Bank of America Launches Life Plan to Help Clients Prioritize Their Financial Goals and Understand Steps Toward Achieving Them

Bank of America Launches Life Plan to Help Clients Prioritize Their Financial Goals and Understand Steps Toward Achieving Them

Available Online and Within the Mobile App, Personalized Digital Experience Enables Clients to Turn Goals into Actions

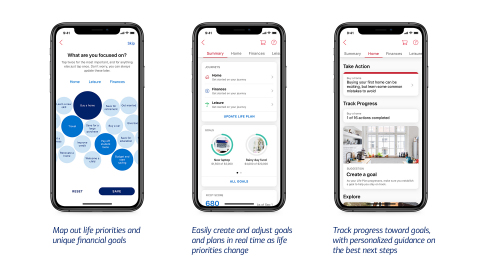

CHARLOTTE, N.C.--(BUSINESS WIRE)--Bank of America today announced the launch of Life Plan®, a new digital experience through which clients can set and track near- and long-term goals based on their life priorities, and better understand and act on steps toward achieving them. Available within the Bank of America mobile app and online banking platform, Life Plan enables clients to:

- Select and prioritize their most important goals at every life stage and across multiple areas, including finances, family, health, home, work, leisure and giving.

- Create and continuously adjust financial goals in real time within the app, as life happens and priorities change.

- Track progress against their goals, with personalized guidance and recommendations on incremental steps toward achieving them along the way.

- Leverage the company’s network of financial professionals by scheduling in-person or virtual one-on-one appointments for collaborative discussions about their goals and strategies to help achieve them.

“We designed Life Plan to give clients the power to define, prioritize and make progress toward their financial goals,” said David Tyrie, Bank of America head of Digital, Financial Center Strategy, and Advanced Client Solutions. “Life Plan delivers a personalized experience for every client, providing information that is timely and relevant, aligned to their unique financial goals, and offering a choice of the next best step.”

Available in English and Spanish, Life Plan delivers a holistic view of a client’s financial goals and helps track progress toward them. The high-tech and high-touch experience integrates with Bank of America’s award-winning solutions such as Erica®, its AI-driven virtual financial assistant, and Preferred Rewards, the company’s industry-leading loyalty program that recognizes the value of a client’s entire relationship. Life Plan also provides information and tips from Better Money Habits®, a free financial education platform that helps clients make sense of their money and take action.

Life Plan is now available nationwide following an eight-month pilot with nearly 80,000 clients. During the pilot, the top five goals set by clients included: budget and start saving (32%); save for retirement (31%); buy a home (30%); save for a large purchase (30%); and improve my credit (28%).

About Bank of America Digital Banking

Bank of America’s award-winning digital banking platform is an evolving source of increased client engagement and satisfaction serving 40 million digital clients, including more than 30 million active mobile users. During the second quarter of 2020, digital clients logged into their accounts more than 2 billion times and used digital to make 133 million bill payments and book 665,000 appointments.

Bank of America

Bank of America is one of the world’s leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 66 million consumer and small business clients with approximately 4,300 retail financial centers, including approximately 3,000 lending centers, 2,600 financial centers with a Consumer Investment Financial Solutions Advisor and approximately 2,200 business centers; approximately 16,900 ATMs; and award-winning digital banking with approximately 39 million active users, including approximately 30 million mobile users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 3 million small business owners through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States, its territories and approximately 35 countries. Bank of America Corporation stock (NYSE: BAC) is listed on the New York Stock Exchange.

For more Bank of America news, including dividend announcements and other important information, visit the Bank of America newsroom. Click here to register for news email alerts.

Bank of America, N.A. Member FDIC © 2020 Bank of America Corporation.

Contacts

Reporters May Contact:

Andy Aldridge, Bank of America, 980.387.0514

andrew.aldridge@bofa.com