Bank of America Receives Approval for 265,500 SBA Paycheck Protection Program Loans to Date for Small Businesses

Bank of America Receives Approval for 265,500 SBA Paycheck Protection Program Loans to Date for Small Businesses

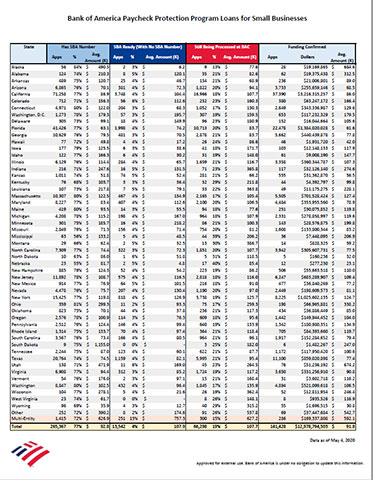

CHARLOTTE, N.C.--(BUSINESS WIRE)--Bank of America announced today that it has received Small Business Administration (SBA) loan approvals for 265,500 small businesses under the SBA’s Paycheck Protection Program (PPP). This represents $24.9 billion in needed relief for small businesses. More than 256,000 of these small businesses have received a loan number since the SBA reopened the PPP funding on April 27.

Of the SBA applications submitted to date:

- 98% are for companies with fewer than 100 employees.

- 76% are for companies with fewer than 10 employees.

- 93% are for less than $350,000.

- 78% are for less than $100,000.

- 23% are from low-to-moderate income (LMI) neighborhoods.

-

The following link provides funding information by state:

https://newsroom.bankofamerica.com/system/files/BAC_Paycheck_Protection_Program_Loans_for_Small_Businesses.pdf.

Since the SBA reopened on April 27, Bank of America:

- Has sent 213,000 promissory notes to small businesses indicating SBA loan approval.

- Is the number one SBA lender in the second round of funding.

“We processed applications for more than 250,000 small businesses during the second phase of this program, and we continue to receive and process new applications. We are happy to see the SBA has been processing submissions at a faster rate, and hopefully there is sufficient funding for everyone in need,” said Dean Athanasia, head of Consumer and Small Business at Bank of America.

Bank of America continues to provide non-government-related lending to small businesses. According to the Federal Deposit Insurance Corporation (FDIC), Bank of America is the No. 1 lender to small businesses in the United States.

While no fees related to the PPP have been received from the SBA, the company announced that net proceeds related to PPP fees will be dedicated to support small businesses and the communities and nonprofits we serve.

In addition to lending through the PPP, Bank of America is providing support to customers including:

- 1,320,000 deferrals of mortgages, credit card and auto loans; including 160,000 mortgage deferrals – foreclosure sales have been paused.

- Clients can request refunds for late fees, overdraft fees, non-sufficient fund fees and CD early withdrawal fees.

- 10.5 million government assistance payments (Economic Impact Payments) processed to date, totaling $18 billion.

- $2.4 billion in credit extended to small business clients in the first quarter of 2020, up 11% year over year apart from the government’s lending program.

Bank of America is supporting communities where our clients live and work:

- $100 million commitment to local communities to purchase medical supplies, food and other priorities in addition to the $250 million provided each year.

- $250 million in capital and $10 million in philanthropic grants to community development financial institutions (CDFIs).

For questions related to a Bank of America account and the Paycheck Protection Program, clients can contact us at PPP_Help@bofa.com.

Bank of America

Bank of America is one of the world’s leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 66 million consumer and small business clients with approximately 4,300 retail financial centers, including approximately 3,000 lending centers, 2,700 financial centers with a Consumer Investment Financial Solutions Advisor and approximately 2,100 business centers; approximately 16,900 ATMs; and award-winning digital banking with approximately 39 million active users, including approximately 30 million mobile users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 3 million small business owners through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States, its territories and approximately 35 countries. Bank of America Corporation stock (NYSE: BAC) is listed on the New York Stock Exchange.

For more Bank of America news, including dividend announcements and other important information, visit the Bank of America newsroom. Click here to register for news email alerts.

Contacts

Reporters May Contact:

Jessica Oppenheim, Bank of America, 1.646.855.1600

jessica.oppenheim@bofa.com

Bill Halldin, Bank of America, 1.916.718.1251

william.halldin@bofa.com