2021 Market Outlook: Institutional Investors Put Portfolios on Defense in Anticipation of Rising Risks, According to Natixis Survey

2021 Market Outlook: Institutional Investors Put Portfolios on Defense in Anticipation of Rising Risks, According to Natixis Survey

- Eight in ten institutional investors say markets have underestimated the long-term impact of the global pandemic; just 21% expect full economic recovery before 2022

- Institutions take defensive portfolio posture heading into 2021 with allocations that favor broad equity diversification and value over growth

- Volatility, political tension, social unrest expected to rise; negative rates, higher taxes and other fallout from fiscal and monetary response to Covid-19 crisis viewed as bigger, long-term risks

BOSTON--(BUSINESS WIRE)--Institutional investors’ pragmatic outlook for the markets and economy in 2021 tempers optimism for growth with anxiety over the lasting impact of the coronavirus pandemic, finds a global survey of institutional investors released today by Natixis Investment Managers. Institutions see alpha opportunities amid rising volatility and a market slowly grinding forward. Yet, they are positioning their portfolios to win on defense, as 78% think the stock market’s current pace of growth is unsustainable, and they expect performance in the year ahead to be hard-won and fragile.

Natixis surveyed 500 institutional investors who collectively manage more than $13.5 trillion in assets for pensions, insurers, sovereign wealth funds, foundations and endowments around the world. After a tumultuous year with economies around the world shut down by Covid-19, markets proved remarkably resilient. Most institutional investors (64%) intend to keep as is or even to raise their return assumptions. The survey found institutional investors’ long-term return assumption is 6.3% on average, a decrease of 60 basis points from 2019. Insurers cut their return assumption even more dramatically, from 6.5% to 5.5% on average.

Broad asset class allocations will remain relatively unchanged in institutional portfolios, with 36% in stocks, 40% in bonds, 17% alternatives and 6% in cash. Yet institutional investors are taking advantage of what they expect will be increased dispersion in the markets, making many tactical adjustments within asset classes. Notable allocation moves in 2021 include plans to:

- Trim US equities and increase exposure to European, emerging market and Asia Pacific stocks.

- Decrease exposure to government bonds and add investment grade corporate debt and securitized loans

- Broaden alternative strategies to include greater use of private equity and infrastructure investments

“With the pandemic, politics and global economies at an inflection point, institutional investors are positioning their portfolios to navigate short-term volatility while anticipating the long-term impacts of this year’s massive economic and market interventions,” said David Giunta, CEO for the US at Natixis Investment Managers. “Investors’ outlook reflects deep concerns about the lasting consequences of the extreme measures needed to cushion the financial blow of the pandemic. However, they also see opportunities to find value through active management, thoughtful portfolio allocation and diversification.”

Defensive Positioning for Portfolios

In the year ahead, a larger share of institutional investors expect value to outperform growth (58%) and large-cap to outperform small-cap (53%). Slightly more than half (52%) think emerging markets will outperform developed markets, though the vast majority (86%) of institutional investors agree on the need to be more selective in pursuing emerging market opportunities.

Despite pushback on the size and influence of Big Tech, 72% of institutional investors expect the growth of technology companies to continue unabated. They see information technology and healthcare as the big winners in next year’s market, while energy, real estate, consumer discretionary and financials underperform.

Many institutions believe a correction is due for the stock market (44%), real estate sector (41%), tech sector (39%) and bond market (29%). To manage risks, eight in ten say that equity factor diversification is an important consideration. While 71% of institutional investors say they are willing to underperform their peers to ensure downside protection, 53% believe that defensive strategies will outperform a more aggressive approach in 2021.

