Spotify Technology S.A. Announces Financial Results for Second Quarter 2020

Spotify Technology S.A. Announces Financial Results for Second Quarter 2020

NEW YORK--(BUSINESS WIRE)--Spotify Technology S.A. (NYSE:SPOT) today reported financial results for the second fiscal quarter of 2020 ending June 30, 2020.

Dear Shareholders,

Our business performed well in Q2 and continues to operate at a high level despite the continuing uncertainty surrounding the COVID-19 pandemic. Excluding the impact of social charges related to the increase in our share price during Q2, all of our key metrics would have finished at or ahead of our expectations. Our liquidity position and Free Cash Flow remain strong, and we are encouraged with the underlying trends of the business.

MONTHLY ACTIVE USERS (“MAUs”)

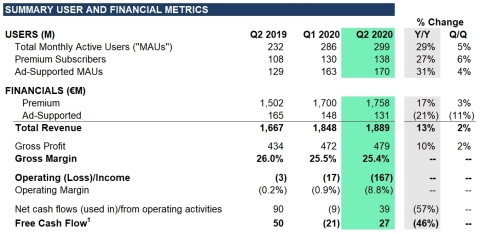

Total MAUs grew 29% Y/Y to 299 million, which is at the top of our guidance range.

Growth in North America exceeded our expectations, accelerating more than 200 bps this quarter relative to growth in Q2 last year. We saw retention continue to improve in Q2. This is on top of the gains we saw in North America throughout 2019. India also outperformed our forecast this quarter thanks to strong performance from marketing campaigns in the region. Latin America and Rest of World continue to see the fastest growth, with those regions growing 33% and 58% Y/Y, respectively.

Early in the quarter, we observed some COVID related softness in several countries across our emerging regions. Parts of Latin America and Rest of World saw slower than expected growth in April and May as we saw lower intake, an increase in churn, and increases in payment failures from our Premium users. Encouragingly, things rebounded significantly in June as we saw increased reactivations and a step down in churn. While we finished below forecast in aggregate across these regions, our strength in North America and other areas more than offset the slow start to the quarter. Additionally, we believe the improved momentum we saw in the back half of the quarter has continued into Q3 and we expect to hit our full year targets.

We noted last quarter that we began to see a modest impact on consumption hour trends driven by COVID. As of June 30, global consumption hours have recovered to pre-COVID levels. All regions have fully recovered with the exception of Latin America which is approximately 6% below peak levels prior to the global health crisis. Regions where the spread of COVID-19 appears to be slowing, including APAC and EU, have led the recovery in consumption. Consumption trends by platform are beginning to normalize as well; in-car listening at the end of the quarter was less than 10% below pre-COVID levels having recovered from a 50% decline at the trough in April.

PREMIUM SUBSCRIBERS

At the end of Q2’20 we had 138 million Premium Subscribers globally, up 27% Y/Y, which is at the top end of our guidance. Family Plan continues to be a significant driver of our outperformance. This quarter we expanded the availability of both Family Plan and our new Duo offering to new geographies. Following our launch in Russia and 12 surrounding markets on July 15th (post Q2), these multi-user plans are now available in 90+ territories globally. We saw strong subscriber growth across all regions in the quarter and finished ahead of our expectations.

Despite the ongoing uncertainty around COVID-19, we had our largest ever bi-annual campaign with strong gross additions in both the ‘3 months on us’ intro offer for new users, as well as the win-back offer for returning customers. Other promotions and partnerships of note this quarter included the expansion of our Microsoft Xbox Game Pass relationship, and the launch of our TV app on Comcast’s X1 set-top box. Following the success of last year’s Xbox Game Pass holiday offer, we expanded the Microsoft partnership by making Spotify Premium available as a Perk for Xbox Game Pass Ultimate customers in seven markets: the US, UK, France, Brazil, Mexico, Australia, and Germany. Separately, the introduction of our TV app on Comcast’s proprietary X1 set-top box marked the first integration with a pay-TV provider in the US, demonstrating continued progress against our ubiquity strategy.

Churn improved approximately 46 bps Y/Y, but ticked up approximately 8 bps sequentially. Our Y/Y churn improvement continues to be driven by the adoption of our higher retention offerings like Family & Student in addition to the overall maturity of our total subscriber base. Due to a shift in our trial offering cadence this year, we did see a bit more seasonality in churn in Q2 relative to years past. Our 3 Month Free trial offer was available until mid to late February in Q1, which meant more subscribers than usual saw an end to their promotional offering in Q2. This led to a slight increase in churn Q/Q. However, this was expected and was in line with the forecast.

FINANCIAL METRICS

Revenue

Total revenue of €1,889 million grew 13% Y/Y in Q2. Consolidated revenue was roughly in line with expectations. Premium revenue grew 17% Y/Y to €1,758 million (up 19% excluding the impact of FX rates), and performed in line with our forecast. We recognized a reduction to revenue of €14 million due to a change in prior period estimates that accounted for an additional 1% headwind. Ad-Supported revenue fell 21% Y/Y as a result of COVID-19, but was slightly above our expectations. The quarter started off particularly slow but improved steadily with momentum in June overcoming the weakness early on.

