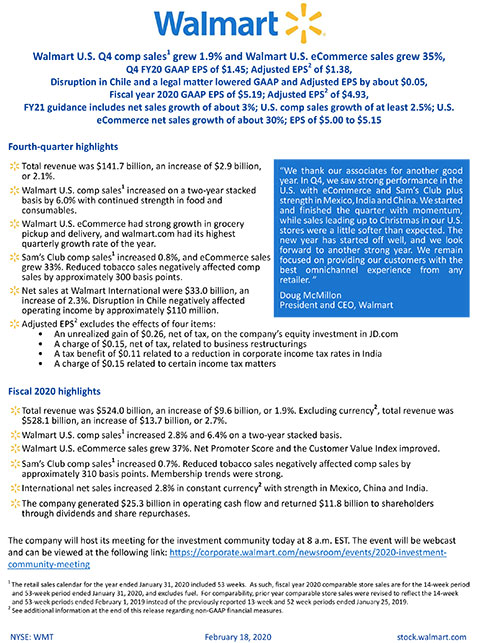

Walmart U.S. Q4 comp sales grew 1.9% and Walmart U.S. eCommerce sales grew 35%

Walmart U.S. Q4 comp sales grew 1.9% and Walmart U.S. eCommerce sales grew 35%

Q4 FY20 GAAP EPS of $1.45; Adjusted EPS of $1.38, Disruption in Chile and a legal matter lowered GAAP and Adjusted EPS by about $0.05, Fiscal year 2020 GAAP EPS of $5.19; Adjusted EPS of $4.93, FY21 guidance includes net sales growth of about 3%; U.S. comp sales growth of at least 2.5%; U.S. eCommerce net sales growth of about 30%; EPS of $5.00 to $5.15

BENTONVILLE, Ark.--(BUSINESS WIRE)--Walmart Inc. (NYSE: WMT):

Fourth-quarter highlights

- Total revenue was $141.7 billion, an increase of $2.9 billion, or 2.1%.

- Walmart U.S. comp sales increased on a two-year stacked basis by 6.0% with continued strength in food and consumables.

- Walmart U.S. eCommerce had strong growth in grocery pickup and delivery, and walmart.com had its highest quarterly growth rate of the year.

- Sam’s Club comp sales increased 0.8%, and eCommerce sales grew 33%. Reduced tobacco sales negatively affected comp sales by approximately 300 basis points.

- Net sales at Walmart International were $33.0 billion, an increase of 2.3%. Disruption in Chile negatively affected operating income by approximately $110 million.

-

Adjusted EPS excludes the effects of four items:

- An unrealized gain of $0.26, net of tax, on the company’s equity investment in JD.com

- A charge of $0.15, net of tax, related to business restructurings

- A tax benefit of $0.11 related to a reduction in corporate income tax rates in India

- A charge of $0.15 related to certain income tax matters

Fiscal 2020 highlights

- Total revenue was $524.0 billion, an increase of $9.6 billion, or 1.9%. Excluding currency, total revenue was $528.1 billion, an increase of $13.7 billion, or 2.7%.

- Walmart U.S. comp sales increased 2.8% and 6.4% on a two-year stacked basis.

- Walmart U.S. eCommerce sales grew 37%. Net Promoter Score and the Customer Value Index improved.

- Sam’s Club comp sales increased 0.7%. Reduced tobacco sales negatively affected comp sales by approximately 310 basis points. Membership trends were strong.

- International net sales increased 2.8% in constant currency with strength in Mexico, China and India.

- The company generated $25.3 billion in operating cash flow and returned $11.8 billion to shareholders through dividends and share repurchases.

The company will host its meeting for the investment community today at 8 a.m. EST. The event will be webcast and can be viewed at the following link: https://corporate.walmart.com/newsroom/events/2020-investment-community-meeting.

About Walmart

Walmart Inc. (NYSE: WMT) helps people around the world save money and live better - anytime and anywhere - in retail stores, online, and through their mobile devices. Each week, over 265 million customers and members visit approximately 11,500 stores under 56 banners in 27 countries and eCommerce websites. With fiscal year 2020 revenue of $524 billion, Walmart employs over 2.2 million associates worldwide. Walmart continues to be a leader in sustainability, corporate philanthropy and employment opportunity. Additional information about Walmart can be found by visiting http://corporate.walmart.com, on Facebook at http://facebook.com/walmart and on Twitter at http://twitter.com/walmart.

Contacts

Investor Relations contact

Dan Binder (479) 258-7172

Media Relations contact

Randy Hargrove (800) 331-0085