Top Issues Shaping Institutional Outlook in 2021

The Natixis report titled, “Into the great wide open: Seven insights on how institutions will take on the risks and opportunities of an uncertain 2021,” identifies key issues on the minds of institutional investors that are shaping their outlook for the year ahead. Foremost among them are the following:

Covid will loom large over the economy and markets for years to come

Nearly 80% of institutional investors believe the global economy cannot escape the consequences of the global pandemic. Despite a market rally on news of promising vaccines, few institutional investors anticipate a return to pre-Covid normalcy any time soon. In fact, 73% believe the Covid-induced “new normal” is here to stay. Most (44%) don’t expect GDP growth to return to its pre-Covid pace until at least 2022, while 35% aren’t expecting full economic recovery until 2023 or later.

Long-term risks outweigh today’s political uncertainty

Global political uncertainty has rattled the markets in the four years since UK’s Brexit and Donald Trump’s presidency. Eight in ten institutions agree that the current political climate suggests more populist political contenders will emerge, and 77% think social unrest will continue to rise. At the same time, seven in ten (69%) institutions expect geopolitical tensions to escalate, and democracy to grow weaker globally (74%).

Ultimately, 78% of institutional investors believe that the outcome of political elections has less impact on the markets than central bank policies do. While 78% trust that central banks will backstop the markets in the event of another serious downturn, they believe that actions taken to quell the initial shock of coronavirus will have long repercussions. Many believe that policy decisions, including rate cuts and fiscal stimulus provided by governments, increased the risk of a financial crisis (53%) and decreased government’s capacity to respond to future crises (52%). Two-thirds (65%) also believe that taxes will inevitably rise, and 44% suspect cuts to social safety net programs, including pension benefits, will be necessary.

Riskier world means greater market risks

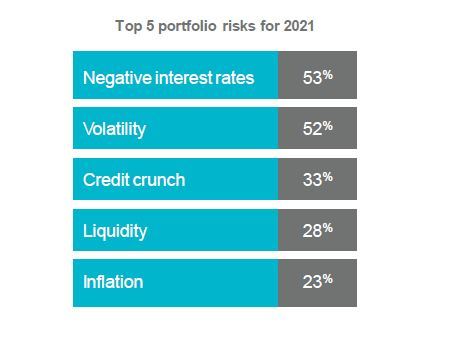

When asked about their top portfolio risk concerns in 2021, negative interest rates topped the list. Eight in ten institutional investors (82%) say low rates have distorted market valuations. More than half (53%) expect to see the volume of negative yielding securities rise next year. In their pursuit of yield, 71% believe institutional investors are taking on too much risk. Half (52%) of institutional investors cite volatility as a top portfolio risk, particularly since 65% expect stock market volatility to increase next year, and 55% expect to see greater volatility in currencies.

Opportunity amid volatility

The silver lining in increased volatility is that with it, 52% of institutional investors also expect to see greater dispersion, or variation in performance between different investments, next year, which could provide opportunities to outperform their benchmarks. Seventy-nine percent agree that the market environment in 2021 will be favorable to active portfolio management, and 67% think active investing will outperform.

Passive can’t be ignored

Eighty-two percent of institutional investors say current valuations don’t reflect company fundamentals. While there are a number of contributing factors, including low rates, and institutions believing retail investors are carelessly speculating on high risk investments, 58% of institutional investors believe the widespread use of passive investments has simply caused the market to ignore fundamentals. Seventy-one percent of institutions worry that large flows into and out of index funds exacerbate market volatility, and to the extent that’s driven by retail investors, 63% of institutional investors don’t believe retail investors add valuable price signals to the market.

Private equity and private debt provide powerful portfolio alternatives

Institutional investors continue to look to private markets for attractive long-term growth and to help meet their long-term return assumptions. Roughly 80% are currently using private equity, largely by investing in private equity funds (65%). Nearly as many (74%) hold private debt through a range of strategies from direct lending (45%) and infrastructure (40%) to funds of funds (31%) and aircraft lending (9%).

Overall, two-thirds (69%) of institutional investors say private assets will play a more prominent role in their portfolio strategy going forward. Forty-four percent cite liquidity risk as a top concern, and 61% worry that too much money is now chasing too few private deals. Eight in ten feel the current fee terms are generally too high, and 25% worry fees will increase. Roughly four in ten (42%) institutional investors are considering direct investment in private deals to keep fees down.

