CRS Data Attracts Six New Customers in Four Months

CRS Data Attracts Six New Customers in Four Months

MLSs help agents sell with MLS Tax Suite’s robust property data, innovative maps

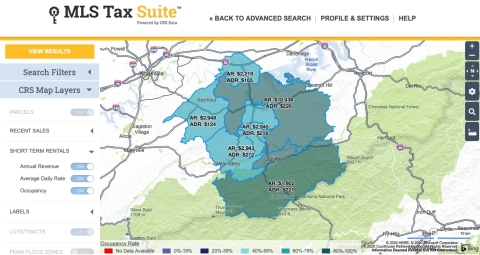

The MLS Tax Suite by CRS Data prioritizes innovation and consistent enhancements to attract and retain customers. One of the team's newest updates is the Short Term Rental Opportunity feature, which allows real estate professionals to review rental income potential for each property of interest. Watch the new Short Term Rental Opportunity video tutorial here to see how the CRS Data team services their customers: https://vimeo.com/471106488. (Graphic: Business Wire)

KNOXVILLE, Tenn.--(BUSINESS WIRE)--CRS Data, a leading provider of property tax data in the U.S., has expanded its national reach with six new MLS and association customers over the past four months, including several alliances and regionals representing multiple groups.

CRS Data will now offer its flagship MLS Tax Suite to: the Southern Oregon MLS; Klamath County MLS; the Southeast Alabama Association of REALTORS®; the Kentucky MLS Alliance (KMA), which includes South Central Kentucky Association of REALTORS®, Heart of Kentucky Association of REALTORS® and REALTOR Association of Southern Kentucky®; North Carolina Regional MLS, which is made up of Jacksonville Board of REALTORS®, Coastal Plains Association of REALTORS®, Cape Fear REALTORS®, Carteret County Association of REALTORS®, Topsail Island Association of REALTORS®, Wilson Board of REALTORS®, Neuse River Region Association of REALTORS®, Rocky Mount Area of Associations of REALTORS®, and Brunswick County Association of REALTORS®; and Strategic MLS Alliance, which is made up of Shoals Area Association of REALTORS® and Cullman Association of REALTORS®.

CRS Data prioritizes personable customer support, ease of use and a multifaceted, user-driven approach to product development. Across all regions of the U.S., the company now services its MLS Tax Suite product to 1,375 counties in 36 states. CRS Data’s new customers are located across various regions of the U.S. and represent a variety of sizes. The boards and MLS teams chose the MLS Tax Suite due to the company’s willingness to customize the platform, offer continuous customer support and provide open communication about data, map capabilities and consistent upkeep.

“When we began our property tax data vendor search, our team of managers chose to focus on the intricate needs of our members to help us identify a partner that was best suited to serve our unique priorities,” said Daniel Jones, CEO at North Carolina Regional MLS. “CRS Data’s MLS Tax Suite team addressed our priorities head on with determination and flexibility. Foundationally, their team provides speedy data updates and corrections with excellent customer support, and ensures that the property data experience is rewarding and backed by advances in technology and fluid data statistics.”

CRS Data’s MLS Tax Suite is regularly updated with intuitive enhancements. The team is committed to creating the leading property tax data platform, with map layers and prospecting capabilities that enrich the lives of real estate agents across the U.S.

“We looked at CRS Data several years ago, but had to wait for our existing contract to expire,” said Tina Grimes, CEO of Rogue Valley Association of REALTORS® and Southern Oregon Multiple Listing Service. “We recently moved to a shared database with two other MLSs, and CRS Data was amazing in their willingness to customize the setup for all three of our groups on one database. Their responsiveness, ability to customize for us, and their exemplary customer service made this an easy decision.”

The MLS Tax Suite is customizable, with a team that is adamantly against upselling and dedicated to creating unmatched search capabilities.

“We work to enhance our MLS Tax Suite in a way that makes it simple and easy to adopt new tools,” said Kari Autry, product and marketing director for the CRS Data MLS Tax Suite. “It’s so important to our team that our users know that they are on the forefront of property data innovation with the MLS Tax Suite.”

The team’s most recent enhancement helps users gauge the potential value of short term rental opportunities. The Short Term Rental Opportunity feature shows property rental estimates related to annual revenue, average daily rate and occupancy rate. The team also recently expanded the platform’s prospecting tools and functionality to increase map search capabilities and ensure simplified access to on-market and off-market listings. The prospecting feature includes off-market listings and helps users broaden their goals and outlook.

Throughout the MLS Tax Suite, all features are accompanied by written tutorials and video tutorials. This integrated support helps users get the most out of their property data and map tools. The team’s help desk is also available by phone or email. While in-person meetings are currently limited, CRS Data hosts live webinar trainings to support customers and ensure they are getting the most out of the product.

The CRS Data team is reaching new MLSs and associations across the U.S. to offer their flexible, robust MLS Tax Suite. Agents and executives can learn more by visiting https://www.crsdata.com/mls-tax-suite/.

About CRS Data: Headquartered in Knoxville, Tenn., CRS Data is a leading provider of public record information servicing bankers, MLSs, appraisers, investors, and other specialty financial customers across the U.S. CRS Data is focused on providing accurate and timely property data, quality products and unparalleled customer satisfaction. Visit www.crsdata.com to learn more.

Contacts

Christina Honkonen

615.260.4595

communications@crsdata.com