Leased(1) |

|

Managed |

|

Franchised |

|

Total |

||||||||||||||||

|

Properties |

|

Rooms |

|

Properties |

|

Rooms |

|

Properties |

|

Rooms |

|

Properties |

|

Rooms |

||||||||

Waldorf Astoria Hotels & Resorts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

U.S. |

— |

|

|

— |

|

|

12 |

|

|

4,866 |

|

|

2 |

|

|

1,047 |

|

|

14 |

|

|

5,913 |

|

Americas (excluding U.S.) |

— |

|

|

— |

|

|

2 |

|

|

261 |

|

|

— |

|

|

— |

|

|

2 |

|

|

261 |

|

Europe |

2 |

|

|

463 |

|

|

4 |

|

|

898 |

|

|

— |

|

|

— |

|

|

6 |

|

|

1,361 |

|

Middle East & Africa |

— |

|

|

— |

|

|

5 |

|

|

1,224 |

|

|

— |

|

|

— |

|

|

5 |

|

|

1,224 |

|

Asia Pacific |

— |

|

|

— |

|

|

6 |

|

|

1,259 |

|

|

— |

|

|

— |

|

|

6 |

|

|

1,259 |

|

LXR Hotels & Resorts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Americas (excluding U.S.) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1 |

|

|

76 |

|

|

1 |

|

|

76 |

|

Europe |

— |

|

|

— |

|

|

2 |

|

|

383 |

|

|

— |

|

|

— |

|

|

2 |

|

|

383 |

|

Middle East & Africa |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1 |

|

|

234 |

|

|

1 |

|

|

234 |

|

Conrad Hotels & Resorts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

U.S. |

— |

|

|

— |

|

|

6 |

|

|

2,211 |

|

|

1 |

|

|

223 |

|

|

7 |

|

|

2,434 |

|

Americas (excluding U.S.) |

— |

|

|

— |

|

|

1 |

|

|

324 |

|

|

— |

|

|

— |

|

|

1 |

|

|

324 |

|

Europe |

— |

|

|

— |

|

|

4 |

|

|

1,155 |

|

|

— |

|

|

— |

|

|

4 |

|

|

1,155 |

|

Middle East & Africa |

1 |

|

|

614 |

|

|

3 |

|

|

1,569 |

|

|

— |

|

|

— |

|

|

4 |

|

|

2,183 |

|

Asia Pacific |

1 |

|

|

164 |

|

|

21 |

|

|

6,138 |

|

|

1 |

|

|

659 |

|

|

23 |

|

|

6,961 |

|

Canopy by Hilton |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

U.S. |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

20 |

|

|

3,363 |

|

|

20 |

|

|

3,363 |

|

Americas (excluding U.S.) |

— |

|

|

— |

|

|

1 |

|

|

174 |

|

|

— |

|

|

— |

|

|

1 |

|

|

174 |

|

Europe |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2 |

|

|

263 |

|

|

2 |

|

|

263 |

|

Middle East & Africa |

— |

|

|

— |

|

|

1 |

|

|

200 |

|

|

— |

|

|

— |

|

|

1 |

|

|

200 |

|

Asia Pacific |

— |

|

|

— |

|

|

3 |

|

|

489 |

|

|

— |

|

|

— |

|

|

3 |

|

|

489 |

|

Hilton Hotels & Resorts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

U.S. |

— |

|

|

— |

|

|

62 |

|

|

46,081 |

|

|

177 |

|

|

54,300 |

|

|

239 |

|

|

100,381 |

|

Americas (excluding U.S.) |

1 |

|

|

405 |

|

|

25 |

|

|

9,323 |

|

|

23 |

|

|

7,371 |

|

|

49 |

|

|

17,099 |

|

Europe |

46 |

|

|

12,757 |

|

|

46 |

|

|

15,495 |

|

|

39 |

|

|

10,694 |

|

|

131 |

|

|

38,946 |

|

Middle East & Africa |

5 |

|

|

1,998 |

|

|

40 |

|

|

13,082 |

|

|

2 |

|

|

1,415 |

|

|

47 |

|

|

16,495 |

|

Asia Pacific |

5 |

|

|

2,999 |

|

|

103 |

|

|

36,691 |

|

|

6 |

|

|

2,177 |

|

|

114 |

|

|

41,867 |

|

Curio Collection by Hilton |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

