Crypto Goes Mainstream: 4 in 10 U.S. Merchants Accept Digital Assets

Crypto Goes Mainstream: 4 in 10 U.S. Merchants Accept Digital Assets

New Survey from PayPal and National Cryptocurrency Association shows accelerating merchant adoption driven by customer demand

SAN JOSE, Calif. & MIAMI--(BUSINESS WIRE)--Cryptocurrency payments are quickly moving into the mainstream of U.S. commerce. According to new research from the National Cryptocurrency Association (NCA), a non-profit organization dedicated to helping Americans understand and use crypto with confidence, and PayPal, nearly 4 out of 10 (39%) of merchants already accept cryptocurrency at checkout, and more than four in five merchants (84%) believe crypto payments will become common within the next five years, signaling a shift in how businesses respond to evolving customer preferences.

Customer interest is a major driver behind merchant adoption with nearly nine in ten merchants (88%) report receiving customer inquiries about paying with crypto, and more than two-thirds (69%) say customers want to use crypto at least once a month. Four in five merchants (79%) agree that accepting crypto could help them attract new customers, highlighting its perceived value as both a payment method and a growth lever. For merchants already accepting crypto, the demand is tangible.

“What we’re seeing both in this data and in conversations with our customers is that crypto payments are moving beyond experimentation and into everyday commerce,” said May Zabaneh, Vice President and General Manager of Crypto at PayPal. “Adoption is being driven by customer demand for faster, more flexible ways to pay—and once businesses start accepting crypto, they see real value. When crypto payments are offered in ways that feel as familiar as cards or online payments, they become a powerful growth tool, helping businesses reach new customers and access funds more quickly.”

Merchants Are Embracing the Shift to Crypto

The study shows crypto adoption is no longer limited to early adopters. Adoption is strongest among large enterprises, which earn more than $500 million in annual revenue: 50% are already accepting crypto, compared to 34% of small businesses and 32% of midsize companies. Among merchants that accept crypto today, it represents over a quarter (26%) of total sales, underscoring the growing role of crypto as a meaningful payment option rather than solely an investment tool with roughly three-quarters (72%) of crypto-accepting merchants report that their crypto sales increased over the past year - evidence that once implemented, crypto payments are gaining traction with customers.

“At Win Win Coffee, our focus is always on meeting customers where they are and making it as easy as possible for them to engage with our brand,” said Nikisha Bailey, co-founder of Win Win Coffee. “As payment options continue to evolve, it’s important that small businesses have the opportunity to explore new tools in a way that feels organic, accessible and aligned with how they already operate. Having flexibility and choice in payments helps ensure independent businesses can grow alongside their customers, not behind them.”

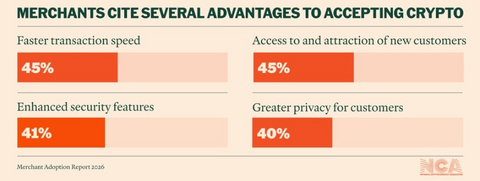

Merchants cite several advantages to accepting crypto, led by:

- Faster transaction speed (45%)

- Access to and attraction of new customers (45%)

- Enhanced security features (41%)

- Greater privacy for customers (40%)

Younger shoppers are leading the charge, with merchants reporting the greatest interest in paying with crypto is coming from Millennials (77%) and Gen Z or younger (73%). Small businesses see especially high inquiry rates from Gen Z (82%) compared to mid-size (67%) and large (65%) companies.

Certain industries are leading adoption, including:

- Hospitality and travel (81%)

- Digital goods, gaming, luxury, and specialty retail (76%)

- Retail and e-commerce (69%), where speed, global reach, and digital-native customers play a significant role

The Final Hurdle: Making Crypto Payments Simple

Momentum is expected to accelerate. More than four in five merchants (84%) believe crypto payments will become common within the next five years. Yet despite strong interest and clear demand, simplicity and usability remain key barriers.

A vast majority of merchants (90%) say they would try accepting crypto if the experience matched the ease of traditional card payments and a striking 90% of merchants say they would be likely to accept crypto if the setup process were as simple as accepting credit cards.

“What this data makes clear is that interest in crypto isn’t the problem; understanding is,” said Stu Alderoty, President of the National Cryptocurrency Association. “Too many people still don’t see how crypto fits into their everyday lives. That’s why partnerships with trusted platforms like PayPal are so important. We’re working together to help close the knowledge gap and show how crypto can be simple, accessible, and easy for everyday businesses and consumers.”

About the National Cryptocurrency Association

The National Cryptocurrency Association (NCA) is a 501(C)(4) organization dedicated to educating consumers about how to engage with crypto. Crypto is positively impacting the lives of millions of Americans but misinformation has held back those who stand to benefit. The NCA is here to help make sense of crypto by sharing the stories of real people and businesses using crypto, providing educational resources to navigate the hype and confusion, and offering guidance and support through partnerships and services. For more information, visit https://www.nca.org.

About PayPal

PayPal has been revolutionizing commerce globally for more than 25 years. Creating innovative experiences that make moving money, selling, and shopping simple, personalized, and secure. PayPal empowers consumers and businesses in approximately 200 markets to join and thrive in the global economy. For more information, visit https://www.paypal.com, https://about.pypl.com/ and https://investor.pypl.com/.

Methodology

This survey was conducted online within the United States by The Harris Poll on behalf of The National Cryptocurrency Association from October 21-27, 2025, among 619 payment strategy decision makers in the retail/e-commerce, hospitality/travel, luxury/specialty, and digital goods/gaming industries who are employed full time and work in or are responsible for C-suite, e-commerce/digital, finance, or marketing areas of their companies. The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within +/- 3.9 percentage points using a 95% confidence level.

Contacts

Media Contacts

National Cryptocurrency Association: media@nca.org

PayPal: press@paypal.com