Will Blockchain Become the Next ‘Game-Changer’ for the Insurance Industry? | Infiniti’s Industry Experts Provide In-Depth Insights

Will Blockchain Become the Next ‘Game-Changer’ for the Insurance Industry? | Infiniti’s Industry Experts Provide In-Depth Insights

LONDON--(BUSINESS WIRE)--Blockchain technology can help efficiently and safely share data, process claims, and prevent fraud in the insurance industry. However, the implementation and inception of blockchain in insurance are still in the early stages. Additionally, companies in the insurance industry still have a long way to go in terms of actively working with industry players to figure out the best ways to navigate the potential challenges of blockchain technology.

To gain comprehensive insights and expert guidance on efficiently navigating the challenges of blockchain in the insurance industry, request a free proposal.

“Not only does blockchain offer the promise of cost reduction and efficiency, but it could also enable revenue growth, as insurers attract new business through higher-quality service,” says an insurance industry expert at Infiniti Research.

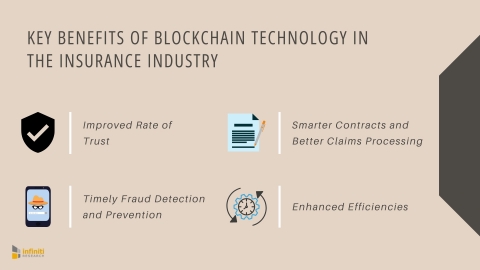

One of the most notable tech trends, blockchain technology, is a distributed, peer-to-peer ledger of records called blocks that is virtually incorruptible. In the insurance industry, this technology offers the promise of cost reduction and efficiency. Higher-quality service and the aspect of self-management help insurers attract new businesses. The applications of blockchain in insurance are expected to revamp the way the insurance industry functions. Although it is in the early stages of inception and implementation, there are many benefits to successfully implementing blockchain technology in the insurance industry. In their recent blog, Infiniti’s experts discuss four key benefits of employing blockchain in the insurance industry.

Unsure about implementing blockchain technology in your organization? To learn the major benefits of blockchain technology in the insurance industry, and why insurance companies should implement it, request more information.

Infiniti’s experts identified the following four benefits of blockchain in the insurance industry:

- Implementing blockchain in insurance provides transparency in transactions and helps build consumer trust.

- This technology helps companies to verify customers, policies, and transactions easily, and prevent fraud.

- Smart contracts and blockchain technology help insurers and the insured manage claims responsively and transparently.

- Blockchain drives security and efficiency and allows individuals to control their personal data while the verification is registered on the blockchain.

- Gain in-depth insights into the benefits of blockchain in the insurance industry by reading the complete article here.

About Infiniti Research

Established in 2003, Infiniti Research is a leading market intelligence company providing smart solutions to address your business challenges. Infiniti Research studies markets in more than 100 countries to help analyze competitive activity, see beyond market disruptions, and develop intelligent business strategies. To know more, visit: https://www.infinitiresearch.com/about-us

Contacts

Press Contact

Infiniti Research

Anirban Choudhury

Marketing Manager

US: +1 844 778 0600

UK: +44 203 893 3400

https://www.infinitiresearch.com/contact-us