U.S. |

— |

|

|

— |

|

|

6 |

|

|

2,485 |

|

|

47 |

|

|

9,329 |

|

|

53 |

|

|

11,814 |

|

Americas (excluding U.S.) |

— |

|

|

— |

|

|

2 |

|

|

99 |

|

|

10 |

|

|

1,177 |

|

|

12 |

|

|

1,276 |

|

Europe |

— |

|

|

— |

|

|

5 |

|

|

520 |

|

|

15 |

|

|

1,846 |

|

|

20 |

|

|

2,366 |

|

Middle East & Africa |

— |

|

|

— |

|

|

4 |

|

|

685 |

|

|

1 |

|

|

356 |

|

|

5 |

|

|

1,041 |

|

Asia Pacific |

— |

|

|

— |

|

|

4 |

|

|

773 |

|

|

2 |

|

|

248 |

|

|

6 |

|

|

1,021 |

|

DoubleTree by Hilton |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

U.S. |

— |

|

|

— |

|

|

32 |

|

|

10,877 |

|

|

339 |

|

|

77,814 |

|

|

371 |

|

|

88,691 |

|

Americas (excluding U.S.) |

— |

|

|

— |

|

|

3 |

|

|

587 |

|

|

36 |

|

|

7,047 |

|

|

39 |

|

|

7,634 |

|

Europe |

— |

|

|

— |

|

|

14 |

|

|

3,524 |

|

|

101 |

|

|

17,458 |

|

|

115 |

|

|

20,982 |

|

Middle East & Africa |

— |

|

|

— |

|

|

14 |

|

|

3,854 |

|

|

5 |

|

|

567 |

|

|

19 |

|

|

4,421 |

|

Asia Pacific |

— |

|

|

— |

|

|

68 |

|

|

18,303 |

|

|

4 |

|

|

1,333 |

|

|

72 |

|

|

19,636 |

|

Tapestry Collection by Hilton |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

U.S. |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

43 |

|

|

5,392 |

|

|

43 |

|

|

5,392 |

|

Americas (excluding U.S.) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2 |

|

|

190 |

|

|

2 |

|

|

190 |

|

Asia Pacific |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1 |

|

|

175 |

|

|

1 |

|

|

175 |

|

Embassy Suites by Hilton |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

U.S. |

— |

|

|

— |

|

|

41 |

|

|

10,923 |

|

|

209 |

|

|

46,869 |

|

|

250 |

|

|

57,792 |

|

Americas (excluding U.S.) |

— |

|

|

— |

|

|

3 |

|

|

667 |

|

|

5 |

|

|

1,336 |

|

|

8 |

|

|

2,003 |

|

Motto by Hilton |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

U.S. |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1 |

|

|

245 |

|

|

1 |

|

|

245 |

|

Hilton Garden Inn |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

U.S. |

— |

|

|

— |

|

|

4 |

|

|

425 |

|

|

706 |

|

|

97,462 |

|

|

710 |

|

|

97,887 |

|

Americas (excluding U.S.) |

— |

|

|

— |

|

|

12 |

|

|

1,723 |

|

|

46 |

|

|

7,042 |

|

|

58 |

|

|

8,765 |

|

Europe |

— |

|

|

— |

|

|

20 |

|

|

3,763 |

|

|

55 |

|

|

9,124 |

|

|

75 |

|

|

12,887 |

|

Middle East & Africa |

— |

|

|

— |

|

|

16 |

|

|

3,475 |

|

|

2 |

|

|

271 |

|

|

18 |

|

|

3,746 |

|

Asia Pacific |

— |

|

|

— |

|

|

38 |

|

|

8,289 |

|

|

— |

|

|

— |

|

|

38 |

|

|

8,289 |

|

Hampton by Hilton |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

U.S. |

— |

|

|

— |

|

|

27 |

|

|

3,396 |

|

|

2,255 |

|

|

222,231 |

|

|

2,282 |

|

|

225,627 |

|

Americas (excluding U.S.) |

— |

|

|

— |

|

|

14 |

|

|

1,786 |

|

|

105 |

|

|

12,694 |

|

|

119 |

|

|

14,480 |

|

Europe |

— |

|

|

— |

|

|

17 |

|

|

2,808 |

|

|

80 |

|

|

12,387 |

|

|

97 |

|

|

15,195 |

|

Middle East & Africa |

— |

|

|

— |

|

|

3 |

|

|

723 |

|

|

— |

|

|

— |

|

|

3 |

|

|

723 |

|

Asia Pacific |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

160 |

|

|

26,621 |

|

|

160 |

|

|

26,621 |

|

Tru by Hilton |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

U.S. |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

177 |

|

|

17,313 |

|

|

177 |

|

|

17,313 |

|

Americas (excluding U.S.) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1 |