Within Premium, average revenue per user (“ARPU”) of €4.41 in Q2 was down 9% Y/Y (down 7% excluding the impact from FX rates). The reduction in revenue resulting from the change in prior period estimates mentioned above accounted for another 1% drag. Product mix was the dominant driver accounting for most of this decline.

While Ad-Supported revenue of €131 million was down both Y/Y and sequentially, we outperformed our forecast. Last quarter we noted a marked deceleration in sales brought on by the global health crisis where the last 3 weeks in March were down more than 20% relative to our forecast. Performance continued to lag our expectations through April and May, but we significantly outperformed expectations in the month of June. QTD through May, Ad-Supported revenues were down 25% Y/Y, but performance in the month of June showed significant improvement and was only down 12% Y/Y. Our Direct and Programmatic channels were hit particularly hard, both declining double digits Y/Y. Conversely, both our Ad Studio and Podcast channels saw double digit growth and exceeded our forecast. Within Ad Studio (our self-service offering) we successfully rolled out video as a new product and expanded the platform out of beta into 22 markets as of June.

We continue to see positive growth in our Streaming Ad Insertion (“SAI”) technology, which will be more widely available to US advertisers this summer. Our latest podcast advertising innovation involves In-App Offers powered by SAI, which resurfaces offers to podcast listeners with a visual reminder, allowing listeners to redeem offers in-app when the time is right for them.

Overall, podcast advertising outperformed in the quarter with momentum continuing into July. Additionally, we announced a $20 million advertising partnership with Omnicom Media Group which we believe is the largest global, strategic podcast advertising partnership to-date.

Gross Margin

Gross Margin finished at 25.4% in Q2 which both exceeded our expectations and finished above the high end of our guidance range. Gross Margin in the quarter was impacted by several “one-time” adjustments that when netted out, did benefit GM by 50 bps. Without these adjustments, GM would have finished modestly ahead of our expectations and at the higher end of guidance. We recognized efficiencies in Other CoR as streaming delivery costs were slightly more favorable relative to forecast. We do continue to invest in content and our spend this quarter was modestly higher than plan and had a slightly higher drag on GM than forecast.

Premium Gross Margin was 28.1% in Q2, down slightly from 28.3% in Q1, and up 60 bps Y/Y. Ad-Supported Gross Margin was (11.9)% in Q2, down from (6.6)% in Q1 and down 2,478 bps Y/Y. As a reminder, we now account for all content costs related to podcast investment in the Ad-Supported business.

Operating Expenses / Income (Loss)

Operating expenses totaled €646 million in Q2, an increase of 48% from Q2’19 and well above forecast. Core operating expenses grew slightly less than expected as certain marketing expenditures have been pushed to later in the year. Reported operating expense was significantly higher than forecast as a result of the accrual of higher than expected social charges related to the strong gains in our stock price during the quarter. Social Charges came in €126 million higher than planned. Roughly 62% of the variance in Social Charges pertained to the R&D function, while 23% of the variance was in S&M and the remainder in G&A. Excluding the higher than planned social charges, Operating Loss would have finished better than forecast as a result of both outperformance in Gross Profit and lower than planned operating expenses.

At the end of Q2, our workforce consisted of 6,049 FTEs globally.

Social Charges

As a reminder, social costs are payroll taxes associated with employee salaries and benefits, including share-based compensation that we are subject to in various countries in which we operate. When the fair market value of our ordinary shares increases on a quarter-to-quarter basis, the accrued expense for social costs will increase, and when the fair market value of ordinary shares falls, the accrued expense will become a reduction in social costs expense, all other things being equal, including the number of vested stock options and exercise price remaining constant. Additionally, approximately 31% of our employees are in Sweden. With respect to our employees in Sweden, we are required to pay a 31.42% tax to the Swedish government on the profit an employee realizes on the exercise of our stock options or the vesting of our restricted stock units.

Our guidance on the impact of social charges on operating expenses is based on our share price at the end of each quarter. At the Q2 close, our stock price was $258.19. As an example, in Q2 a 10% increase or decrease in FMV compared to the quarter-end price would have an approximate +/- €25M impact on Social Charges. We don’t forecast stock price changes in our guidance so upward or downward movements will impact our reported operating expenses relative to our guidance.

Product and Platform

We continue to accelerate product innovation in order to enrich the consumer experience and serve the right content from the more than 60 million unique tracks and more than 1.5 million podcasts on our platform. Through experimentation, we aim to scale features that will lead to improved intake, retention, conversion, and thus higher LTV. For example, we rolled out lyrics this quarter in 26 countries across Southeast Asia, Latin America, and India covering more than 100 million of our users.

