STAMFORD, Conn.--(BUSINESS WIRE)--WWE (NYSE:WWE) today announced that it has reached a multi-year agreement in principle with NBCU for the renewed U.S. licensing of WWE’s flagship programs and ratings juggernauts Raw and SmackDown. Given the anticipated increase in television rights, and with successful WWE Network subscriber growth, WWE management continues to believe that the Company can achieve significant earnings growth, potentially doubling or tripling 2012 OIBDA1 results to a range of $125 million to $190 million by 2015.2

“We continue to achieve significant increases in the value of our largest television agreements, a key component of our business plan” stated Vince McMahon, Chairman and Chief Executive Officer. “The rising value of our content coupled with the global expansion of WWE Network will provide the foundation for long-term growth that continues to transform our business over the coming years.”

“With the favorable renegotiation of our largest television agreements, WWE transitions to a subscription-based business model for future growth,” added George Barrios, Chief Strategy & Financial Officer. “Successful execution of our WWE Network strategy could significantly raise the Company’s earnings profile and better reflect WWE’s tremendous global appeal and brand strength. With such execution, the Company anticipates sufficient financial resources, including debt capacity, to fund growth, support ongoing business requirements and maintain its current dividend.”

Renewal of Key Television Agreements

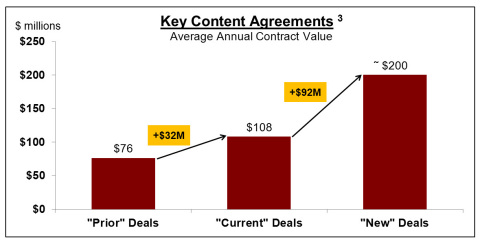

Over the past six months, the Company has negotiated television distribution agreements in the U.S., U.K. and Thailand, and is in the midst of discussions regarding the distribution of WWE content in India.3 The Company estimates that it will increase the average annual value of these key television agreements to approximately $200 million, representing an increase of more than $90 million, that is nearly three times (3x) the increase achieved in the previous round of negotiations.

Management believes that the new agreements more fully reflect the value of WWE content, including significant first-run hours, a passionate and loyal fan base, and 90% “live plus same day” viewership, in the U.S., which makes WWE content, like sports, “DVR-proof.” The Company plans to capitalize on the value of WWE content to drive further increases in value in other international markets.

The Global Expansion of WWE Network

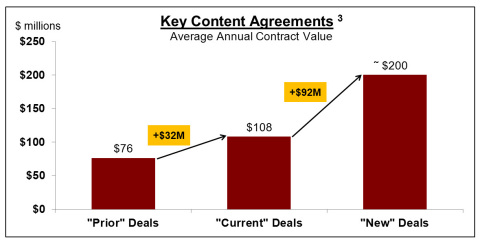

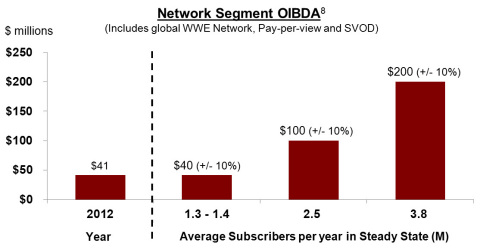

The Company’s consumer research indicates a high proportion of U.S. and international broadband users have an affinity for WWE content.4 This research indicates that in the U.S. and certain international markets5, approximately 50% of broadband households have an affinity for WWE content, representing 77 million homes (WWE Homes) in these markets. The Company’s research also indicates that based on an overall take-rate of 3% to 5% of WWE homes in these markets, between 2.5 million and 3.8 million subscribers could subscribe to the WWE Network in these U.S. and international markets at a “steady state” (when the ramp-up of subscribers has been completed and subscriber levels are relatively stable), representing a sizable economic opportunity.6

At a retail price per month of up to $9.99, this would represent estimated incremental OIBDA, net of potential pay-per-view cannibalization, between $50 million and $180 million.7 Managing subscriber growth contains significant execution risk and actual results could vary materially from this range based on, among other factors, the rate of subscriber adoption and churn rates, as well as changes in pricing, promotion levels and distribution terms.2

