2019 Smartphone Apps Processor Market Share: Shipments Decline 11 Percent, says Strategy Analytics

2019 Smartphone Apps Processor Market Share: Shipments Decline 11 Percent, says Strategy Analytics

Qualcomm Leads despite Strong Competition from Vertical Vendors

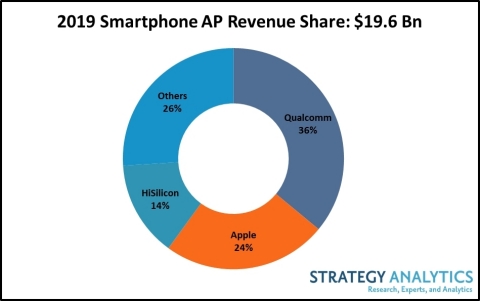

BOSTON--(BUSINESS WIRE)--The global smartphone Applications Processor (AP) market declined 3 percent year-over-year falling to $19.6 billion, according to Strategy Analytics’ Handset Component Technologies service report, “Smartphone Apps Processor Market Share Tracker Q4 2019: Shipments decline 13 Percent.”

According to this research report from Strategy Analytics, Qualcomm, Apple, HiSilicon, Samsung LSI and MediaTek captured the top-five revenue share spots in the global smartphone applications processor (AP) market in 2019. Qualcomm maintained the smartphone AP market with 36 percent revenue share followed by Apple with 24 percent and HiSilicon with 14 percent.

- Artificial intelligence (AI)-enabled smartphone applications processor (AP) shipments grew 45 percent.

- Smartphone applications processors (AP) with on-device AI engines accounted for nearly 51 percent of total smartphone APs shipped in 2019 up from approximately 31 percent in 2018.

Sravan Kundojjala, Associate Director at Strategy Analytics, commented, “In 2019, Qualcomm’s flagship processors Snapdragon 855 and 855 Plus featured in multiple popular smartphones including the Samsung Galaxy S10, Note 10 5G, Google Pixel 4, Xiaomi Mi 9 and OnePlus 7T Pro among others. The first phase of 5G smartphones played to the strengths of Qualcomm and the company captured over 50 percent share in 5G smartphones in 2019, by our estimates. We expect 5G to continue to perform well despite the COVID-19 crisis. Strategy Analytics believes that Qualcomm’s new Snapdragon 865 and 765/G processors will further expand its 5G share and volume in 2020.”

Stuart Robinson, Executive Director of the Strategy Analytics Handset Component Technologies service, added, “Vertical smartphone AP vendors Apple, HiSilicon and Samsung LSI continued their momentum in 2019 and gained market share. Strategy Analytics estimates that together these companies captured 50 percent revenue share in 2019. Smartphone OEMs who design their own processors continue to be a strategic threat to merchant vendors such as Qualcomm and MediaTek. ”

#SA_Components

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include: industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in: smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com.

Contacts

European Contact: Stuart Robinson, +44 1908 423 637, srobinson@strategyanalytics.com

US Contact: Christopher Taylor, +1 617 614 0706, ctaylor@strategyanalytics.com