We continue to make improvements to our join flow and onboarding experience and have seen a demonstrable improvement to both short term and long term retention as a result. Once on the platform, we constantly add or improve features such as our recent announcement that we have removed the cap on the number of tracks a user can download, now offering the ability to save an unlimited number of songs, albums and podcasts to their collection of favorites (up from a max of 10,000 tracks previously).

With COVID-19 protective measures still in place, we launched a Listening Together microsite that visualizes when two Spotify listeners start to play the same song at the exact same time - which happens on average 30,000 times every second on Spotify. A further enhancement to the user experience, Spotify launched a Group Session feature that allows up to five Premium users to share control over the music being played. Group Session participants can control what’s playing in real-time as well as contribute to a collaborative playlist for the group. Another product feature we’re experimenting with is Canvas, which turns formerly static song pages into engaging video-art showcases with 8 second visual loops. Spotify users and artists can now share Canvas artwork to Instagram stories, a feature that is unique to the Spotify platform and sharing experience.

Ubiquity remains a core strategy, and we continue to find ways for consumers to seamlessly connect with our platform. This quarter we expanded our Spotify Free offering through Amazon Alexa devices beyond the US, Australia and New Zealand. Amazon Alexa devices will now support Spotify Free in Austria, Brazil, Canada, France, Germany, Ireland, Italy, Japan, Mexico, Spain and the UK. Additionally, we are also excited to be launching Spotify (Free and Premium) on Alexa in India.

Content

Last week we announced a multi-year global license agreement with the world's largest music company, Universal Music Group (UMG), that further aligns the companies’ efforts to foster groundbreaking new features providing value for artists and great experiences for music fans. With this new agreement, the companies advance their industry-leading partnership, reflecting a shared commitment to music’s continued growth, deeper music discovery experiences and collaboration on new, state-of-the-art marketing campaigns across Spotify’s platform.

During Q2, we announced a multi-year exclusive licensing deal with The Joe Rogan Experience, which will debut on Spotify in September 2020 and become exclusive on the platform later this year. Additionally, we announced a multi-year partnership with Warner Bros. and DC to produce and distribute an original slate of narrative scripted podcasts exclusively on Spotify. We are excited about these partnerships and look forward to creating an unrivaled content experience for Spotify listeners.

Harry Potter at Home came to Spotify, an exclusive rendering of the Sorcerer’s Stone as read by notable actors, including Daniel Radcliffe, Eddie Redmayne, and Whoopi Goldberg. This content release marks the first multi-market promotional campaign for an audio-story on Spotify. Harry Potter at Home quickly became our #1 O&E show on the platform.

Today, 21% of our Total MAUs engage with podcast content, up from 19% of MAUs in Q1 2020, and consumption continues to grow at triple digit rates Y/Y. We see strong MAU growth in podcast content across all regions for Spotify. Overall supply of new podcast content recovered in Q2 after a slight impact related to COVID-19 in the previous quarter. There have been a healthy number of releases for Catalog, as well as Spotify Originals within the quarter. We launched 110 podcast playlists across 6 markets (including 49 new O&E podcasts outside the US) on a variety of themes and topics to continue to drive podcast discovery for users. Currently, Spotify’s podcast catalog has over 1.5 million shows, 50% of which launched in 2020. Our acquisition of Anchor last year has helped accelerate content growth on the platform with approximately three quarters of new podcast releases being powered by Anchor. Spotify announced an additional 9 exclusives like Do You See What I See and Rapot to our Creator Accelerator Program in Indonesia, launched our first original podcast, Search Engine Sex, in Australia, and released our first exclusive, XRey, in Spain.

As COVID-19 has impacted the creator community and the way in which users interact with Spotify, we created user experiences that allow listeners to adapt to the current environment. Spotify launched an “At Home Music & Podcast Entertainment” hub, which has had over 20M unique visitors. Additionally, we created a “COVID-19 Guide” podcast hub to serve as a resource to those wanting to engage and understand more about COVID-19 related information and topics. As we mentioned last quarter, we launched the Spotify COVID-19 Music Relief project, through which we have partnered with organizations that offer financial relief to those in the music and creator community around the world. We pledged to match dollar-for-dollar public donations made to these organizations, up to a total Spotify contribution of $10 million. We also launched Artist Fundraising Pick (a feature that enables artists to raise money to support themselves, their bands, their crews and charitable organizations) in April, and to date have seen more than 91,000 artists take advantage.

Two-Sided Marketplace

We continue to build out our marketplace offering of tools and services. As stated above, we recently announced a multi-year deal with Universal Music Group and together, we look forward to accelerating our progress in building new tools and offerings that will make a difference for artists around the world. This is one more step in our goal to enable a million creators to live off their work.

