Tortoise Announces Modification to Non-Fundamental Investment Policy for TYG to Position for the Future of Energy

Tortoise Announces Modification to Non-Fundamental Investment Policy for TYG to Position for the Future of Energy

LEAWOOD, KS--(BUSINESS WIRE)--Tortoise today announces that in order to provide Tortoise Energy Infrastructure Corp. (TYG) the ability to increase exposure to renewables and power infrastructure companies, the Board approved a non-fundamental investment policy change eliminating the requirement to invest a specific percentage of total assets in MLPs and midstream equities. This change will be effective 60-days after providing written notice to stockholders.

Positioning for the Future of Energy

“The world is facing competing challenges of meeting growing energy demand while simultaneously reducing global CO2 emissions,” said Matt Sallee, President - Tortoise. “This is leading to a massive disruption around how energy is delivered and consumed. We are convinced the best way to meet the conflicting needs is not an either-or solution. Low- or zero-carbon renewables and natural gas are needed, to work in concert, to replace heavy carbon energy sources. This creates a secular tailwind benefiting renewables and natural gas as they displace coal. As the energy sector and the companies that comprise it evolve, we think it’s in the best interest of our stockholders for the funds to be in a position to benefit from the energy evolution.”

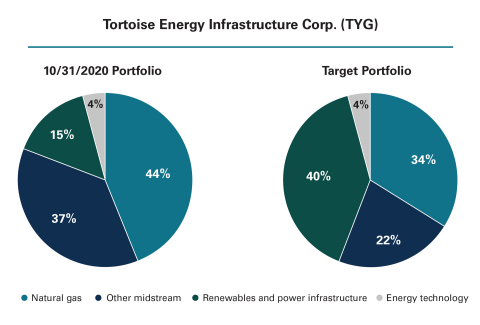

- As of October 31, 2020, approximately 15% of TYG was allocated to renewable and power infrastructure along with energy technology companies. Tortoise Midstream Energy Fund, Inc. (NTG) has a similar allocation.

- Furthermore, the midstream companies in each portfolio are actively participating in the energy evolution including exporting low carbon gas and propane to allow developing markets to reduce their dependence on coal, transporting renewable natural gas and renewable diesel, and integrating renewable power into operations.

Below is the current and target TYG portfolio, highlighting the planned strategic shift in the fund’s allocations.

|

Tortoise Energy Infrastructure Corp. (TYG) |

|||||

|

10/31/2020 Portfolio |

|

Target Portfolio |

|||

Natural Gas |

44 |

% |

|

34 |

% |

|

Other Midstream |

37 |

% |

|

22 |

% |

|

Renewables and Power Infrastructure |

15 |

% |

|

40 |

% |

|

Energy Technology |

4 |

% |

|

4 |

% |

|

Total |

100 |

% |

|

100 |

% |

|

The Board also approved changes to the non-fundamental investment policies for each of TYG and NTG to change the measurements from a percentage of “Total Assets” to a percentage of “Total Investments.” “Total Investments” is defined as the value of all investments that would be reported as total investments in the schedule of investments of the fund. These non-fundamental investment policy changes will also be effective 60-days after providing written notice to stockholders.

Tortoise Capital Advisors, L.L.C. is the adviser to Tortoise Energy Infrastructure Corp. and Tortoise Midstream Energy Fund, Inc.

For additional information on these funds, please visit cef.tortoiseecofin.com.

About Tortoise

Tortoise focuses on energy and power infrastructure and the transition to cleaner energy. Tortoise’s solid track record of energy value chain investment experience and research dates back more than 20 years. As one of the earliest investors in midstream energy, Tortoise believes it is well-positioned to be at the forefront of the global energy evolution that is underway. With a steady wins approach and a long-term perspective, Tortoise strives to make a positive impact on clients and communities. To learn more, visit www.TortoiseEcofin.com.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains certain statements that may include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included herein are "forward-looking statements." Although the funds and Tortoise Capital Advisors believe that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in the fund’s reports that are filed with the Securities and Exchange Commission. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Other than as required by law, the funds and Tortoise Capital Advisors do not assume a duty to update this forward-looking statement.

Safe Harbor Statement

This press release shall not constitute an offer to sell or a solicitation to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer or solicitation or sale would be unlawful prior to registration or qualification under the laws of such state or jurisdiction.

Contacts

For more information contact Maggie Zastrow at (913) 981-1020 or info@tortoiseadvisors.com.