Standish Delivers Record Growth, Surpasses $700 Billion in Assets Under Administration

Standish Delivers Record Growth, Surpasses $700 Billion in Assets Under Administration

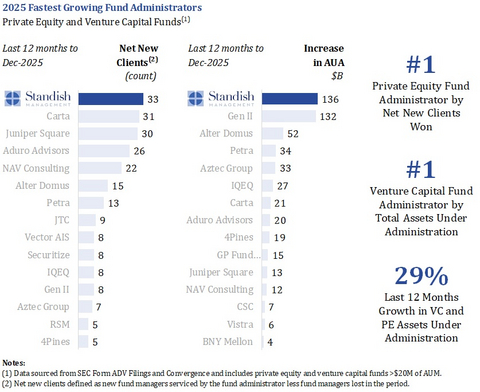

Standish was the fastest growing fund administrator by new clients & AUA in 2025

SAN FRANCISCO--(BUSINESS WIRE)--Standish Management, the leading independent provider of fund administration services to the private capital industry, today announced that it has surpassed $700 billion of assets under administration (“AUA”). The firm was the fastest-growing fund administrator in 2025 across private equity and venture capital funds and now serves over 500 clients who collectively manage more than $1 trillion of assets. Standish’s client base includes many of the most recognized and highest performing fund managers in private equity and venture capital.

"Reaching $700 billion of assets under administration is a testament to the trust our clients place in us and the extraordinary commitment of our teams globally."

Share

Over the last twelve months, Standish has added more new clients and increased its AUA with private equity and venture capital funds faster than any of its peers over the same period. The firm’s AUA for private equity and venture capital firms grew at 29% during 2025, compared to market AUA growth of 8%, reflecting continued strong client demand for Standish’s high-touch service.

“These major milestones reflect Standish’s sustained growth, expanding global footprint, and continued investment in best-in-class talent, technology, and service. Since our founding in 2007, our mission has remained constant: hire and retain the best people, empower them with market-leading technology, and deliver outstanding fund administration services to the world’s leading alternative asset managers,” said Bob Raynard, Chairman, Chief Executive Officer & Founder of Standish.

Standish serves all alternative asset classes, including buyout, growth equity, venture capital, real estate, private credit, infrastructure, and fund of funds, providing a comprehensive service model that is purpose-built for the complex operational needs of its clients. Today, Standish’s team of 1,100-plus professionals operates across 19 offices in seven countries, providing global coverage and deep jurisdictional knowledge while delivering a consistent “white glove” service across the fund lifecycle.

“From day one, we’ve built the company around three enduring pillars, people, process, and technology, to deliver best-in-class service for the world’s leading private capital managers. Reaching $700 billion of assets under administration is a testament to the trust our clients place in us and the extraordinary commitment of our teams globally. We’re proud of what we’ve built and even more excited about what’s ahead as private markets continue to grow and evolve,” added Raynard.

About Standish

Standish is the leading independent provider of fund administration and related services to the private capital industry. With more than 1,100 professionals across 19 offices in North America, Europe, Africa, and Asia, Standish provides comprehensive solutions spanning fund administration, management company, tax, and compliance services as well as corporate and depositary services for its clients in Europe. The firm supports over 500 clients with over $700 billion in assets under administration and serves all major alternative asset classes.

For more information, please visit www.standishmanagement.com or contact us at info@standishmanagement.com.

Contacts

Media Contact:

Jeff Fox

The Blueshirt Group

jeff@blueshirtgroup.com