The number of artists and their teams utilizing our Spotify for Artists tools on a monthly basis has grown to more than 690,000, growth of 68% Y/Y, and these creators are finding ways to unlock new channels for discovery. Growth in the number of artists making up our top tier (those accounting for the top 10% of streams) is accelerating; that cohort now stands at over 43,000 artists, up 43% from 30,000 one year ago. Our product and platform are driving discovery, diversifying taste, and helping up-and-coming artists reach new audiences. Gone are the days of Top 40, it’s now the Top 43,000. We continue to add new features to our suite of Marketplace products to better serve the needs of these creators and their teams. We also expanded our Sponsored Recommendation functionality to Canada this quarter, and look forward to launching in further markets soon. We also began piloting new targeting features in the Sponsored Recommendation product that allow for more flexibility to suit the unique needs of marketers. Conversion remains high, and the number of artists taking advantage of these features grew more than 37% Q/Q.

Free Cash Flow

Total Free Cash Flow was €27 million in Q2, a €23 million decrease Y/Y principally related to an increase in net loss adjusted for non-cash items, partially offset by favorable working capital movements and lower cash outflow for PP&E related to office build-outs. We maintain positive working capital dynamics overall and continue to expect that we will deliver positive Free Cash Flow for the year.

In addition to the positive Free Cash Flow dynamics, we maintain a strong liquidity position and are confident in the financial position of the business as we look at the current and future uncertainty surrounding the global health crisis. At the end of Q2, we had €1.8 billion in cash and cash equivalents, restricted cash, and short term investments on our Balance Sheet, and no indebtedness2.

Q3 & Q4 2020 OUTLOOK

These forward-looking statements reflect Spotify’s expectations as of July 29, 2020 and are subject to substantial uncertainty. The estimates below utilize the same methodology we’ve used in prior quarters with respect to our guidance and the potential range of outcomes. Given the extraordinary operating circumstances we currently face with respect to the impact of COVID-19 there is a greater likelihood of variances within those ranges than typical quarters.

Q3 2020 Guidance:

- Total MAUs: 312-317 million

- Total Premium Subscribers: 140-144 million

-

Total Revenue: €1.85-€2.05 billion

- Assumes approximately 260 bps headwind to growth Y/Y due to movements in foreign exchange rates

- Gross Margin: 23.1-25.1%

- Operating Profit/Loss: €(70)-€(150) million

Q4 2020 Guidance:

- Total MAUs: 328-348 million

- Total Premium Subscribers: 146-153 million

-

Total Revenue: €2.05-€2.25 billion

- Assumes approximately 360 bps headwind to growth Y/Y due to movements in foreign exchange rates

- Gross Margin: 23.7-25.7%

- Operating Profit/Loss: €(45)-€(145) million

EARNINGS QUESTION & ANSWER SESSION

We will host a live question and answer session starting at 8 a.m. ET today on investors.spotify.com. Daniel Ek, our Founder and CEO, and Paul Vogel, our Chief Financial Officer, will be on hand to answer questions submitted through slido.com using the event code #SpotifyEarnings. Participants also may join using the listen-only conference line by registering through the following site:

Direct Event Registration Portal: http://www.directeventreg.com/registration/event/2944914

We use investors.spotify.com and newsroom.spotify.com websites as well as other social media listed in the “Resources – Social Media” tab of our Investors website to disclose material company information.

Use of Non-IFRS Measures

To supplement our interim condensed consolidated financial statements, which are prepared and presented in accordance with IFRS, we use the following non-IFRS financial measures: Revenue excluding foreign exchange effect, Premium revenue excluding foreign exchange effect, Ad-Supported revenue excluding foreign exchange effect, and Free Cash Flow. Management believes that Revenue excluding foreign exchange effect, Premium revenue excluding foreign exchange effect and Ad-Supported revenue excluding foreign exchange effect are useful to investors because they present measures that facilitate comparison to our historical performance.

However, Revenue excluding foreign exchange effect, Premium revenue excluding foreign exchange effect and Ad-Supported revenue excluding foreign exchange effect should be considered in addition to, not as a substitute for or superior to, Revenue, Premium revenue, Ad-Supported revenue or other financial measures prepared in accordance with IFRS. Management believes that Free Cash Flow is useful to investors because it presents a measure that approximates the amount of cash generated that is available to repay debt obligations, to make investments, and for certain other activities that exclude certain infrequently occurring and/or non-cash items.

However, Free Cash Flow should be considered in addition to, not as a substitute for or superior to, net cash flows (used in)/from operating activities or other financial measures prepared in accordance with IFRS. For more information on these non-IFRS financial measures, please see “Reconciliation of IFRS to Non-IFRS Results” table.

Forward Looking Statements

This shareholder letter contains estimates and forward-looking statements. All statements other than statements of historical fact are forward-looking statements. The words “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “seek,” “believe,” “estimate,” “predict,” “potential,” “continue,” “contemplate,” “possible,” and similar words are intended to identify estimates and forward-looking statements.