“The Covid economy, politics and policy, and an increased focus on valuations are all colliding to shape institutional portfolio strategy in the year ahead,” said Dave Goodsell, Executive Director of Natixis’ Center for Investor Insight. “But even when faced with what they see as a risky landscape, institutional investors believe investment opportunities can be found – those who know where to look will likely be the ones to outperform.”

The full report is available for download at im.natixis.com/us/research/institutional-investor-survey-2021-outlook.

Methodology

Natixis Investment Managers surveyed 500 institutional investors, including managers of corporate and public pension funds, foundations, endowments, insurance funds and sovereign wealth funds in North America, Latin America, the United Kingdom, Continental Europe, Asia and the Middle East. Data were gathered in October and November 2020 by the research firm CoreData.

About the Natixis Investment Institute

The Natixis Investment Institute applies Active Thinking® to critical issues shaping the investment landscape. A global effort, the Institute combines expertise in the areas of investor sentiment, macroeconomics, and portfolio construction within Natixis Investment Managers, along with the unique perspectives of our affiliated investment managers and experts outside the greater Natixis organization. Our goal is to fuel a more substantive discussion of issues with a 360° view of markets and insightful analysis of investment trends.

About Natixis Investment Managers

Natixis Investment Managers serves financial professionals with more insightful ways to construct portfolios. Powered by the expertise of more than 20 specialized investment managers globally, we apply Active Thinking® to deliver proactive solutions that help clients pursue better outcomes in all markets. Natixis Investment Managers ranks among the world’s largest asset management firms1 with nearly $1.1 trillion assets under management2 (€910.0 billion).

Headquartered in Paris and Boston, Natixis Investment Managers is a subsidiary of Natixis. Listed on the Paris Stock Exchange, Natixis is a subsidiary of BPCE, the second-largest banking group in France. Natixis Investment Managers’ affiliated investment management firms include AEW; Alliance Entreprendre; AlphaSimplex Group; DNCA Investments;3 Dorval Asset Management; Flexstone Partners; Gateway Investment Advisers; H2O Asset Management; Harris Associates; Investors Mutual Limited; Loomis, Sayles & Company; Mirova; MV Credit; Naxicap Partners; Ossiam; Ostrum Asset Management; Seeyond; Seventure Partners; Thematics Asset Management; Vauban Infrastructure Partners; Vaughan Nelson Investment Management; Vega Investment Managers;4 and WCM Investment Management. Additionally, investment solutions are offered through Natixis Investment Managers Solutions, and Natixis Advisors offers other investment services through its AIA and MPA division. Not all offerings available in all jurisdictions. For additional information, please visit Natixis Investment Managers’ website at im.natixis.com | LinkedIn: linkedin.com/company/natixis-investment-managers.

Natixis Investment Managers’ distribution and service groups include Natixis Distribution, L.P., a limited purpose broker-dealer and the distributor of various US registered investment companies for which advisory services are provided by affiliated firms of Natixis Investment Managers, Natixis Investment Managers S.A. (Luxembourg), Natixis Investment Managers International (France), and their affiliated distribution and service entities in Europe and Asia.

1 Cerulli Quantitative Update: Global Markets 2020 ranked Natixis Investment Managers as the 17th largest asset manager in the world based on assets under management as of December 31, 2019.

2 Assets under management (“AUM”) as of September 30, 2020 is $1,067.3 billion. AUM, as reported, may include notional assets, assets serviced, gross assets, assets of minority owned affiliated entities and other types of non-regulatory AUM managed or serviced by firms affiliated with Natixis Investment Managers.

3 A brand of DNCA Finance.

4 A wholly-owned subsidiary of Natixis Wealth Management.

3354119.1.1

Contacts

Maggie McCuen

(617) 849-2769

Maggie.McCuen@Natixis.com