Life Insurance Customer Satisfaction Flatlines Despite Pandemic Fears, J.D. Power Finds

Life Insurance Customer Satisfaction Flatlines Despite Pandemic Fears, J.D. Power Finds

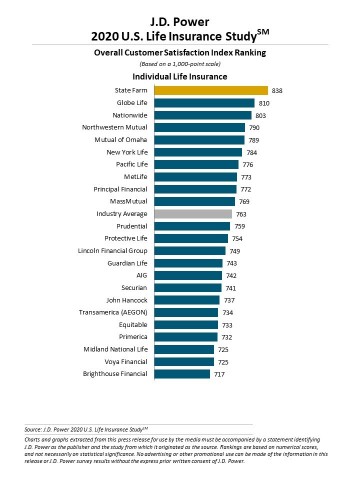

State Farm Ranks Highest in Individual Life Insurance; Nationwide, New York Life Tie for Highest in Annuity

TROY, Mich.--(BUSINESS WIRE)--Even as deaths associated with COVID-19 eclipse 200,000 in the United States, consumers don’t seem motivated to buy life insurance and life insurance customers are largely apathetic toward their insurer despite some standout performances. According to the J.D. Power 2020 U.S. Life Insurance Study,SM released today, a combination of infrequent client communications and a pervasive perception of high cost and transaction complexity have suppressed consumer interest and customer satisfaction with life insurance providers.

"The life insurance industry has a significant perception problem because, in the throes of a pandemic, consumers naturally should be more engaged with their insurer—but they aren’t,” said Robert M. Lajdziak, senior consultant of insurance intelligence at J.D. Power. “We’ve been observing a trend for several years that customer satisfaction with life insurance companies starts declining the moment a policy is purchased and continues to decline throughout the relationship due to a lack of policyholder contact from most insurers. The fact that insurers and agents have not been able to reverse this trend during a historic global pandemic speaks to the depth of the challenge the industry faces. Life insurance providers need to dramatically ratchet up their client communications efforts and demonstrate their value to their end customers—not just to advisors and sales representatives."

Following are some key findings of the 2020 study:

- Life insurance customer satisfaction flat year over year: The overall customer satisfaction score for life insurance providers is 763 (on a 1,000-point scale), up just two points from 2019. Annuity customer satisfaction increases to 778, also just two points higher than in 2019.

- Customer interest in life insurance unaffected by pandemic: Even during the height of fear and uncertainty about the pandemic in March and April of 2020, a majority (70%) of life insurance customers said their perceptions of their life insurance provider were unchanged by current events. Likewise, the number of customers without life insurance who considered purchasing a policy was largely static during the same period, hovering around 40%. The main reasons customers avoid life insurance continue to be the perception of unaffordability and the complexity of the application process.

- Customer satisfaction declines with product tenure: Customers who’ve owned a life insurance policy for less than five years have the highest overall level of satisfaction with their policy (803). Scores fall 27 points among customers with a tenure of six to 10 years; by 45 points among those who’ve been customers for 11 to 20 years; and by 56 points among customers with a tenure of more than 20 years. Annuity customer satisfaction is relatively stable across tenure segments, increasing among higher-tenured customers, but influenced in those later years due to customers beginning to receive payments.

- Policy understanding is key to improvement: Overall levels of satisfaction rise considerably when life insurance customers indicate having a detailed understanding of their policy and benefits. The key driver of this understanding is consistent communication, achieved through a combination of online access, offering to review policy needs and ongoing interaction.

Study Rankings

State Farm ranks highest among individual life insurance providers with a score of 838. Globe Life (810) ranks second and Nationwide (803) ranks third.

Nationwide and New York Life rank highest in a tie among annuity providers, each with a score of 802. American Equity Investment Life Insurance (801) ranks third.

The 2020 U.S. Life Insurance Study measures the experiences of customers of the largest life insurance and annuity companies in the United States. The study measures overall customer satisfaction based on performance in six factors (in alphabetical order): application and orientation; communications; interaction; price; product offerings; and statements.

The study is based on responses from 5,469 individual life insurance customers and 3,674 annuity customers. It was fielded from June through August 2020.

For more information about the U.S. Life Insurance Study, visit http://www.jdpower.com/business/resource/us-individual-life-insurance-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2020129.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power is headquartered in Troy, Mich., and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com