Our estimates and forward-looking statements are mainly based on our current expectations and estimates of future events and trends, which affect or may affect our businesses and operations. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to numerous risks and uncertainties and are made in light of information currently available to us. Many important factors may adversely affect our results as indicated in forward-looking statements. These factors include, but are not limited to: our ability to attract prospective users and to retain existing users; competition for users and user listening time; our dependence upon third-party licenses for most of the content we stream; our lack of control over the providers of our content and their effect on our access to music and other content; our ability to comply with the many complex license agreements to which we are a party; our ability to accurately estimate the amounts payable under our license agreements; the limitations on our operating flexibility due to the minimum guarantees required under certain of our license agreements; our ability to obtain accurate and comprehensive information about music compositions in order to obtain necessary licenses or perform obligations under our existing license agreements; new copyright legislation that may increase the cost and/or difficulty of music licensing; risks associated with our international expansion, including difficulties obtaining rights to stream content on favorable terms; our ability to generate sufficient revenue to be profitable or to generate positive cash flow on a sustained basis; our ability to expand our operations to deliver content beyond music, including podcasts; potential breaches of our security systems; assertions by third parties of infringement or other violations by us of their intellectual property rights; our ability to accurately estimate our user metrics and other estimates; risks associated with manipulation of stream counts and user accounts and unauthorized access to our services; changes in legislation or governmental regulations affecting us; risks relating to privacy and protection of user data; our ability to maintain, protect, and enhance our brand; ability to hire and retain key personnel; risks relating to the acquisition, investment, and disposition of companies or technologies; tax-related risks; the concentration of voting power among our founders who have and will continue to have substantial control over our business; risks related to our status as a foreign private issuer; international, national or local economic, social or political conditions; and risks associated with accounting estimates, currency fluctuations and foreign exchange controls; and the impact of the COVID-19 pandemic on our business and operations, including any adverse impact on advertising revenue or subscriber acquisition and retention.

A detailed discussion of these and other risks and uncertainties that could cause actual results and events to differ materially from our estimates and forward-looking statements is included in our filings with the U.S. Securities and Exchange Commission (“SEC”), including our Annual Report on Form 20-F filed with the SEC on February 12, 2020, as updated in our Form 6-K filed with the SEC on April 29, 2020 (containing the interim condensed consolidated financial statements for the three months ended March 31, 2020). We undertake no obligation to update forward-looking statements to reflect events or circumstances occurring after the date of this shareholder letter.