|

|

90 |

|

|

1 |

|

|

90 |

|

Homewood Suites by Hilton |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

U.S. |

— |

|

|

— |

|

|

10 |

|

|

1,148 |

|

|

476 |

|

|

54,217 |

|

|

486 |

|

|

55,365 |

|

Americas (excluding U.S.) |

— |

|

|

— |

|

|

3 |

|

|

406 |

|

|

22 |

|

|

2,457 |

|

|

25 |

|

|

2,863 |

|

Home2 Suites by Hilton |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

U.S. |

— |

|

|

— |

|

|

3 |

|

|

313 |

|

|

453 |

|

|

47,691 |

|

|

456 |

|

|

48,004 |

|

Americas (excluding U.S.) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

7 |

|

|

753 |

|

|

7 |

|

|

753 |

|

Other |

— |

|

|

— |

|

|

5 |

|

|

2,530 |

|

|

5 |

|

|

1,395 |

|

|

10 |

|

|

3,925 |

|

Hotels |

61 |

|

|

19,400 |

|

|

715 |

|

|

225,905 |

|

|

5,646 |

|

|

764,952 |

|

|

6,422 |

|

|

1,010,257 |

|

Hilton Grand Vacations |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

56 |

|

|

9,030 |

|

|

56 |

|

|

9,030 |

|

Total |

61 |

|

|

19,400 |

|

|

715 |

|

|

225,905 |

|

|

5,702 |

|

|

773,982 |

|

|

6,478 |

|

|

1,019,287 |

|

| (1) | Includes hotels owned or leased by entities in which Hilton owns a noncontrolling financial interest. |

HILTON WORLDWIDE HOLDINGS INC. CAPITAL EXPENDITURES AND CONTRACT ACQUISITION COSTS (unaudited, dollars in millions) |

|||||||||||||

|

Three Months Ended |

|

|

||||||||||

|

December 31, |

|

Increase / (Decrease) |

||||||||||

|

2020 |

|

2019 |

|

$ |

|

% |

||||||

Capital expenditures for property and equipment(1) |

$ |

8 |

|

|

$ |

15 |

|

|

(7 |

) |

|

(46.7 |

) |

Capitalized software costs(2) |

8 |

|

|

45 |

|

|

(37 |

) |

|

(82.2 |

) |

||

Total capital expenditures |

16 |

|

|

60 |

|

|

(44 |

) |

|

(73.3 |

) |

||

Contract acquisition costs |

13 |

|

|

41 |

|

|

(28 |

) |

|

(68.3 |

) |

||

Total capital expenditures and contract acquisition costs |

$ |

29 |

|

|

$ |

101 |

|

|

(72 |

) |

|

(71.3 |

) |

|

Year Ended |

|

|

||||||||||

|

December 31, |

|

Increase / (Decrease) |

||||||||||

|

2020 |

|

2019 |

|

$ |

|

% |

||||||

Capital expenditures for property and equipment(1) |

$ |

46 |

|

|

$ |

81 |

|

|

(35 |

) |

|

(43.2 |

) |

Capitalized software costs(2) |

46 |

|

|

124 |

|

|

(78 |

) |

|

(62.9 |

) |

||

Total capital expenditures |

92 |

|

|

205 |

|

|

(113 |

) |

|

(55.1 |

) |

||

Contract acquisition costs |

50 |

|

|

90 |

|

|

(40 |

) |

|

(44.4 |

) |

||

Total capital expenditures and contract acquisition costs |

$ |

142 |

|

|

$ |

295 |

|

|

(153 |

) |

|

(51.9 |

) |

| (1) | Includes expenditures for hotels, corporate and other property and equipment, of which $1 million and $8 million were indirectly reimbursed by hotel owners for the three months ended December 31, 2020 and 2019, respectively, and $11 million and $17 million for the years ended December 31, 2020 and 2019, respectively. Excludes expenditures for furniture, fixtures and equipment ("FF&E") replacement reserves of $18 million and $17 million for the three months ended December 31, 2020 and 2019, respectively, and $57 million and $59 million for the years ended December 31, 2020 and 2019, respectively. |

| (2) | Includes $8 million and $36 million of expenditures that were indirectly reimbursed by hotel owners for the three months ended December 31, 2020 and 2019, respectively, and $39 million and $100 million for the years ended December 31, 2020 and 2019, respectively. |

