Santander Bank Announces Key Executive Appointments

Santander Bank Announces Key Executive Appointments

New Heads of Small Business Banking, Consumer Lending and new Chief Marketing Officer bring deep experience to accelerate the Bank’s transformation

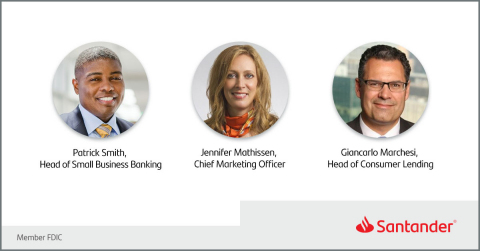

BOSTON--(BUSINESS WIRE)--Santander Bank, N.A. (“Santander Bank” or “the Bank”) announced today the appointment of three key executives: Patrick Smith has been named Head of Small Business Banking, Giancarlo Marchesi has been named Head of Consumer Lending, and Jennifer Mathissen has been named Chief Marketing Officer. They will report to Head of Consumer and Business Banking Pierre Habis. The appointments are another important step in Santander Bank’s growth and transformation strategy.

“Santander Bank is on a path toward growth through simplifying how we go to market and expanding our digital product offerings,” said Santander US and Santander Bank CEO Tim Wennes. “These leaders will bring a wealth of knowledge and experience to Santander and their talent will be invaluable as we execute against our strategy.”

“I want to welcome Patrick, Giancarlo and Jennifer to Santander,” said Habis. “They are subject matter experts in their fields and having their talent on the team will greatly accelerate the Bank’s transformation. We want to become closer to our customers, and these new leaders will help us build an operating model that matches our customer-first mindset.”

Head of Small Business Banking

Smith joined Santander Bank on October 5, based in Boston, as Head of Small Business Banking. He is responsible for developing the strategic direction, product pricing and portfolio management of the Small Business Banking division.

“Small businesses are the fabric of our economy, and we’re modernizing our banking model to better help small businesses prosper and to serve their holistic financial needs. Patrick will be integral to this transformation to become a premier small business bank,” said Habis.

Smith comes to Santander from KeyBank where he was Executive Vice President and Head of Commercial Digital. Prior to that, Smith was Executive Vice President of Financial Wellness and Consumer Strategy and was responsible for creating and executing the strategy to transform KeyBank’s consumer banking franchise through digital products, financial wellness programs and brand partnerships. He has more than 25 years of experience in the financial services industry. Smith earned a Bachelor of Science degree from Tuskegee University, his MBA from the University of Chicago, and a Master of Science in Information Technology Management from the University of Virginia.

Head of Consumer Lending

Marchesi has been named Head of Consumer Lending and will join Santander Bank on October 13, based in New York. He will manage all aspects of consumer lending, from mortgages to auto lending, responsible for driving the growth of the businesses and their products.

“This newly created role consolidates all of our consumer lending products under one leader to not only simplify our organization but also diversify and digitize the products we offer,” said Habis. “Giancarlo has deep experience in the consumer lending space, and his background in credit risk will only enhance the Bank’s responsible lending.”

Marchesi will join Santander from Wells Fargo where he was a Senior Credit Officer in the auto lending division. He has served in key leadership roles at large financial firms, including Chief Risk Officer of Student Lending and Auto Finance at JPMorgan Chase. He will bring nearly 30 years of banking experience to Santander, with deep knowledge in risk management and retail lending. Marchesi holds a Bachelor of Arts degree in international marketing from Hofstra University and an MBA in finance from New York University.

Chief Marketing Officer

Mathissen will join Santander on November 2 as the Chief Marketing Officer, based in Boston. She will be a strategic partner in driving business growth and customer loyalty. She will also oversee the Customer Experience team.

“Jennifer’s analytical background will help us deliver a best-in-class brand and customer experience through data-driven customer insights and analytics,” said Habis. “She will help us build a modern marketing organization with a strong digital framework where we can effectively tell our story to customers.”

She spent the last two years at CVS Health leading their Enterprise Insights. She will bring to Santander more than 20 years of experience in acquisition marketing, building brands, launching products and developing digital customer experiences honed during her time at Epsilon Agency (formerly Catapult) and McKinsey & Co. She earned a Bachelor of Arts degree in economics from Mount Holyoke College.

Santander Bank, N.A. is one of the country’s largest retail and commercial banks with $89.5 billion in assets. With its corporate offices in Boston, the Bank’s 9,100 employees, 575 branches, more than 2,000 ATMs and more than 2.1 million customers are principally located in Massachusetts, New Hampshire, Connecticut, Rhode Island, New York, New Jersey, Pennsylvania and Delaware. The Bank is a wholly-owned subsidiary of Madrid-based Banco Santander, S.A. (NYSE: SAN) - one of the most respected banking groups in the world with more than 146 million customers in the U.S., Europe, and Latin America. It is overseen by Santander Holdings USA, Inc., Banco Santander’s intermediate holding company in the U.S. For more information on Santander Bank, please visit www.santanderbank.com.

Contacts

Laurie Kight

214.801.6455

mediarelations@santander.us

Nancy Orlando

617-757-5765

mediarelations@santander.us