Interim condensed consolidated statement of operations

|

|||||||||||||||

|

|

Three months ended |

|

Six months ended |

|||||||||||

|

|

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

June 30, |

|||||

2020 |

2020 |

2019 |

2020 |

2019 |

|||||||||||

Revenue |

|

1,889 |

|

|

1,848 |

|

|

1,667 |

|

|

3,737 |

|

|

3,178 |

|

Cost of revenue |

|

1,410 |

|

|

1,376 |

|

|

1,233 |

|

|

2,786 |

|

|

2,371 |

|

Gross profit |

|

479 |

|

|

472 |

|

|

434 |

|

|

951 |

|

|

807 |

|

Research and development |

|

267 |

|

|

162 |

|

|

151 |

|

|

429 |

|

|

306 |

|

Sales and marketing |

|

248 |

|

|

231 |

|

|

200 |

|

|

479 |

|

|

372 |

|

General and administrative |

|

131 |

|

|

96 |

|

|

86 |

|

|

227 |

|

|

179 |

|

|

|

646 |

|

|

489 |

|

|

437 |

|

|

1,135 |

|

|

857 |

|

Operating (loss)/income |

|

(167 |

) |

|

(17 |

) |

|

(3 |

) |

|

(184 |

) |

|

(50 |

) |

Finance income |

|

6 |

|

|

70 |

|

|

8 |

|

|

76 |

|

|

42 |

|

Finance costs |

|

(294 |

) |

|

(12 |

) |

|

(64 |

) |

|

(306 |

) |

|

(220 |

) |

Finance income/(costs) - net |

|

(288 |

) |

|

58 |

|

|

(56 |

) |

|

(230 |

) |

|

(178 |

) |

Loss before tax |

|

(455 |

) |

|

41 |

|

|

(59 |

) |

|

(414 |

) |

|

(228 |

) |

Income tax (benefit)/expense |

|

(99 |

) |

|

40 |

|

|

17 |

|

|

(59 |

) |

|

(10 |

) |

Net (loss)/income attributable to owners of the parent |

|

(356 |

) |

|

1 |

|

|

(76 |

) |

|

(355 |

) |

|

(218 |

) |

(Loss)/Earnings per share attributable to owners of the parent |

|

|

|

|

|

|

|

|

|

|

|||||

Basic |

|

(1.91 |

) |

|

0.00 |

|

|

(0.42 |

) |

|

(1.91 |

) |

|

(1.21 |

) |

Diluted |

|

(1.91 |

) |

|

(0.20 |

) |

|

(0.42 |

) |

|

(1.91 |

) |

|

(1.21 |

) |

Weighted-average ordinary shares outstanding |

|

|

|

|

|

|

|

|

|

|

|||||

Basic |

|

186,552,877 |

|

|

185,046,324 |

|

|

180,409,115 |

|

|

185,799,600 |

|

|

180,510,763 |

|

Diluted |

|

186,552,877 |

|

|

185,632,113 |

|

|

180,409,115 |

|

|

185,799,600 |

|

|

180,510,763 |

|

Condensed consolidated statement of financial position

|

||||||

|

June 30, |

|

December 31, |

|||

2020 |

2019 |

|||||

Assets |

|

|

|

|

||

Non-current assets |

|

|

|

|

||

Lease right-of-use assets |

|

476 |

|

|

489 |

|

Property and equipment |

|

287 |

|

|

291 |

|

Goodwill |

|

617 |

|

|

478 |

|

Intangible assets |

|

86 |

|

|

58 |

|

Long term investments |

|

1,725 |

|

|

1,497 |

|

Restricted cash and other non-current assets |

|

66 |

|

|

69 |

|

Deferred tax assets |

|

13 |

|

|

9 |

|

|

|

3,270 |

|

|

2,891 |

|

Current assets |

|

|

|

|

||

Trade and other receivables |

|

361 |

|

|

402 |

|

Income tax receivable |

|

4 |

|

|

4 |

|

Short term investments |

|

636 |

|

|

692 |

|

Cash and cash equivalents |

|

1,148 |

|

|

1,065 |

|

Other current assets |

|

115 |

|

|

68 |

|

|

|

2,264 |

|

|

2,231 |

|

Total assets |

|

5,534 |

|

|

5,122 |

|

Equity and liabilities |

|

|

|

|

||

Equity |

|

|

|

|

||

Share capital |

|

— |

|

|

— |

|

Other paid in capital |

|

4,175 |

|

|

4,192 |

|

Treasury shares |

|

(175 |

) |

|

(370 |

) |

Other reserves |

|

1,187 |

|

|

924 |

|

Accumulated deficit |

|

(3,064 |

) |

|

(2,709 |

) |

Equity attributable to owners of the parent |

|

2,123 |

|

|

2,037 |

|

Non-current liabilities |

|

|

|

|

||

Lease liabilities |

|

612 |

|

|

622 |

|

Accrued expenses and other liabilities |

|

37 |

|

|

20 |

|

Provisions |

|

2 |

|

|

2 |

|

Deferred tax liabilities |

|

1 |

|

|

2 |

|

|

|

652 |

|

|

646 |

|

Current liabilities |

|

|

|

|

||

Trade and other payables |

|

555 |

|

|

549 |

|

Income tax payable |

|

4 |

|

|

9 |

|

Deferred revenue |

|

349 |

|

|

319 |

|

Accrued expenses and other liabilities |

|

1,527 |

|

|

1,438 |

|

Provisions |

|

12 |

|

|

13 |

|

Derivative liabilities |

|

312 |

|

|

111 |

|

|

|

2,759 |

|

|

2,439 |

|

Total liabilities |

|

3,411 |

|

|

3,085 |

|

Total equity and liabilities |

|

5,534 |

|

|

5,122 |

|