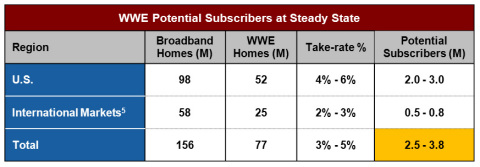

As shown below, the Company estimates that the WWE Network, on a global basis, will require 1.3 million to 1.4 million subscribers at “steady state” for the WWE Network’s incremental OIBDA to offset the complete cannibalization of the Company’s Pay-Per-View and SVOD businesses. At 1.3 million to 1.4 million subscribers, the Company’s Network segment, which includes the results of WWE’s Network, Pay-Per-View and SVOD businesses, would generate OIBDA results of $40 million, (+/- 10%), which is on par with the OIBDA profits generated by the Company’s Pay-Per-View and SVOD businesses in 2012.8

WWE Business Outlook for 2014 and 2015

The rate of subscriber adoption is a critical determinant of the Company’s projected future financial performance. If WWE Network achieves approximately one million subscribers by year-end 2014, it would yield a 12-month average of 650,000 subscribers for the year.9 This rate of adoption in 2014 translates to an estimated 2014 OIBDA loss ranging from $35 million to $45 million, and a 2014 Net loss ranging from $45 million to $52 million.

If WWE Network achieves an average of 2 million to 2.5 million subscribers for 2015, the Company’s 2015 OIBDA is expected to range from $125 million to $200 million, and 2015 Net income expected to range from $57 million to $105 million. Actual subscriber levels and financial performance could vary materially based on various factors.2

The table below outlines a range of potential outcomes for the Company in both 2014 and 2015.

| WWE 2014 Potential | WWE Network 2014 Average Subscibers9 | ||||||||||||

| Outcomes | 500 | 575 | 650 | 825 | 1,000 | ||||||||

| OIBDA | ($65) - ($55) | ($55) - ($45) | ($45) - ($35) | ($25) - ($15) | ($10) - $0 | ||||||||

| Dep. and Amort. | (25) | (25) | (25) | (25) | (25) | ||||||||

| Operating Income/(Loss) | ($90) - ($80) | ($80) - ($70) | ($70) - ($60) | ($50) - ($40) | ($35) - ($25) | ||||||||

| Other Income/(Expense)10 | 28 - 25 | 23 - 20 | 18 - 15 | 13 - 10 | 8 - 5 | ||||||||

| Net Income/(Loss) | ($62) - ($55) | ($57) - ($50) | ($52) - ($45) | ($37) - ($30) | ($27) - ($20) | ||||||||

| WWE 2015 Potential | WWE Network 2015 Average Subscribers | ||||||||||||

| Outcomes | 2012 | 500 | 1,000 | 1,500 | 2,000 | 2,500 | |||||||

| OIBDA | $63 | ($40) - ($20) | $15 - $35 | $70 - $90 | $125 - $145 | $180 - $200 | |||||||

| Dep. and Amort. | ($20) | (30) | (30) | (30) | (30) | (30) | |||||||

| Operating Income/(Loss) | $43 | ($70) - ($50) | ($15) - $5 | $40 - $60 | $95 - $115 | $150 - $170 | |||||||

| Other Income/(Expense)10 | ($12) | 17 - 10 | 2 - (5) | (18) - (25) | (38) - (45) | (58) - (65) | |||||||

| Net Income/ (Loss) | $31 | ($53) - ($40) | ($13) - $0 | $22 - $35 | $57 - $70 | $92 - $105 | |||||||

|

Notes: |

||

| 1 |

WWE defines OIBDA as operating income before depreciation and amortization, excluding feature film and television production asset amortization and impairments. OIBDA is a non-GAAP financial measure and may be different than similarly-titled non-GAAP financial measures used by other companies. A limitation of OIBDA is that it excludes depreciation and amortization, which represents the periodic charge for certain fixed assets and intangible assets used in generating revenues for the Company's business. OIBDA should not be regarded as an alternative to operating income or net income as an indicator of operating performance, or to the statement of cash flows as a measure of liquidity, nor should it be considered in isolation or as a substitute for financial measures prepared in accordance with GAAP. We believe that operating income is the most directly comparable GAAP financial measure to OIBDA. |

|

|

Potential 2015 OIBDA ranging from $125 million to $190 million corresponds to operating income ranging from $95 million to $160 million, (where the difference between OIBDA and Operating Income is depreciation and amortization). |

||

| 2 | WWE will face a variety of risks associated with the creation and maintenance of WWE Network. These risks are outlined in the Company’s Form 10-K filing with the SEC. | |

| 3 |

“Key content agreements” as used herein reflect television distribution agreements in the U.K. and Thailand, an agreement in principle in the U.S., and an estimate for India. |

|

|

“Prior” deals refer to multi-year television distribution agreements that were effective in key countries through 2009 or all or part of 2010. |

