Chase Launches Business Complete Banking with All the Essentials Built In

Chase Launches Business Complete Banking with All the Essentials Built In

First-to-market account means business owners can start taking payments in minutes with same day deposits and relationship benefits

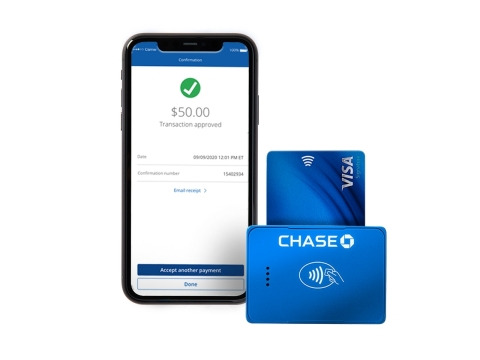

NEW YORK--(BUSINESS WIRE)--Chase for Business, the nation’s leading small business bank and part of JPMorgan Chase & Co. (NYSE: JPM), today launched Business Complete Banking, a new business checking account that includes QuickAccept, a built-in feature that enables a business owner to take card payments in minutes and have the funds available the same day.

“Checking accounts are the transaction hub of a business, so we brought the essential elements of paying in and paying out together in one place,” said Jen Roberts, CEO of Chase Business Banking. “Too often, business owners have to cobble together what they need to start and grow, and that’s why we created Chase Business Complete Banking as an integrated system where everything is built in and easily available on demand.”

Chase Business Complete Banking provides relationship benefits with multiple ways to waive fees, including purchases made with Chase Ink business credit cards and payment processing volumes.

QuickAccept’s simple pricing uses a flat, pay-as-you-go rate. A business customer can activate it right away for use every day in their Chase Mobile app or contactless mobile card reader, giving them flexibility to make sales anywhere in the United States. For a demonstration of how QuickAccept works, click here.

“Especially in the challenging times we’ve seen in 2020, helping small business clients make every sale has been our priority,” said Max Neukirchen, CEO of Merchant Services for JPMorgan Chase, the largest payment processor in North America. “We applaud small business owners’ creativity and support their ability to generate revenue in person, online and over the phone.”

Chase small business credit and debit sales in North America were up 6% in February 2020 compared to 2019, but fell almost 50% for the month of April when many businesses had to temporarily close or pivot to online-only operations.

To find out more about Chase Business Complete Banking with QuickAccept and open an account, visit www.chase.com/business or visit one of more than 4,700 Chase branches.

Contacts

Media Contacts:

Elizabeth Seymour:

Elizabeth.c.seymour@jpmorgan.com

Jessica Francisco:

Jessica.francisco@jpmchase.com