Interim condensed consolidated statement of cash flows

|

|||||||||||||||

|

|

Three months ended |

|

Six months ended |

|||||||||||

|

|

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

June 30, |

|||||

2020 |

2020 |

2019 |

2020 |

2019 |

|||||||||||

Operating activities |

|

|

|

|

|

|

|

|

|

|

|||||

Net (loss)/income |

|

(356 |

) |

|

1 |

|

|

(76 |

) |

|

(355 |

) |

|

(218 |

) |

Adjustments to reconcile net (loss)/income to net cash flows |

|

|

|

|

|

|

|

|

|

|

|||||

Depreciation of property and equipment and lease right-of-use assets |

|

23 |

|

|

21 |

|

|

17 |

|

|

44 |

|

|

34 |

|

Amortization of intangible assets |

|

5 |

|

|

5 |

|

|

3 |

|

|

10 |

|

|

7 |

|

Share-based payments expense |

|

50 |

|

|

37 |

|

|

37 |

|

|

87 |

|

|

63 |

|

Finance income |

|

(6 |

) |

|

(70 |

) |

|

(8 |

) |

|

(76 |

) |

|

(42 |

) |

Finance costs |

|

294 |

|

|

12 |

|

|

64 |

|

|

306 |

|

|

220 |

|

Income tax (benefit)/expense |

|

(99 |

) |

|

40 |

|

|

17 |

|

|

(59 |

) |

|

(10 |

) |

Other |

|

2 |

|

|

4 |

|

|

(10 |

) |

|

6 |

|

|

(2 |

) |

Changes in working capital: |

|

|

|

|

|

|

|

|

|

|

|||||

(Increase)/decrease in trade receivables and other assets |

|

(39 |

) |

|

22 |

|

|

(50 |

) |

|

(17 |

) |

|

(15 |

) |

Increase/(decrease) in trade and other liabilities |

|

151 |

|

|

(63 |

) |

|

75 |

|

|

88 |

|

|

230 |

|

Increase/(decrease) in deferred revenue |

|

34 |

|

|

(4 |

) |

|

19 |

|

|

30 |

|

|

32 |

|

(Decrease)/increase in provisions |

|

— |

|

|

(1 |

) |

|

8 |

|

|

(1 |

) |

|

8 |

|

Interest paid on lease liabilities |

|

(15 |

) |

|

(15 |

) |

|

(9 |

) |

|

(30 |

) |

|

(13 |

) |

Interest received |

|

— |

|

|

3 |

|

|

4 |

|

|

3 |

|

|

8 |

|

Income tax paid |

|

(5 |

) |

|

(1 |

) |

|

(1 |

) |

|

(6 |

) |

|

(3 |

) |

Net cash flows from/(used in) operating activities |

|

39 |

|

|

(9 |

) |

|

90 |

|

|

30 |

|

|

299 |

|

Investing activities |

|

|

|

|

|

|

|

|

|

|

|||||

Business combinations, net of cash acquired |

|

— |

|

|

(137 |

) |

|

(36 |

) |

|

(137 |

) |

|

(324 |

) |

Purchases of property and equipment |

|

(14 |

) |

|

(12 |

) |

|

(40 |

) |

|

(26 |

) |

|

(77 |

) |

Purchases of short term investments |

|

(145 |

) |

|

(498 |

) |

|

(298 |

) |

|

(643 |

) |

|

(402 |

) |

Sales and maturities of short term investments |

|

242 |

|

|

477 |

|

|

370 |

|

|

719 |

|

|

753 |

|

Change in restricted cash |

|

2 |

|

|

— |

|

|

— |

|

|

2 |

|

|

1 |

|

Other |

|

(7 |

) |

|

(14 |

) |

|

(3 |

) |

|

(21 |

) |

|

(7 |

) |

Net cash flows from/(used in) investing activities |

|

78 |

|

|

(184 |

) |

|

(7 |

) |

|

(106 |

) |

|

(56 |

) |

Financing activities |

|

|

|

|

|

|

|

|

|

|

|||||

Proceeds from exercise of share options |

|

101 |

|

|

77 |

|

|

20 |

|

|

178 |

|

|

53 |

|

Repurchases of ordinary shares |

|

— |

|

|

— |

|

|

(157 |

) |

|

— |

|

|

(283 |

) |

Payments of lease liabilities |

|

(6 |

) |

|

(4 |

) |

|

(4 |

) |

|

(10 |

) |

|

(9 |

) |

Lease incentives received |

|

— |

|

|

7 |

|

|

— |

|

|

7 |

|

|

— |

|

Other |

|

(5 |

) |

|

(3 |

) |

|

— |

|

|

(8 |

) |

|

— |

|

Net cash flows from/(used in) financing activities |

|

90 |

|

|

77 |

|

|

(141 |

) |

|

167 |

|

|

(239 |

) |

Net increase/(decrease) in cash and cash equivalents |

|

207 |

|

|

(116 |

) |

|

(58 |

) |

|

91 |

|

|

4 |

|

Cash and cash equivalents at beginning of the period |

|

951 |

|

|

1,065 |

|

|

966 |

|

|

1,065 |

|

|

891 |

|

Net exchange (losses)/gains on cash and cash equivalents |

|

(10 |

) |

|

2 |

|

|

1 |

|

|

(8 |

) |

|

14 |

|

Cash and cash equivalents at period end |

|

1,148 |

|

|

951 |

|

|

909 |

|

|

1,148 |

|

|

909 |

|

Calculation of basic and diluted earnings/(loss) per share

|

|||||||||||||||

|

|

Three months ended |

|

Six months ended |

|||||||||||

|

|

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

June 30, |

|||||

2020 |

2020 |

2019 |

2020 |

2019 |