HILTON WORLDWIDE HOLDINGS INC. RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES NET INCOME (LOSS) AND DILUTED EPS, ADJUSTED FOR SPECIAL ITEMS (unaudited, in millions, except per share data) |

||||||||||||||||

|

|

|

||||||||||||||

|

Three Months Ended |

|

Year Ended |

|||||||||||||

|

December 31, |

|

December 31, |

|||||||||||||

|

2020 |

|

2019 |

|

2020 |

|

|

2019 |

||||||||

Net income (loss) attributable to Hilton stockholders, as reported |

$ |

(224 |

) |

|

$ |

175 |

|

|

$ |

(715 |

) |

|

|

$ |

881 |

|

Diluted EPS, as reported |

$ |

(0.80 |

) |

|

$ |

0.61 |

|

|

$ |

(2.56 |

) |

|

|

$ |

3.04 |

|

Special items: |

|

|

|

|

|

|

|

|||||||||

Net other expenses from managed and franchised properties |

$ |

116 |

|

|

$ |

56 |

|

|

$ |

397 |

|

|

|

$ |

77 |

|

Purchase accounting amortization(1) |

21 |

|

|

50 |

|

|

164 |

|

|

|

202 |

|

||||

FF&E replacement reserves |

18 |

|

|

17 |

|

|

57 |

|

|

|

59 |

|

||||

Asset dispositions(2) |

— |

|

|

1 |

|

|

— |

|

|

|

(78 |

) |

||||

Reorganization costs |

3 |

|

|

— |

|

|

41 |

|

|

|

— |

|

||||

Impairment losses |

122 |

|

|

— |

|

|

258 |

|

|

|

— |

|

||||

Financing transactions(3) |

48 |

|

|

— |

|

|

48 |

|

|

|

11 |

|

||||

Other adjustments(4) |

(11 |

) |

|

17 |

|

|

28 |

|

|

|

29 |

|

||||

Total special items before tax |

317 |

|

|

141 |

|

|

993 |

|

|

|

300 |

|

||||

Income tax benefit (expense) on special items(5) |

(120 |

) |

|

(32 |

) |

|

(250 |

) |

|

|

(52 |

) |

||||

Total special items after tax |

$ |

197 |

|

|

$ |

109 |

|

|

$ |

743 |

|

|

|

$ |

248 |

|

|

|

|

|

|

|

|

|

|||||||||

Net income (loss), adjusted for special items |

$ |

(27 |

) |

|

$ |

284 |

|

|

$ |

28 |

|

|

|

$ |

1,129 |

|

Diluted EPS, adjusted for special items |

$ |

(0.10 |

) |

|

$ |

1.00 |

|

|

$ |

0.10 |

|

|

|

$ |

3.90 |

|

| (1) | Represents the amortization of intangible assets that were recorded at fair value in October 2007 when the Company became a wholly owned subsidiary of affiliates of The Blackstone Group Inc. During the years ended December 31, 2020 and 2019, certain of these assets became fully amortized. The majority of the remaining finite-lived intangible assets will be fully amortized during 2023. |

| (2) | Includes the gain on sale of the Hilton Odawara Resort & Spa, which was recognized in gain on sale of assets, net, and severance costs recognized in general and administrative expenses related to the 2015 sale of the Waldorf Astoria New York. |

| (3) | The three months and year ended December 31, 2020 includes the loss on debt extinguishments, consisting of redemption premiums paid for the repayments of the 4.250% Senior Notes due 2024 and the 5.625% Senior Notes due 2025 totaling $31 million and the accelerated recognition of $17 million of unamortized deferred financing costs. The year ended December 31, 2019 includes expenses recognized in connection with the June 2019 refinancings and repayments of the senior secured credit facilities that were included in other non-operating income (loss), net. |

| (4) | All periods include gains recognized in other non-operating income (loss), net related to reimbursements by a third party for taxes owed from the sale of a hotel in a prior period. The year ended December 31, 2020 also includes costs recognized for the settlement of a dispute with an owner of a managed hotel, which were recognized in other expenses, and losses related to the disposal of an investment and a loan guarantee for a franchised hotel, which were both recognized in other non-operating income (loss), net. The three months and year ended December 31, 2019 include estimated settlement costs related to the contract termination of a previously operated hotel recognized in general and administrative expenses, and, in addition, the year ended December 31, 2019 includes a loss on the disposal of a real estate investment recognized in other non-operating income (loss), net. |