||

| “Current” deals refer to multi-year television distribution agreements that were effective in key countries through 2013 or all or part of 2014. | ||

|

“New” deals refer to multi-year television distribution agreements that became or will become effective in key countries in 2014 or early 2015. |

||

| 4 | Estimates of WWE fan households are based on our consumer research performed by a third party, which surveyed a representative sample of U.S. and international respondents. | |

| 5 | These international markets consist of the United Kingdom, Canada, Australia, New Zealand, Singapore, Hong Kong and the Nordics. The Company expects to launch WWE Network in these markets by the end of 2014. | |

| 6 | WWE cannot provide any assurances regarding the length of time, if at all, that it would take to reach the level of subscribers characterized by a “steady state” with full distribution or to surpass a break-even level of subscribers. | |

| 7 |

This potential range of incremental OIBDA results for the WWE Network at steady state with 2.5 million to 3.8 million subscribers corresponds to incremental operating income of approximately $30 million, and $165 million, respectively (where the difference between OIBDA and Operating Income is network-related depreciation and amortization). |

|

| 8 | The Company changed its business segment reporting and introduced a “Network” segment with the publication of its first quarter, 2014 earnings results. The Network segment includes the results of the WWE Network as well as the Company’s pay-per-view and former SVOD businesses. Results for the Company’s Network segment in 2012 can be found in the Company’s historical trending schedules at corporate.wwe.com. | |

| 9 |

Average subscribers shown for 2014 represent the mean level of subscribers over the 12 months of 2014. WWE Network launched in the U.S. on February 24, 2014. |

|

| 10 |

Other Income/(Expense) includes incudes interest and other expense (as reflected in “other income and expense, net” on the Company’s income statement) as well as the provision (benefit) for income taxes. |

|

About WWE

WWE, a publicly traded company (NYSE: WWE), is an integrated media organization and recognized leader in global entertainment. The company consists of a portfolio of businesses that create and deliver original content 52 weeks a year to a global audience. WWE is committed to family friendly entertainment on its television programming, pay-per-view, digital media and publishing platforms. WWE programming is broadcast in more than 150 countries and 30 languages and reaches more than 650 million homes worldwide. The company is headquartered in Stamford, Conn., with offices in New York, Los Angeles, London, Miami, Mexico City, Mumbai, Shanghai, Singapore, Munich and Tokyo.

Additional information on WWE (NYSE: WWE) can be found at wwe.com and corporate.wwe.com. For information on our global activities, go to http://www.wwe.com/worldwide/.

Trademarks: All WWE programming, talent names, images, likenesses, slogans, wrestling moves, trademarks, logos and copyrights are the exclusive property of WWE and its subsidiaries. All other trademarks, logos and copyrights are the property of their respective owners.

Forward-Looking Statements: This press release contains forward-looking statements pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995, which are subject to various risks and uncertainties. These risks and uncertainties include, without limitation, risks relating to entering into, maintaining and renewing key agreements, including television and pay-per-view programming and our new network distribution agreements; risks relating to the launch and maintenance of our new network; the need for continually developing creative and entertaining programming; the continued importance of key performers and the services of Vincent McMahon; the conditions of the markets in which we compete and acceptance of the Company's brands, media and merchandise within those markets; uncertainties relating to regulatory matters; risks resulting from the highly competitive and fragmented nature of our markets; uncertainties associated with international markets; the importance of protecting our intellectual property and complying with the intellectual property rights of others; the risk of accidents or injuries during our physically demanding events; risks associated with producing and travelling to and from our large live events, both domestically and internationally; risks relating to our film business; risks relating to new businesses and strategic investments; risks relating to our computer systems and online operations; risks relating to general economic conditions and our exposure to bad debt risk; risks relating to litigation; risks relating to market expectations for our financial performance; risks relating to our revolving credit facility specifically and capital markets more generally; risks relating to the large number of shares of common stock controlled by members of the McMahon family and the possibility of the sale of their stock by the McMahons or the perception of the possibility of such sales; the relatively small public float of our stock; and other risks and factors set forth from time to time in Company filings with the Securities and Exchange Commission. Actual results could differ materially from those currently expected or anticipated. In addition, our dividend is dependent on a number of factors, including, among other things, our liquidity and historical and projected cash flow, strategic plan (including alternative uses of capital), our financial results and condition, contractual and legal restrictions on the payment of dividends, general economic and competitive conditions and such other factors as our Board of Directors may consider relevant.