|||||||||||

Basic (loss)/earnings per share |

|

|

|

|

|

|

|

|

|

|

|||||

Net (loss)/income attributable to owners of the parent |

|

(356 |

) |

|

1 |

|

|

(76 |

) |

|

(355 |

) |

|

(218 |

) |

Share used in computation: |

|

|

|

|

|

|

|

|

|

|

|||||

Weighted-average ordinary shares outstanding |

|

186,552,877 |

|

|

185,046,324 |

|

|

180,409,115 |

|

|

185,799,600 |

|

|

180,510,763 |

|

Basic (loss)/earnings per share attributable to owners of the parent |

|

(1.91 |

) |

|

0.00 |

|

|

(0.42 |

) |

|

(1.91 |

) |

|

(1.21 |

) |

|

|

|

|

|

|

|

|

|

|

|

|||||

Diluted loss per share |

|

|

|

|

|

|

|

|

|

|

|||||

Net (loss)/income attributable to owners of the parent |

|

(356 |

) |

|

1 |

|

|

(76 |

) |

|

(355 |

) |

|

(218 |

) |

Fair value gains on dilutive warrants |

|

— |

|

|

(38 |

) |

|

— |

|

|

— |

|

|

— |

|

Net loss used in the computation of diluted loss per share |

|

(356 |

) |

|

(37 |

) |

|

(76 |

) |

|

(355 |

) |

|

(218 |

) |

Shares used in computation: |

|

|

|

|

|

|

|

|

|

|

|||||

Weighted-average ordinary shares outstanding |

|

186,552,877 |

|

|

185,046,324 |

|

|

180,409,115 |

|

|

185,799,600 |

|

|

180,510,763 |

|

Warrants |

|

— |

|

|

585,789 |

|

|

— |

|

|

— |

|

|

— |

|

Diluted weighted-average ordinary shares |

|

186,552,877 |

|

|

185,632,113 |

|

|

180,409,115 |

|

|

185,799,600 |

|

|

180,510,763 |

|

Diluted loss per share attributable to owners of the parent |

|

(1.91 |

) |

|

(0.20 |

) |

|

(0.42 |

) |

|

(1.91 |

) |

|

(1.21 |

) |

Reconciliation of IFRS to Non-IFRS Results

|

||||||||||

|

|

Three months ended |

|

Six months ended |

||||||

|

|

June 30, |

|

June 30, |

|

June 30, |

|

June 30, |

||

2020 |

2019 |

2020 |

2019 |

|||||||

IFRS revenue |

|

1,889 |

|

|

1,667 |

|

3,737 |

|

|

3,178 |

Foreign exchange effect on 2020 revenue using 2019 rates |

|

34 |

|

|

|

|

23 |

|

|

|

Revenue excluding foreign exchange effect |

|

1,923 |

|

|

|

|

3,760 |

|

|

|

IFRS revenue year-over-year change % |

|

13 |

% |

|

|

|

18 |

% |

|

|

Revenue excluding foreign exchange effect year-over-year change % |

|

15 |

% |

|

|

|

18 |

% |

|

|

IFRS Premium revenue |

|

1,758 |

|

|

1,502 |

|

3,458 |

|

|

2,887 |

Foreign exchange effect on 2020 Premium revenue using 2019 rates |

|

35 |

|

|

|

|

27 |

|

|

|

Premium revenue excluding foreign exchange effect |

|

1,793 |

|

|

|

|

3,485 |

|

|

|

IFRS Premium revenue year-over-year change % |

|

17 |

% |

|

|

|

20 |

% |

|

|

Premium revenue excluding foreign exchange effect year-over-year change % |

|

19 |

% |

|

|

|

21 |

% |

|

|

IFRS Ad-Supported revenue |

|

131 |

|

|

165 |

|

279 |

|

|

291 |

Foreign exchange effect on 2020 Ad-Supported revenue using 2019 rates |

|

(1 |

) |

|

|

|

(4 |

) |

|

|

Ad-Supported revenue excluding foreign exchange effect |

|

130 |

|

|

|

|

275 |

|

|

|

IFRS Ad-Supported revenue year-over-year change % |

|

(21 |

)% |

|

|

|

(4 |

)% |

|

|

Ad-Supported revenue excluding foreign exchange effect year-over-year change % |

|

(21 |

)% |

|

|

|

(5 |

)% |

|

|

Free Cash Flow

|

|||||||||||||||

|

|

Three months ended |

|

Six months ended |

|||||||||||

|

|

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

June 30, |

|||||

2020 |

2020 |

2019 |

2020 |

2019 |

|||||||||||

Net cash flows from/(used in) operating activities |

|

39 |

|

|

(9 |

) |

|

90 |

|

|

30 |

|

|

299 |

|

Capital expenditures |

|

(14 |

) |

|

(12 |

) |

|

(40 |

) |

|

(26 |

) |

|

(77 |

) |

Change in restricted cash |

|

2 |

|

|

— |

|

|

— |

|

|

2 |

|

|

1 |

|

Free Cash Flow |

|

27 |

|

|

(21 |

) |

|

50 |

|

|

6 |

|

|

223 |

|

1Free Cash Flow is a non-IFRS measure. See “Use of Non-IFRS Measures” and “Reconciliation of IFRS to Non-IFRS Results” for additional information.

2As of June 30, 2020, we have no material outstanding indebtedness, other than lease liabilities recognized under IFRS 16.

Contacts

Investor Relations:

Michael Urciuoli

ir@spotify.com

Public Relations:

Dustee Jenkins

press@spotify.com