| (5) | Includes the estimated tax impact of total special items before tax and adjustments to specific uncertain tax position reserves. |

|

HILTON WORLDWIDE HOLDINGS INC. RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES ADJUSTED EBITDA AND ADJUSTED EBITDA MARGIN (unaudited, dollars in millions) |

|||||||||||||||

|

Three Months Ended |

|

Year Ended |

||||||||||||

|

December 31, |

|

December 31, |

||||||||||||

|

2020 |

|

2019 |

|

2020 |

|

2019 |

||||||||

Net income (loss) |

$ |

(225 |

) |

|

$ |

176 |

|

|

$ |

(720 |

) |

|

$ |

886 |

|

Interest expense |

113 |

|

|

110 |

|

|

429 |

|

|

414 |

|

||||

Income tax expense (benefit) |

(124 |

) |

|

67 |

|

|

(204 |

) |

|

358 |

|

||||

Depreciation and amortization |

62 |

|

|

90 |

|

|

331 |

|

|

346 |

|

||||

EBITDA |

(174 |

) |

|

443 |

|

|

(164 |

) |

|

2,004 |

|

||||

Gain on sale of assets, net |

— |

|

|

— |

|

|

— |

|

|

(81 |

) |

||||

Loss on foreign currency transactions |

11 |

|

|

6 |

|

|

27 |

|

|

2 |

|

||||

Loss on debt extinguishments |

48 |

|

|

— |

|

|

48 |

|

|

— |

|

||||

FF&E replacement reserves |

18 |

|

|

17 |

|

|

57 |

|

|

59 |

|

||||

Share-based compensation expense |

60 |

|

|

31 |

|

|

97 |

|

|

154 |

|

||||

Reorganization costs |

3 |

|

|

— |

|

|

41 |

|

|

— |

|

||||

Impairment losses |

122 |

|

|

— |

|

|

258 |

|

|

— |

|

||||

Amortization of contract acquisition costs |

7 |

|

|

8 |

|

|

29 |

|

|

29 |

|

||||

Net other expenses from managed and franchised properties |

116 |

|

|

56 |

|

|

397 |

|

|

77 |

|

||||

Other adjustment items(1) |

(7 |

) |

|

25 |

|

|

52 |

|

|

64 |

|

||||

Adjusted EBITDA |

$ |

204 |

|

|

$ |

586 |

|

|

$ |

842 |

|

|

$ |

2,308 |

|

| (1) | All periods include severance not related to the 2020 reorganization and other items. The three months and year ended December 31, 2020 include a gain related to the reimbursement by a third party for taxes owed resulting from the sale of a hotel in a prior period, and the year ended December 31, 2020 further includes costs recognized for the settlement of a dispute with an owner of a managed hotel and losses related to the disposal of an investment and a loan guarantee for a franchised hotel. The year ended December 31, 2019 includes expenses recognized in connection with the refinancings and repayments of the senior secured credit facilities. |

|

Three Months Ended |

|

Year Ended |

||||||||||||

|

December 31, |

|

December 31, |

||||||||||||

|

2020 |

|

2019 |

|

2020 |

|

2019 |

||||||||

Total revenues, as reported |

$ |

890 |

|

|

$ |

2,369 |

|

|

$ |

4,307 |

|

|

$ |

9,452 |

|

Add: amortization of contract acquisition costs |

7 |

|

|

8 |

|

|

29 |

|

|

29 |

|

||||

Less: other revenues from managed and franchised properties |

(506 |

) |

|

(1,423 |

) |

|

(2,707 |

) |

|

(5,686 |

) |

||||

Total revenues, as adjusted |

$ |

391 |

|

|

$ |

954 |

|

|

$ |

1,629 |

|

|

$ |

3,795 |

|

|

|

|

|

|

|

|

|

||||||||

Adjusted EBITDA |

$ |

204 |

|

|

$ |

586 |

|

|

$ |

842 |

|

|

$ |

2,308 |

|

|

|

|

|

|

|

|

|

||||||||

Adjusted EBITDA margin |

52.2 |

% |

|

61.4 |

% |

|

51.7 |

% |

|

60.8 |

% |

||||

HILTON WORLDWIDE HOLDINGS INC. RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES NET DEBT AND NET DEBT TO ADJUSTED EBITDA RATIO (unaudited, dollars in millions) |

|||||||

|

December 31, |

||||||

|

2020 |

|

2019 |

||||

Long-term debt, including current maturities |

$ |

10,487 |

|

|

$ |

7,993 |

|

Add: unamortized deferred financing costs and discount |

93 |

|

|

83 |

|

||

Long-term debt, including current maturities and excluding unamortized deferred financing costs and discount |

