Discover Launches Personalized Tool for Students and Their Families Making Important College Decisions

Discover Launches Personalized Tool for Students and Their Families Making Important College Decisions

My College Plan, a one stop tool helps students compare college costs, determine a major that matches their interests and understand the earnings potential of their future career

RIVERWOODS, Ill.--(BUSINESS WIRE)--Planning for college is an exciting moment in any student’s life and brings with it many important decisions. Students need to pick a school that is the right fit, determine a major that matches their skills and interests and also evaluate different career paths post-college. These are big life decisions for anyone, let alone for someone in high school.

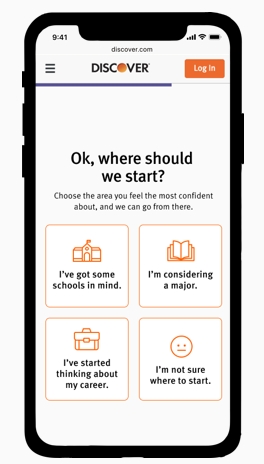

To help students and their families navigate some of the complex decisions as they start to think about their college experience, Discover Student Loans recently launched My College Plan. Discover’s innovative tool guides students as they select their institution type, and provides the skills needed to forecast how their college decisions will impact them while in college as well as after they graduate.

“It’s easy to feel overwhelmed when planning for college since there are so many choices. That’s why we developed a tool for students and their families to easily evaluate their options,” said Manny Chagas, vice president of Discover Student Loans. “College requires a big investment, so it is critical that students and families feel confident in their choices and how those decisions could influence their future.”

By using My College Plan, students can explore the implications of choosing different schools, majors, and career paths. Once students enter some simple information, My College Plan helps them compare the cost of attendance, expected federal student loan debt and predict median salary for different schools and career paths.

“Understanding their financial situation, post-graduation, can help students choose a school and, potentially, a major. Future salaries should become part of the conversation earlier and help inform how much to invest in college now,” Chagas said.

My College Plan is available on https://www.discover.com/student-loans/calculators/college-plan and adds to the extensive suite of free resources designed to help families navigate the college decision-making process.

About Discover

Discover Financial Services (NYSE: DFS) is a digital banking and payment services company with one of the most recognized brands in U.S. financial services. Since its inception in 1986, the company has become one of the largest card issuers in the United States. The company issues the Discover card, America's cash rewards pioneer, and offers private student loans, personal loans, home loans, checking and savings accounts and certificates of deposit through its banking business. It operates the Discover Global Network comprised of Discover Network, with millions of merchant and cash access locations; PULSE, one of the nation's leading ATM/debit networks; and Diners Club International, a global payments network with acceptance around the world. For more information, visit www.discover.com/company.

Contacts

Sheetal Shah

Discover

sheetalshah@discover.com

224-405-0297

@Discover_News