10,580 |

|

|

8,076 |

|

||

Add: Hilton's share of unconsolidated affiliate debt |

8 |

|

|

2 |

|

||

Less: cash and cash equivalents |

(3,218 |

) |

|

(538 |

) |

||

Less: restricted cash and cash equivalents |

(45 |

) |

|

(92 |

) |

||

Net debt |

$ |

7,325 |

|

|

$ |

7,448 |

|

|

|

|

|

||||

Adjusted EBITDA |

$ |

842 |

|

|

$ |

2,308 |

|

|

|

|

|

||||

Net debt to Adjusted EBITDA ratio |

8.7 |

|

3.2 |

||||

HILTON WORLDWIDE HOLDINGS INC.

DEFINITIONS

Net Income (Loss), Adjusted for Special Items, and Diluted EPS, Adjusted for Special Items

Net income (loss), adjusted for special items, and diluted earnings (loss) per share ("EPS"), adjusted for special items, are not recognized terms under GAAP and should not be considered as alternatives to net income (loss) or other measures of financial performance or liquidity derived in accordance with GAAP. In addition, the Company's definition of net income (loss), adjusted for special items, and diluted EPS, adjusted for special items, may not be comparable to similarly titled measures of other companies.

Net income (loss), adjusted for special items, and diluted EPS, adjusted for special items, are included to assist investors in performing meaningful comparisons of past, present and future operating results and as a means of highlighting the results of the Company's ongoing operations.

EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin

Earnings (loss) before interest expense, taxes and depreciation and amortization ("EBITDA"), presented herein, reflects net income (loss), excluding interest expense, a provision for income tax benefit (expense) and depreciation and amortization.

Adjusted EBITDA, presented herein, is calculated as EBITDA, as previously defined, further adjusted to exclude certain items, including gains, losses, revenues and expenses in connection with: (i) asset dispositions for both consolidated and unconsolidated equity investments; (ii) foreign currency transactions; (iii) debt restructurings and retirements; (iv) FF&E replacement reserves required under certain lease agreements; (v) share-based compensation; (vi) reorganization, severance, relocation and other related expenses; (vii) non-cash impairment; (viii) amortization of contract acquisition costs; (ix) the net effect of reimbursable costs included in other revenues and other expenses from managed and franchised properties; and (x) other items.

Adjusted EBITDA margin represents Adjusted EBITDA as a percentage of total revenues, adjusted to exclude the amortization of contract acquisition costs and other revenues from managed and franchised properties.

The Company believes that EBITDA, Adjusted EBITDA and Adjusted EBITDA margin provide useful information to investors about the Company and its financial condition and results of operations for the following reasons: (i) these measures are among the measures used by the Company's management team to evaluate its operating performance and make day-to-day operating decisions and (ii) these measures are frequently used by securities analysts, investors and other interested parties as a common performance measure to compare results or estimate valuations across companies in the industry. Additionally, these measures exclude certain items that can vary widely across different industries and among competitors within the Company's industry. For instance, interest expense and income taxes are dependent on company specifics, including, among other things, capital structure and operating jurisdictions, respectively, and, therefore, could vary significantly across companies. Depreciation and amortization, as well as amortization of contract acquisition costs, are dependent upon company policies, including the method of acquiring and depreciating assets and the useful lives that are used. For Adjusted EBITDA, the Company also excludes items such as: (i) FF&E replacement reserves for leased hotels to be consistent with the treatment of FF&E for owned hotels, where it is capitalized and depreciated over the life of the FF&E; (ii) share-based compensation, as this could vary widely among companies due to the different plans in place and the usage of them; (iii) the net effect of the Company's cost reimbursement revenues and reimbursed expenses, as the Company contractually does not operate the related programs to generate a profit over the terms of the respective contracts; and (iv) other items, such as amounts related to debt restructurings and retirements and reorganization and related severance costs, that are not core to the Company's operations and are not reflective of the Company's operating performance.

EBITDA, Adjusted EBITDA and Adjusted EBITDA margin are not recognized terms under GAAP and should not be considered as alternatives to net income (loss) or other measures of financial performance or liquidity derived in accordance with GAAP. The Company's definitions of EBITDA, Adjusted EBITDA and Adjusted EBITDA margin may not be comparable to similarly titled measures of other companies and may have limitations as analytical tools.

Net Debt

Net debt, presented herein, is a non-GAAP financial measure that the Company uses to evaluate its financial leverage. Net debt is calculated as: (i) long-term debt, including current maturities and excluding unamortized deferred financing costs and discount and (ii) the Company's share of unconsolidated affiliate debt; reduced by: (a) cash and cash equivalents and (b) restricted cash and cash equivalents. Net debt should not be considered as a substitute to debt presented in accordance with GAAP. Net debt may not be comparable to a similarly titled measure of other companies.

The Company believes net debt provides useful information about its indebtedness to investors as it is frequently used by securities analysts, investors and other interested parties to compare the indebtedness of companies.

Net Debt to Adjusted EBITDA Ratio

Net debt to Adjusted EBITDA ratio, presented herein, is a non-GAAP financial measure and is included as it is frequently used by securities analysts, investors and other interested parties to compare the financial condition of companies. Net debt to Adjusted EBITDA ratio should not be considered as an alternative to measures of financial condition derived in accordance with GAAP, and it may not be comparable to a similarly titled measure of other companies.

Comparable Hotels

The Company defines comparable hotels as those that: (i) were active and operating in the Company's system for at least one full calendar year as of the end of the current period, and open January 1st of the previous year; (ii) have not undergone a change in brand or ownership type during the current or comparable periods reported; and (iii) have not sustained substantial property damage, business interruption, undergone large-scale capital projects or for which comparable results were not available. Of the 6,422 hotels in the Company's system as of December 31, 2020, 4,956 hotels were classified as comparable hotels. The 1,466 non-comparable hotels included 123 hotels, or approximately two percent of the total hotels in the system, that were removed from the comparable group during the last twelve months because they sustained substantial property damage, business interruption, underwent large-scale capital projects or comparable results were otherwise not available.

When considering business interruption in the context of the Company's definition of comparable hotels, any hotel that had completely or partially suspended operations on a temporary basis at any point during the year ended December 31, 2020 as a result of the COVID-19 pandemic was considered to be part of the definition of comparable hotels. Despite these temporary suspensions of hotel operations, the Company believes that including these hotels within the hotel operating statistics of occupancy, average daily rate ("ADR") and revenue per available room ("RevPAR"), reflects the underlying results of the business for the year ended December 31, 2020.

Occupancy

Occupancy represents the total number of room nights sold divided by the total number of room nights available at a hotel or group of hotels for a given period. Occupancy measures the utilization of the hotels' available capacity. Management uses occupancy to gauge demand at a specific hotel or group of hotels in a given period. Occupancy levels also help management determine achievable ADR pricing levels as demand for hotel rooms increases or decreases.

ADR

ADR represents hotel room revenue divided by the total number of room nights sold for a given period. ADR measures average room price attained by a hotel, and ADR trends provide useful information concerning the pricing environment and the nature of the customer base of a hotel or group of hotels. ADR is a commonly used performance measure in the industry, and management uses ADR to assess pricing levels that the Company is able to generate by type of customer, as changes in rates charged to customers have different effects on overall revenues and incremental profitability than changes in occupancy, as described above.

RevPAR

RevPAR is calculated by dividing hotel room revenue by the total number of room nights available to guests for a given period. Management considers RevPAR to be a meaningful indicator of the Company's performance as it provides a metric correlated to two primary and key drivers of operations at a hotel or group of hotels, as previously described: occupancy and ADR. RevPAR is also a useful indicator in measuring performance over comparable periods for comparable hotels.

References to RevPAR, ADR and occupancy throughout this press release are presented on a comparable basis, and references to RevPAR and ADR are presented on a currency neutral basis, unless otherwise noted. As such, comparisons of these hotel operating statistics for the years ended December 31, 2020 and 2019 use the exchange rates for the year ended December 31, 2020.

Contacts

Investor Contact

Jill Slattery

+1 703 883 6043

Media Contact

Nigel Glennie

+1 703 883 5262